Connor Clark & Lunn Investment Management Ltd. lessened its stake in shares of GoodRx Holdings, Inc. (NASDAQ:GDRX - Free Report) by 14.6% in the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 886,055 shares of the company's stock after selling 151,465 shares during the period. Connor Clark & Lunn Investment Management Ltd. owned about 0.23% of GoodRx worth $6,149,000 at the end of the most recent quarter.

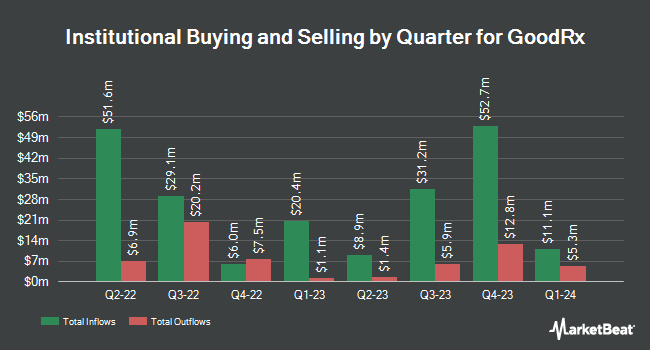

Other hedge funds have also made changes to their positions in the company. Beacon Capital Management LLC purchased a new position in GoodRx during the 1st quarter valued at about $28,000. nVerses Capital LLC purchased a new position in GoodRx during the third quarter valued at approximately $33,000. Plato Investment Management Ltd bought a new position in GoodRx in the second quarter worth approximately $43,000. Dark Forest Capital Management LP bought a new position in GoodRx in the second quarter worth approximately $86,000. Finally, Quest Partners LLC purchased a new stake in GoodRx during the third quarter worth $160,000. 63.77% of the stock is currently owned by hedge funds and other institutional investors.

GoodRx Stock Performance

NASDAQ:GDRX traded up $0.61 during mid-day trading on Friday, hitting $4.90. The company's stock had a trading volume of 2,978,123 shares, compared to its average volume of 2,047,514. The stock has a market cap of $1.87 billion, a price-to-earnings ratio of -163.33, a PEG ratio of 3.12 and a beta of 1.39. GoodRx Holdings, Inc. has a 1 year low of $4.09 and a 1 year high of $9.26. The business's fifty day moving average is $6.22 and its two-hundred day moving average is $7.32. The company has a debt-to-equity ratio of 0.70, a current ratio of 5.48 and a quick ratio of 5.48.

Wall Street Analyst Weigh In

A number of brokerages recently weighed in on GDRX. Citigroup decreased their price objective on GoodRx from $10.00 to $7.00 and set a "buy" rating for the company in a research note on Wednesday, November 13th. UBS Group lowered their price target on shares of GoodRx from $9.00 to $8.50 and set a "neutral" rating on the stock in a report on Friday, August 9th. Raymond James upgraded shares of GoodRx from an "outperform" rating to a "strong-buy" rating and set a $10.00 price objective for the company in a research note on Friday, August 9th. Barclays lowered their target price on shares of GoodRx from $10.00 to $6.00 and set an "overweight" rating for the company in a research note on Monday, November 11th. Finally, Royal Bank of Canada reaffirmed an "outperform" rating and issued a $10.00 price target on shares of GoodRx in a report on Friday, August 16th. One analyst has rated the stock with a sell rating, four have assigned a hold rating, nine have given a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, GoodRx presently has an average rating of "Moderate Buy" and a consensus target price of $8.86.

View Our Latest Stock Analysis on GoodRx

Insider Buying and Selling at GoodRx

In other news, major shareholder Equity Vii L.P. Spectrum sold 10,677 shares of the firm's stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $7.86, for a total transaction of $83,921.22. The transaction was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. 4.17% of the stock is currently owned by corporate insiders.

GoodRx Company Profile

(

Free Report)

GoodRx Holdings, Inc, together with its subsidiaries, offers information and tools that enable consumers to compare prices and save on their prescription drug purchases in the United States. The company operates a price comparison platform that provides consumers with curated, geographically relevant prescription pricing, and access to negotiated prices.

Featured Articles

Before you consider GoodRx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GoodRx wasn't on the list.

While GoodRx currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.