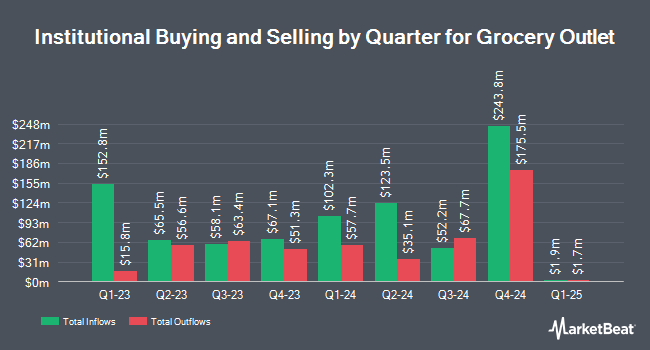

Connor Clark & Lunn Investment Management Ltd. bought a new stake in Grocery Outlet Holding Corp. (NASDAQ:GO - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor bought 25,122 shares of the company's stock, valued at approximately $441,000.

Other large investors have also recently bought and sold shares of the company. Blue Trust Inc. boosted its holdings in shares of Grocery Outlet by 76.6% in the third quarter. Blue Trust Inc. now owns 1,665 shares of the company's stock valued at $29,000 after buying an additional 722 shares during the period. Innealta Capital LLC acquired a new position in shares of Grocery Outlet in the second quarter valued at approximately $38,000. Capital Performance Advisors LLP acquired a new position in shares of Grocery Outlet in the third quarter valued at approximately $32,000. Arizona State Retirement System boosted its holdings in shares of Grocery Outlet by 7.2% in the second quarter. Arizona State Retirement System now owns 27,779 shares of the company's stock valued at $614,000 after buying an additional 1,862 shares during the period. Finally, Price T Rowe Associates Inc. MD boosted its holdings in shares of Grocery Outlet by 5.9% in the first quarter. Price T Rowe Associates Inc. MD now owns 53,616 shares of the company's stock valued at $1,544,000 after buying an additional 2,968 shares during the period. Institutional investors own 99.87% of the company's stock.

Grocery Outlet Stock Performance

GO stock traded down $0.25 during trading hours on Friday, reaching $21.00. The stock had a trading volume of 1,258,772 shares, compared to its average volume of 1,858,570. Grocery Outlet Holding Corp. has a fifty-two week low of $13.60 and a fifty-two week high of $29.80. The company has a debt-to-equity ratio of 0.34, a current ratio of 1.46 and a quick ratio of 0.33. The stock has a market capitalization of $2.04 billion, a PE ratio of 41.18, a price-to-earnings-growth ratio of 5.35 and a beta of 0.13. The stock has a 50-day simple moving average of $17.29 and a 200 day simple moving average of $19.08.

Grocery Outlet (NASDAQ:GO - Get Free Report) last issued its quarterly earnings results on Tuesday, November 5th. The company reported $0.28 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.27 by $0.01. The firm had revenue of $1.11 billion for the quarter, compared to the consensus estimate of $1.10 billion. Grocery Outlet had a net margin of 1.20% and a return on equity of 5.25%. The company's revenue for the quarter was up 10.4% on a year-over-year basis. During the same quarter in the previous year, the company earned $0.25 EPS. Analysts predict that Grocery Outlet Holding Corp. will post 0.63 EPS for the current fiscal year.

Insider Transactions at Grocery Outlet

In related news, Director Erik D. Ragatz bought 110,000 shares of the company's stock in a transaction that occurred on Friday, November 15th. The shares were bought at an average price of $18.25 per share, for a total transaction of $2,007,500.00. Following the transaction, the director now directly owns 539,785 shares of the company's stock, valued at approximately $9,851,076.25. The trade was a 25.59 % increase in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Eric J. Jr. Lindberg sold 200,095 shares of the business's stock in a transaction on Thursday, September 19th. The shares were sold at an average price of $16.29, for a total transaction of $3,259,547.55. Following the transaction, the director now owns 70,938 shares in the company, valued at $1,155,580.02. The trade was a 73.83 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 4.50% of the company's stock.

Analyst Upgrades and Downgrades

Several research analysts have recently weighed in on GO shares. Craig Hallum reduced their price target on shares of Grocery Outlet from $20.00 to $17.00 and set a "hold" rating for the company in a report on Wednesday, November 6th. Melius Research assumed coverage on shares of Grocery Outlet in a report on Monday, September 23rd. They issued a "hold" rating and a $17.00 price target for the company. Roth Mkm reduced their target price on shares of Grocery Outlet from $20.00 to $16.00 and set a "neutral" rating for the company in a report on Wednesday, November 6th. Wells Fargo & Company reduced their target price on shares of Grocery Outlet from $26.00 to $23.00 and set an "overweight" rating for the company in a report on Wednesday, November 6th. Finally, Deutsche Bank Aktiengesellschaft reduced their target price on shares of Grocery Outlet from $29.00 to $26.00 and set a "buy" rating for the company in a report on Wednesday, November 6th. One analyst has rated the stock with a sell rating, eight have assigned a hold rating, two have assigned a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus price target of $18.00.

Read Our Latest Analysis on Grocery Outlet

Grocery Outlet Profile

(

Free Report)

Grocery Outlet Holding Corp. operates as a retailer of consumables and fresh products sold through independently operated stores in the United States. Its stores offer products in various categories, such as dairy and deli, produce, floral, fresh meat, seafood products, grocery, general merchandise, health and beauty care, frozen food, beer and wine, and ethnic products.

Further Reading

Before you consider Grocery Outlet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grocery Outlet wasn't on the list.

While Grocery Outlet currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.