Connor Clark & Lunn Investment Management Ltd. lowered its stake in Tutor Perini Co. (NYSE:TPC - Free Report) by 70.7% during the third quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 41,931 shares of the construction company's stock after selling 101,200 shares during the quarter. Connor Clark & Lunn Investment Management Ltd. owned approximately 0.08% of Tutor Perini worth $1,139,000 as of its most recent filing with the SEC.

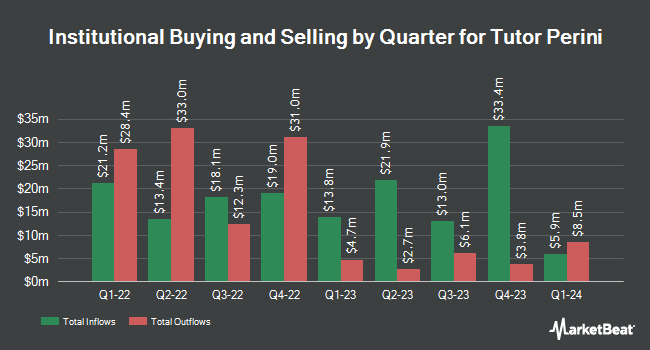

A number of other large investors have also recently bought and sold shares of the stock. CWM LLC grew its holdings in shares of Tutor Perini by 142.8% during the second quarter. CWM LLC now owns 1,714 shares of the construction company's stock worth $37,000 after buying an additional 1,008 shares in the last quarter. Allspring Global Investments Holdings LLC acquired a new stake in Tutor Perini during the second quarter worth approximately $51,000. Plato Investment Management Ltd purchased a new stake in Tutor Perini in the 3rd quarter worth approximately $52,000. nVerses Capital LLC acquired a new position in Tutor Perini in the 2nd quarter valued at $63,000. Finally, Quest Partners LLC lifted its stake in shares of Tutor Perini by 537.2% during the 2nd quarter. Quest Partners LLC now owns 4,148 shares of the construction company's stock worth $90,000 after purchasing an additional 3,497 shares during the period. Institutional investors and hedge funds own 65.01% of the company's stock.

Tutor Perini Trading Down 3.9 %

Shares of TPC stock traded down $1.11 on Thursday, reaching $27.25. 254,009 shares of the stock were exchanged, compared to its average volume of 482,294. The company has a quick ratio of 1.55, a current ratio of 1.55 and a debt-to-equity ratio of 0.53. The stock has a market cap of $1.43 billion, a P/E ratio of -10.86 and a beta of 1.50. The firm has a 50 day moving average of $27.56 and a two-hundred day moving average of $23.86. Tutor Perini Co. has a 1-year low of $7.83 and a 1-year high of $34.55.

Tutor Perini (NYSE:TPC - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The construction company reported ($1.92) EPS for the quarter, missing the consensus estimate of ($1.89) by ($0.03). The firm had revenue of $1.08 billion for the quarter, compared to analyst estimates of $1.17 billion. Tutor Perini had a negative return on equity of 9.56% and a negative net margin of 3.08%. The business's revenue was up 2.1% compared to the same quarter last year. During the same quarter in the prior year, the company earned ($0.71) earnings per share. On average, research analysts anticipate that Tutor Perini Co. will post -1.47 EPS for the current year.

Insider Buying and Selling at Tutor Perini

In other Tutor Perini news, Director Raymond R. Oneglia sold 100,000 shares of the business's stock in a transaction dated Wednesday, November 20th. The stock was sold at an average price of $28.73, for a total transaction of $2,873,000.00. Following the transaction, the director now owns 400,000 shares in the company, valued at $11,492,000. The trade was a 20.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, CEO Ronald N. Tutor sold 50,000 shares of the stock in a transaction dated Friday, November 8th. The shares were sold at an average price of $30.78, for a total value of $1,539,000.00. Following the completion of the sale, the chief executive officer now owns 2,362,267 shares of the company's stock, valued at approximately $72,710,578.26. This trade represents a 2.07 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 325,000 shares of company stock valued at $9,686,000 over the last ninety days. Corporate insiders own 19.50% of the company's stock.

Wall Street Analyst Weigh In

TPC has been the subject of a number of recent analyst reports. B. Riley lifted their price objective on Tutor Perini from $38.00 to $40.00 and gave the company a "buy" rating in a research report on Thursday, November 7th. StockNews.com cut Tutor Perini from a "buy" rating to a "hold" rating in a report on Friday, November 15th. Finally, UBS Group increased their price objective on shares of Tutor Perini from $27.00 to $39.00 and gave the stock a "buy" rating in a report on Wednesday, October 23rd.

Read Our Latest Report on TPC

About Tutor Perini

(

Free Report)

Tutor Perini Corporation, a construction company, provides diversified general contracting, construction management, and design-build services to private customers and public agencies in the United States and internationally. It operates through three segments: Civil, Building, and Specialty Contractors.

Featured Articles

Before you consider Tutor Perini, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tutor Perini wasn't on the list.

While Tutor Perini currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.