Connor Clark & Lunn Investment Management Ltd. lessened its stake in shares of Alpha and Omega Semiconductor Limited (NASDAQ:AOSL - Free Report) by 16.4% during the 3rd quarter, according to its most recent 13F filing with the SEC. The firm owned 83,650 shares of the semiconductor company's stock after selling 16,372 shares during the period. Connor Clark & Lunn Investment Management Ltd. owned approximately 0.29% of Alpha and Omega Semiconductor worth $3,105,000 at the end of the most recent quarter.

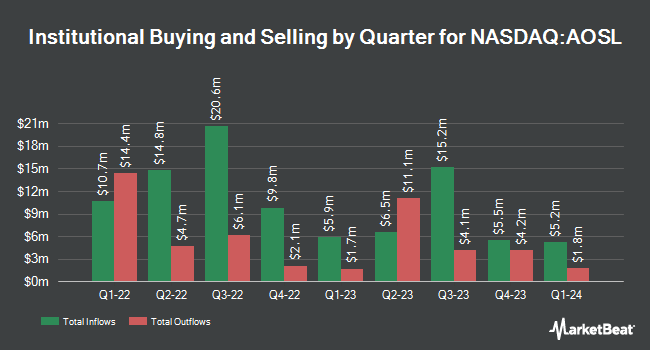

Other institutional investors also recently bought and sold shares of the company. Vanguard Group Inc. lifted its stake in Alpha and Omega Semiconductor by 1.9% in the first quarter. Vanguard Group Inc. now owns 2,125,356 shares of the semiconductor company's stock worth $46,843,000 after purchasing an additional 40,183 shares during the last quarter. Price T Rowe Associates Inc. MD boosted its holdings in Alpha and Omega Semiconductor by 4.8% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 19,636 shares of the semiconductor company's stock valued at $433,000 after acquiring an additional 893 shares during the period. Public Employees Retirement System of Ohio grew its position in Alpha and Omega Semiconductor by 51.3% in the 1st quarter. Public Employees Retirement System of Ohio now owns 21,993 shares of the semiconductor company's stock valued at $485,000 after acquiring an additional 7,453 shares during the last quarter. Jacobs Levy Equity Management Inc. increased its stake in Alpha and Omega Semiconductor by 101.8% in the first quarter. Jacobs Levy Equity Management Inc. now owns 199,369 shares of the semiconductor company's stock worth $4,394,000 after purchasing an additional 100,591 shares during the period. Finally, SG Americas Securities LLC bought a new stake in shares of Alpha and Omega Semiconductor during the second quarter worth $1,040,000. 78.97% of the stock is currently owned by institutional investors.

Alpha and Omega Semiconductor Stock Up 4.5 %

Shares of NASDAQ:AOSL traded up $1.73 during trading hours on Monday, hitting $40.36. The company's stock had a trading volume of 1,314,611 shares, compared to its average volume of 275,949. The company has a debt-to-equity ratio of 0.03, a current ratio of 2.65 and a quick ratio of 1.44. The firm's fifty day moving average price is $34.31 and its 200 day moving average price is $34.81. Alpha and Omega Semiconductor Limited has a 52 week low of $19.38 and a 52 week high of $47.45. The company has a market capitalization of $1.17 billion, a price-to-earnings ratio of -65.07 and a beta of 2.42.

Alpha and Omega Semiconductor (NASDAQ:AOSL - Get Free Report) last posted its earnings results on Monday, November 4th. The semiconductor company reported $0.21 earnings per share for the quarter, missing analysts' consensus estimates of $0.22 by ($0.01). The company had revenue of $181.89 million for the quarter, compared to analysts' expectations of $180.07 million. Alpha and Omega Semiconductor had a positive return on equity of 0.19% and a negative net margin of 2.94%. The firm's quarterly revenue was up .7% on a year-over-year basis. During the same quarter in the prior year, the company earned $0.30 EPS. As a group, research analysts expect that Alpha and Omega Semiconductor Limited will post -0.67 EPS for the current year.

Insider Buying and Selling at Alpha and Omega Semiconductor

In other news, COO Wenjun Li sold 2,183 shares of the stock in a transaction on Thursday, October 24th. The stock was sold at an average price of $35.49, for a total transaction of $77,474.67. Following the completion of the sale, the chief operating officer now owns 61,331 shares in the company, valued at approximately $2,176,637.19. This represents a 3.44 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. 16.90% of the stock is owned by insiders.

Analyst Upgrades and Downgrades

A number of research analysts have recently commented on AOSL shares. B. Riley cut their price target on shares of Alpha and Omega Semiconductor from $50.00 to $47.00 and set a "buy" rating on the stock in a report on Tuesday, November 5th. Benchmark reaffirmed a "buy" rating and set a $40.00 target price on shares of Alpha and Omega Semiconductor in a research report on Wednesday, November 6th. Stifel Nicolaus lowered their price target on Alpha and Omega Semiconductor from $34.00 to $27.00 and set a "sell" rating for the company in a report on Wednesday, November 6th. Finally, StockNews.com cut Alpha and Omega Semiconductor from a "hold" rating to a "sell" rating in a research note on Friday.

View Our Latest Analysis on AOSL

About Alpha and Omega Semiconductor

(

Free Report)

Alpha and Omega Semiconductor Limited designs, develops, and supplies power semiconductor products for computing, consumer electronics, communication, and industrial applications in Hong Kong, China, South Korea, the United States, and internationally. It offers power discrete products, including metal-oxide-semiconductor field-effect transistors (MOSFET), SRFETs, XSFET, electrostatic discharge, protected MOSFETs, high and mid-voltage MOSFETs, and insulated gate bipolar transistors for use in smart phone chargers, battery packs, notebooks, desktop and servers, data centers, base stations, graphics card, game boxes, TVs, AC adapters, power supplies, motor control, power tools, E-vehicles, white goods and industrial motor drives, UPS systems, solar inverters, and industrial welding.

Read More

Before you consider Alpha and Omega Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alpha and Omega Semiconductor wasn't on the list.

While Alpha and Omega Semiconductor currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.