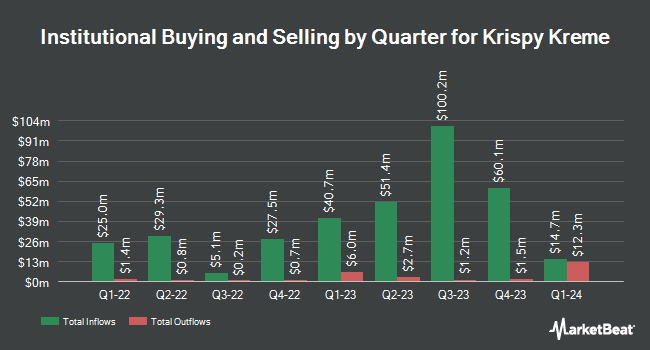

Connor Clark & Lunn Investment Management Ltd. purchased a new position in Krispy Kreme, Inc. (NASDAQ:DNUT - Free Report) during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm purchased 75,438 shares of the company's stock, valued at approximately $810,000.

Other large investors also recently modified their holdings of the company. Blue Trust Inc. purchased a new stake in shares of Krispy Kreme during the 2nd quarter valued at about $68,000. nVerses Capital LLC bought a new stake in shares of Krispy Kreme during the 3rd quarter valued at $124,000. Tidal Investments LLC purchased a new stake in shares of Krispy Kreme in the 1st quarter worth $154,000. American Century Companies Inc. bought a new position in Krispy Kreme in the 2nd quarter worth $185,000. Finally, Sei Investments Co. purchased a new stake in Krispy Kreme in the second quarter worth about $198,000. Institutional investors own 81.72% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts have recently commented on DNUT shares. Bank of America lifted their target price on shares of Krispy Kreme from $15.00 to $16.00 and gave the company a "buy" rating in a research note on Tuesday, October 22nd. Morgan Stanley initiated coverage on shares of Krispy Kreme in a report on Tuesday, November 5th. They issued an "equal weight" rating and a $14.00 target price on the stock. Evercore ISI restated an "in-line" rating and set a $13.00 target price on shares of Krispy Kreme in a research report on Tuesday, August 27th. Finally, JPMorgan Chase & Co. dropped their price objective on shares of Krispy Kreme from $14.00 to $13.00 and set an "overweight" rating for the company in a report on Tuesday, November 12th. Four investment analysts have rated the stock with a hold rating, five have given a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, Krispy Kreme currently has an average rating of "Moderate Buy" and a consensus price target of $15.56.

View Our Latest Research Report on DNUT

Krispy Kreme Trading Up 0.3 %

Shares of NASDAQ DNUT traded up $0.03 during midday trading on Friday, hitting $11.02. The company's stock had a trading volume of 700,853 shares, compared to its average volume of 2,019,599. Krispy Kreme, Inc. has a 12-month low of $9.18 and a 12-month high of $17.84. The company has a current ratio of 0.35, a quick ratio of 0.28 and a debt-to-equity ratio of 0.67. The firm has a market cap of $1.87 billion, a P/E ratio of 64.82, a price-to-earnings-growth ratio of 4.61 and a beta of 1.39. The business's 50 day moving average is $11.23 and its two-hundred day moving average is $11.07.

Krispy Kreme Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Wednesday, November 6th. Stockholders of record on Wednesday, October 23rd were paid a dividend of $0.035 per share. This represents a $0.14 dividend on an annualized basis and a dividend yield of 1.27%. The ex-dividend date was Wednesday, October 23rd. Krispy Kreme's dividend payout ratio is currently 82.35%.

Krispy Kreme Company Profile

(

Free Report)

Krispy Kreme, Inc, together with its subsidiaries, produces doughnuts in the United States, the United Kingdom, Ireland, Australia, New Zealand, Mexico, Canada, Japan, and internationally. The company operates through three segments: U.S., International, and Market Development. The company offers doughnut experiences through hot light theater and fresh shops, delivered fresh daily branded cabinets and merchandising units within grocery and convenience stores, quick service restaurants, club memberships, drug stores, and ecommerce, as well as through its branded sweet treat line comprising Krispy Kreme branded sweet treats.

Read More

Before you consider Krispy Kreme, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Krispy Kreme wasn't on the list.

While Krispy Kreme currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.