Connor Clark & Lunn Investment Management Ltd. bought a new stake in Unum Group (NYSE:UNM - Free Report) in the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund bought 84,480 shares of the financial services provider's stock, valued at approximately $5,021,000.

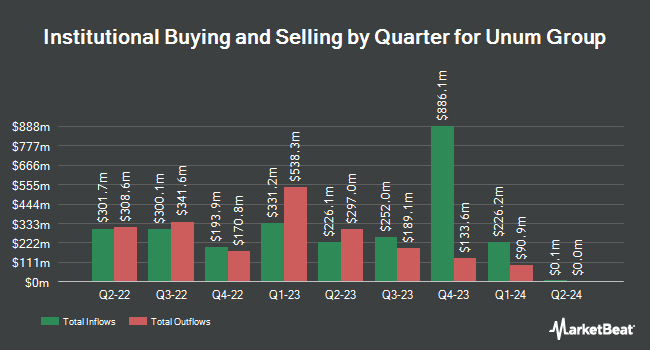

Other institutional investors have also recently made changes to their positions in the company. Versant Capital Management Inc raised its stake in shares of Unum Group by 361.5% during the second quarter. Versant Capital Management Inc now owns 503 shares of the financial services provider's stock valued at $26,000 after acquiring an additional 394 shares in the last quarter. V Square Quantitative Management LLC acquired a new position in shares of Unum Group in the second quarter worth $26,000. Capital Performance Advisors LLP purchased a new stake in shares of Unum Group during the 3rd quarter worth $31,000. 1620 Investment Advisors Inc. purchased a new stake in shares of Unum Group in the second quarter valued at about $29,000. Finally, Thurston Springer Miller Herd & Titak Inc. acquired a new position in shares of Unum Group during the third quarter worth about $37,000. Institutional investors own 86.57% of the company's stock.

Insider Transactions at Unum Group

In other news, EVP Christopher W. Pyne sold 3,250 shares of the company's stock in a transaction on Wednesday, November 6th. The stock was sold at an average price of $70.02, for a total transaction of $227,565.00. Following the transaction, the executive vice president now directly owns 50,762 shares of the company's stock, valued at approximately $3,554,355.24. This represents a 6.02 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CEO Richard P. Mckenney sold 67,795 shares of the firm's stock in a transaction on Thursday, September 5th. The stock was sold at an average price of $54.98, for a total value of $3,727,369.10. Following the completion of the transaction, the chief executive officer now owns 1,065,868 shares of the company's stock, valued at $58,601,422.64. This trade represents a 5.98 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 165,709 shares of company stock valued at $10,956,914. 0.93% of the stock is currently owned by insiders.

Unum Group Price Performance

NYSE UNM traded up $0.41 during trading on Friday, reaching $75.84. The company's stock had a trading volume of 1,758,127 shares, compared to its average volume of 1,493,110. The stock has a market capitalization of $13.85 billion, a PE ratio of 8.21, a P/E/G ratio of 1.11 and a beta of 0.76. The company has a debt-to-equity ratio of 0.32, a current ratio of 0.28 and a quick ratio of 0.28. The firm has a fifty day moving average of $63.86 and a 200 day moving average of $56.71. Unum Group has a one year low of $41.97 and a one year high of $76.31.

Unum Group (NYSE:UNM - Get Free Report) last released its quarterly earnings results on Tuesday, October 29th. The financial services provider reported $2.13 EPS for the quarter, beating analysts' consensus estimates of $2.10 by $0.03. Unum Group had a return on equity of 15.21% and a net margin of 13.76%. The business had revenue of $3.22 billion during the quarter, compared to analyst estimates of $3.26 billion. During the same quarter in the prior year, the company posted $1.94 EPS. Unum Group's quarterly revenue was up 4.0% compared to the same quarter last year. Analysts expect that Unum Group will post 8.53 EPS for the current fiscal year.

Unum Group declared that its board has authorized a share buyback program on Tuesday, July 30th that allows the company to repurchase $1.00 billion in outstanding shares. This repurchase authorization allows the financial services provider to purchase up to 10% of its shares through open market purchases. Shares repurchase programs are generally a sign that the company's board of directors believes its stock is undervalued.

Unum Group Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Friday, November 15th. Shareholders of record on Friday, October 25th were issued a dividend of $0.42 per share. The ex-dividend date of this dividend was Friday, October 25th. This represents a $1.68 dividend on an annualized basis and a yield of 2.22%. Unum Group's dividend payout ratio is presently 18.18%.

Analyst Ratings Changes

Several research firms have recently issued reports on UNM. Evercore ISI raised shares of Unum Group from an "in-line" rating to an "outperform" rating and increased their price objective for the stock from $67.00 to $84.00 in a research report on Thursday, November 14th. Truist Financial lifted their price objective on shares of Unum Group from $70.00 to $75.00 and gave the company a "buy" rating in a research report on Friday, November 1st. Wells Fargo & Company lifted their target price on shares of Unum Group from $69.00 to $71.00 and gave the stock an "overweight" rating in a research report on Thursday, October 10th. JPMorgan Chase & Co. reduced their price objective on shares of Unum Group from $65.00 to $63.00 and set an "overweight" rating for the company in a research note on Thursday, October 3rd. Finally, Morgan Stanley lifted their target price on Unum Group from $62.00 to $64.00 and gave the company an "equal weight" rating in a research note on Wednesday, October 30th. Four equities research analysts have rated the stock with a hold rating and nine have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $67.73.

Check Out Our Latest Stock Report on Unum Group

Unum Group Company Profile

(

Free Report)

Unum Group, together with its subsidiaries, provides financial protection benefit solutions primarily in the United States, the United Kingdom, Poland, and internationally. It operates through Unum US, Unum International, Colonial Life, and Closed Block segment. The company offers group long-term and short-term disability, group life, and accidental death and dismemberment products; supplemental and voluntary products, such as individual disability, voluntary benefits, and dental and vision products; and accident, sickness, disability, life, and cancer and critical illness products.

Read More

Before you consider Unum Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unum Group wasn't on the list.

While Unum Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report