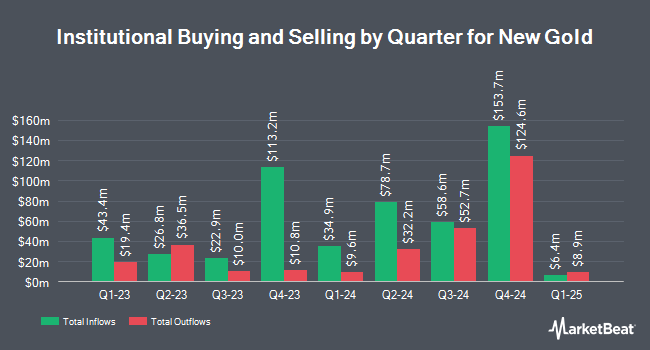

Connor Clark & Lunn Investment Management Ltd. lessened its holdings in New Gold Inc. (NYSE:NGD - Free Report) by 5.2% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 13,827,282 shares of the company's stock after selling 754,600 shares during the quarter. Connor Clark & Lunn Investment Management Ltd. owned 1.75% of New Gold worth $40,073,000 as of its most recent SEC filing.

Other institutional investors and hedge funds also recently made changes to their positions in the company. CIBC Asset Management Inc increased its stake in shares of New Gold by 2.2% in the 3rd quarter. CIBC Asset Management Inc now owns 2,105,546 shares of the company's stock valued at $6,105,000 after acquiring an additional 44,571 shares during the last quarter. Plato Investment Management Ltd acquired a new stake in shares of New Gold in the third quarter valued at approximately $226,000. Sumitomo Mitsui Trust Group Inc. increased its stake in shares of New Gold by 12.9% during the third quarter. Sumitomo Mitsui Trust Group Inc. now owns 265,441 shares of the company's stock worth $764,000 after purchasing an additional 30,366 shares during the period. Old West Investment Management LLC increased its stake in shares of New Gold by 42.9% during the third quarter. Old West Investment Management LLC now owns 1,000,000 shares of the company's stock worth $2,880,000 after purchasing an additional 300,000 shares during the period. Finally, Intact Investment Management Inc. increased its stake in shares of New Gold by 9.4% during the third quarter. Intact Investment Management Inc. now owns 2,329,400 shares of the company's stock worth $6,752,000 after purchasing an additional 200,000 shares during the period. Institutional investors and hedge funds own 42.82% of the company's stock.

New Gold Stock Performance

Shares of NYSE:NGD remained flat at $2.78 during trading hours on Wednesday. 7,142,157 shares of the company's stock were exchanged, compared to its average volume of 8,266,683. The stock has a market cap of $2.20 billion, a PE ratio of 139.25 and a beta of 1.31. The business's 50-day moving average is $2.86 and its 200 day moving average is $2.41. The company has a quick ratio of 0.84, a current ratio of 1.42 and a debt-to-equity ratio of 0.45. New Gold Inc. has a 52 week low of $1.09 and a 52 week high of $3.25.

New Gold (NYSE:NGD - Get Free Report) last announced its quarterly earnings results on Tuesday, October 29th. The company reported $0.08 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.04 by $0.04. New Gold had a net margin of 2.33% and a return on equity of 9.38%. The company had revenue of $252.00 million for the quarter. Analysts forecast that New Gold Inc. will post 0.17 EPS for the current year.

Analyst Ratings Changes

NGD has been the topic of several recent research reports. Scotiabank raised their price objective on New Gold from $2.75 to $3.25 and gave the company a "sector outperform" rating in a report on Tuesday, September 17th. Royal Bank of Canada increased their price objective on shares of New Gold from $3.00 to $3.50 and gave the stock an "outperform" rating in a research note on Tuesday, September 10th. Finally, StockNews.com upgraded shares of New Gold from a "hold" rating to a "buy" rating in a report on Friday, October 25th. Two research analysts have rated the stock with a hold rating, four have assigned a buy rating and two have issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, New Gold has a consensus rating of "Buy" and an average target price of $3.08.

View Our Latest Analysis on NGD

About New Gold

(

Free Report)

New Gold Inc, an intermediate gold mining company, develops and operates of mineral properties in Canada. It primarily explores for gold, silver, and copper deposits. The company's principal operating properties include 100% interest in the Rainy River mine located in Northwestern Ontario, Canada; and New Afton project situated in South-Central British Columbia.

Featured Articles

Before you consider New Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and New Gold wasn't on the list.

While New Gold currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.