Connor Clark & Lunn Investment Management Ltd. cut its holdings in Lyft, Inc. (NASDAQ:LYFT - Free Report) by 14.1% during the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 1,821,726 shares of the ride-sharing company's stock after selling 299,602 shares during the quarter. Connor Clark & Lunn Investment Management Ltd. owned approximately 0.44% of Lyft worth $23,227,000 at the end of the most recent reporting period.

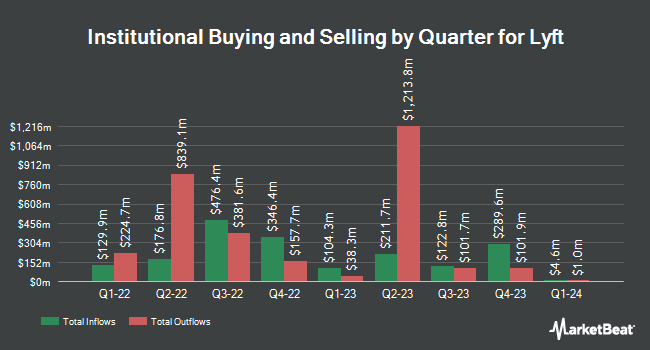

A number of other hedge funds and other institutional investors have also recently bought and sold shares of LYFT. Allspring Global Investments Holdings LLC bought a new stake in shares of Lyft during the first quarter worth $41,000. Sei Investments Co. increased its holdings in Lyft by 55.3% in the 1st quarter. Sei Investments Co. now owns 98,676 shares of the ride-sharing company's stock worth $1,909,000 after purchasing an additional 35,146 shares in the last quarter. Mitsubishi UFJ Trust & Banking Corp raised its position in Lyft by 430.9% in the first quarter. Mitsubishi UFJ Trust & Banking Corp now owns 3,886 shares of the ride-sharing company's stock valued at $75,000 after purchasing an additional 3,154 shares during the last quarter. Vanguard Group Inc. boosted its stake in shares of Lyft by 2.4% during the first quarter. Vanguard Group Inc. now owns 32,899,391 shares of the ride-sharing company's stock valued at $636,603,000 after purchasing an additional 782,736 shares in the last quarter. Finally, Healthcare of Ontario Pension Plan Trust Fund acquired a new stake in shares of Lyft during the first quarter valued at about $484,000. Institutional investors own 83.07% of the company's stock.

Insider Buying and Selling

In other Lyft news, Director John Patrick Zimmer sold 2,424 shares of Lyft stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $11.32, for a total transaction of $27,439.68. Following the completion of the transaction, the director now owns 929,638 shares of the company's stock, valued at $10,523,502.16. The trade was a 0.26 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, insider Lindsay Catherine Llewellyn sold 8,486 shares of the stock in a transaction dated Tuesday, August 27th. The stock was sold at an average price of $11.76, for a total transaction of $99,795.36. Following the completion of the sale, the insider now directly owns 764,332 shares in the company, valued at approximately $8,988,544.32. The trade was a 1.10 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 38,799 shares of company stock valued at $537,082. Company insiders own 3.07% of the company's stock.

Lyft Stock Performance

Shares of LYFT opened at $16.77 on Thursday. The company has a debt-to-equity ratio of 0.88, a current ratio of 0.75 and a quick ratio of 0.75. The firm has a market cap of $6.96 billion, a PE ratio of -104.81, a PEG ratio of 5.26 and a beta of 2.04. Lyft, Inc. has a 1 year low of $8.93 and a 1 year high of $20.82. The stock's fifty day moving average price is $13.97 and its two-hundred day moving average price is $13.59.

Lyft (NASDAQ:LYFT - Get Free Report) last announced its quarterly earnings data on Wednesday, November 6th. The ride-sharing company reported $0.29 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.20 by $0.09. The business had revenue of $1.52 billion for the quarter, compared to analysts' expectations of $1.44 billion. Lyft had a negative return on equity of 1.58% and a negative net margin of 1.19%. The firm's quarterly revenue was up 31.6% compared to the same quarter last year. During the same period in the previous year, the business posted ($0.02) EPS. On average, equities research analysts forecast that Lyft, Inc. will post 0.08 EPS for the current year.

Analyst Upgrades and Downgrades

A number of research analysts recently issued reports on LYFT shares. Bank of America raised their price objective on shares of Lyft from $16.00 to $19.00 and gave the company a "buy" rating in a report on Thursday, November 7th. Cantor Fitzgerald upped their price target on Lyft from $13.00 to $16.00 and gave the company a "neutral" rating in a research report on Thursday, November 7th. Nomura upgraded Lyft from a "reduce" rating to a "neutral" rating and lowered their price objective for the stock from $15.00 to $13.00 in a research report on Friday, August 23rd. Raymond James initiated coverage on Lyft in a report on Tuesday, September 24th. They issued a "market perform" rating on the stock. Finally, Evercore ISI boosted their price target on shares of Lyft from $17.00 to $19.00 and gave the stock an "in-line" rating in a research report on Thursday, November 7th. Twenty-eight equities research analysts have rated the stock with a hold rating, nine have issued a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Hold" and an average target price of $17.48.

Read Our Latest Stock Analysis on LYFT

Lyft Profile

(

Free Report)

Lyft, Inc operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada. It operates multimodal transportation networks that offer access to various transportation options through the Lyft platform and mobile-based applications. The company's platform provides a ridesharing marketplace, which connects drivers with riders; Express Drive, a car rental program for drivers; and a network of shared bikes and scooters in various cities to address the needs of riders for short trips.

Featured Stories

Want to see what other hedge funds are holding LYFT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Lyft, Inc. (NASDAQ:LYFT - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lyft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lyft wasn't on the list.

While Lyft currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.