Connor Clark & Lunn Investment Management Ltd. cut its holdings in shares of Brady Co. (NYSE:BRC - Free Report) by 62.7% in the third quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 31,690 shares of the industrial products company's stock after selling 53,372 shares during the quarter. Connor Clark & Lunn Investment Management Ltd. owned 0.07% of Brady worth $2,428,000 at the end of the most recent quarter.

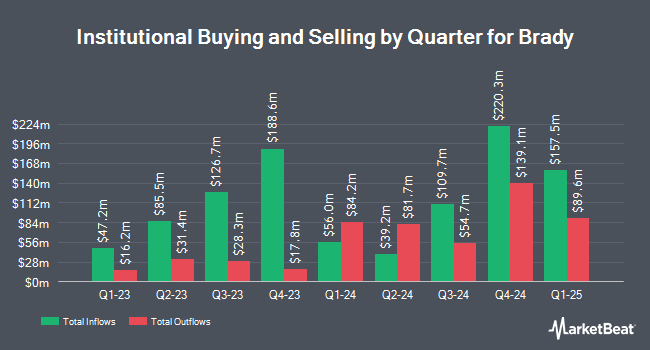

Other institutional investors and hedge funds also recently bought and sold shares of the company. Swedbank AB acquired a new position in shares of Brady in the first quarter worth $13,439,000. Assenagon Asset Management S.A. increased its position in Brady by 143.1% in the 3rd quarter. Assenagon Asset Management S.A. now owns 266,981 shares of the industrial products company's stock worth $20,459,000 after purchasing an additional 157,149 shares during the last quarter. Royce & Associates LP raised its stake in shares of Brady by 27.1% during the 3rd quarter. Royce & Associates LP now owns 555,792 shares of the industrial products company's stock worth $42,590,000 after purchasing an additional 118,557 shares in the last quarter. DekaBank Deutsche Girozentrale lifted its holdings in shares of Brady by 23.5% during the 2nd quarter. DekaBank Deutsche Girozentrale now owns 560,274 shares of the industrial products company's stock valued at $36,631,000 after buying an additional 106,652 shares during the last quarter. Finally, Thrivent Financial for Lutherans grew its stake in shares of Brady by 231.8% in the 2nd quarter. Thrivent Financial for Lutherans now owns 132,019 shares of the industrial products company's stock valued at $8,716,000 after buying an additional 92,228 shares in the last quarter. Hedge funds and other institutional investors own 76.28% of the company's stock.

Insider Transactions at Brady

In other news, COO Thomas F. Debruine sold 2,851 shares of the firm's stock in a transaction dated Thursday, September 26th. The stock was sold at an average price of $75.77, for a total value of $216,020.27. Following the sale, the chief operating officer now directly owns 9,727 shares of the company's stock, valued at approximately $737,014.79. This trade represents a 22.67 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CEO Russell Shaller sold 21,128 shares of the business's stock in a transaction dated Friday, September 27th. The stock was sold at an average price of $75.30, for a total value of $1,590,938.40. Following the transaction, the chief executive officer now directly owns 102,150 shares of the company's stock, valued at $7,691,895. This represents a 17.14 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders sold 45,262 shares of company stock worth $3,371,231. 15.60% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

Separately, StockNews.com lowered shares of Brady from a "strong-buy" rating to a "buy" rating in a research report on Friday, October 11th.

View Our Latest Report on BRC

Brady Stock Up 3.8 %

Shares of BRC stock traded up $2.77 on Monday, hitting $75.55. The company's stock had a trading volume of 542,505 shares, compared to its average volume of 276,497. The company has a debt-to-equity ratio of 0.11, a current ratio of 1.84 and a quick ratio of 1.25. The stock has a market capitalization of $3.61 billion, a price-to-earnings ratio of 18.56 and a beta of 0.76. Brady Co. has a fifty-two week low of $52.99 and a fifty-two week high of $77.68. The firm's fifty day moving average price is $74.17 and its 200-day moving average price is $70.45.

Brady (NYSE:BRC - Get Free Report) last announced its quarterly earnings results on Monday, November 18th. The industrial products company reported $1.12 earnings per share for the quarter, topping analysts' consensus estimates of $1.10 by $0.02. Brady had a return on equity of 19.79% and a net margin of 14.19%. The company had revenue of $377.10 million during the quarter, compared to analysts' expectations of $365.88 million. During the same quarter in the previous year, the firm earned $1.00 earnings per share. The business's quarterly revenue was up 13.6% compared to the same quarter last year. Research analysts anticipate that Brady Co. will post 4.55 EPS for the current year.

Brady Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Thursday, October 31st. Stockholders of record on Thursday, October 10th were given a $0.24 dividend. This is a positive change from Brady's previous quarterly dividend of $0.24. The ex-dividend date of this dividend was Thursday, October 10th. This represents a $0.96 dividend on an annualized basis and a dividend yield of 1.27%. Brady's dividend payout ratio (DPR) is currently 23.59%.

Brady Company Profile

(

Free Report)

Brady Corporation manufactures and supplies identification solutions (IDS) and workplace safety (WPS) products to identify and protect premises, products, and people in the United States and internationally. The company offers materials, printing systems, RFID, and bar code scanners for product identification, brand protection labeling, work in process labeling, finished product identification, and industrial track and trace applications; safety signs, floor-marking tapes, pipe markers, labeling systems, spill control products, lockout/tagout device, and software and services for safety compliance auditing, procedure writing, and training; and hand-held printers, wire markers, sleeves, and tags for wire identification.

Recommended Stories

Before you consider Brady, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brady wasn't on the list.

While Brady currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.