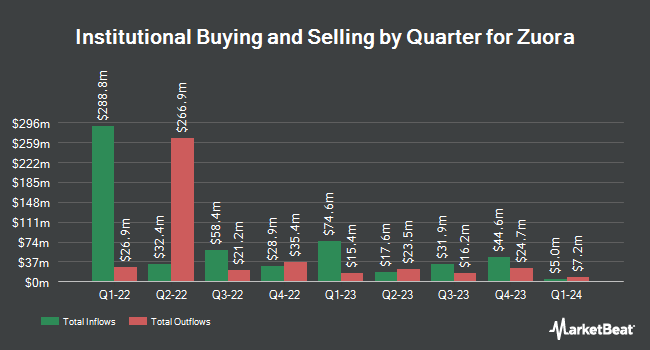

Connor Clark & Lunn Investment Management Ltd. increased its position in shares of Zuora, Inc. (NYSE:ZUO - Free Report) by 27.9% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 502,634 shares of the company's stock after purchasing an additional 109,570 shares during the period. Connor Clark & Lunn Investment Management Ltd. owned about 0.33% of Zuora worth $4,333,000 at the end of the most recent reporting period.

A number of other large investors have also modified their holdings of ZUO. Point72 Asia Singapore Pte. Ltd. bought a new stake in Zuora in the second quarter valued at $44,000. CWM LLC grew its holdings in shares of Zuora by 25.0% in the 2nd quarter. CWM LLC now owns 7,945 shares of the company's stock worth $79,000 after purchasing an additional 1,590 shares during the last quarter. Canada Pension Plan Investment Board acquired a new stake in shares of Zuora during the 2nd quarter worth about $85,000. Castleview Partners LLC acquired a new stake in shares of Zuora during the 3rd quarter worth about $79,000. Finally, Palumbo Wealth Management LLC lifted its holdings in Zuora by 11.7% during the 3rd quarter. Palumbo Wealth Management LLC now owns 11,536 shares of the company's stock valued at $99,000 after purchasing an additional 1,210 shares during the last quarter. 83.02% of the stock is currently owned by institutional investors and hedge funds.

Zuora Price Performance

NYSE ZUO traded up $0.04 during trading hours on Friday, hitting $9.94. The company's stock had a trading volume of 4,098,508 shares, compared to its average volume of 3,054,060. The stock has a fifty day moving average of $9.37 and a 200 day moving average of $9.33. The company has a current ratio of 2.77, a quick ratio of 2.77 and a debt-to-equity ratio of 1.90. Zuora, Inc. has a twelve month low of $7.70 and a twelve month high of $10.85.

Zuora (NYSE:ZUO - Get Free Report) last issued its quarterly earnings data on Wednesday, August 21st. The company reported $0.19 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.10 by $0.09. The firm had revenue of $115.40 million during the quarter, compared to analysts' expectations of $112.63 million. Zuora had a negative net margin of 10.60% and a negative return on equity of 12.54%. The business's revenue for the quarter was up 6.8% on a year-over-year basis. During the same quarter in the previous year, the company earned ($0.12) earnings per share.

Insiders Place Their Bets

In related news, CEO Tien Tzuo sold 63,873 shares of the business's stock in a transaction on Thursday, October 3rd. The shares were sold at an average price of $8.34, for a total value of $532,700.82. Following the sale, the chief executive officer now directly owns 63,312 shares of the company's stock, valued at approximately $528,022.08. The trade was a 50.22 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, insider Peter Hirsch sold 18,855 shares of the stock in a transaction dated Tuesday, October 15th. The stock was sold at an average price of $9.06, for a total value of $170,826.30. Following the transaction, the insider now owns 19,279 shares of the company's stock, valued at approximately $174,667.74. This trade represents a 49.44 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 221,081 shares of company stock worth $1,857,391. Corporate insiders own 8.62% of the company's stock.

Analysts Set New Price Targets

Several research firms have recently weighed in on ZUO. Canaccord Genuity Group reaffirmed a "buy" rating and set a $13.00 price objective on shares of Zuora in a report on Thursday, August 22nd. Lake Street Capital reaffirmed a "hold" rating and set a $10.00 price target on shares of Zuora in a report on Friday, October 18th. Finally, Needham & Company LLC reiterated a "hold" rating and issued a $15.00 price objective on shares of Zuora in a research report on Monday, October 21st. Five investment analysts have rated the stock with a hold rating and two have assigned a buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus target price of $11.43.

Check Out Our Latest Analysis on Zuora

Zuora Profile

(

Free Report)

Zuora, Inc provides a monetization suite for modern businesses to help companies launch and scale new services and operate dynamic customer-centric business models. The company offers Zuora Billing that allows customers to deploy various pricing and packaging strategies to monetize their recurring revenue streams, bill customers, calculate prorations when subscriptions change, and automate billing and payment operations; Zuora Revenue, a revenue recognition and automation solution that accounting teams use to manage their complex revenue streams; Zuora Payments to provide payment orchestration services for companies looking to operate globally; and Zephr, a digital subscriber experience platform that helps companies orchestrate dynamic experiences that increase conversion, reduce churn, and nurture ongoing subscriber relationships.

Read More

Before you consider Zuora, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zuora wasn't on the list.

While Zuora currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.