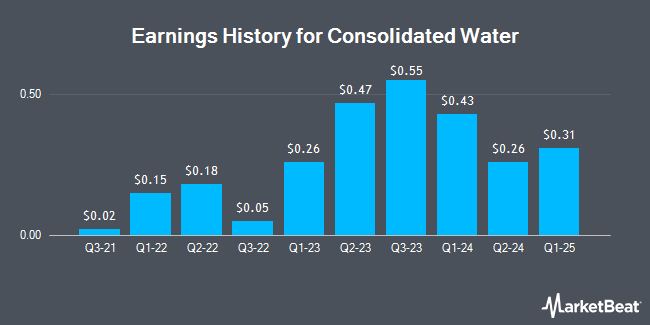

Consolidated Water (NASDAQ:CWCO - Get Free Report) will post its quarterly earnings results after the market closes on Thursday, November 14th. Analysts expect Consolidated Water to post earnings of $0.26 per share for the quarter. Investors that are interested in registering for the company's conference call can do so using this link.

Consolidated Water (NASDAQ:CWCO - Get Free Report) last announced its quarterly earnings results on Wednesday, August 14th. The utilities provider reported $0.26 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.34 by ($0.08). Consolidated Water had a return on equity of 15.49% and a net margin of 23.26%. The company had revenue of $32.48 million for the quarter, compared to analyst estimates of $37.12 million. On average, analysts expect Consolidated Water to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Consolidated Water Trading Down 2.5 %

Shares of CWCO traded down $0.64 on Thursday, reaching $25.20. The company's stock had a trading volume of 80,019 shares, compared to its average volume of 121,020. Consolidated Water has a twelve month low of $23.55 and a twelve month high of $38.29. The firm has a fifty day moving average of $25.31 and a 200-day moving average of $26.27.

Consolidated Water Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Thursday, October 31st. Stockholders of record on Tuesday, October 1st were issued a dividend of $0.11 per share. This is a boost from Consolidated Water's previous quarterly dividend of $0.10. The ex-dividend date was Tuesday, October 1st. This represents a $0.44 dividend on an annualized basis and a dividend yield of 1.75%.

Consolidated Water Company Profile

(

Get Free Report)

Consolidated Water Co Ltd., together with its subsidiaries, designs, constructs, manages, and operates water production and water treatment plants primarily in the Cayman Islands, the Bahamas, and the United States. The company operates through four segments: Retail, Bulk, Services, and Manufacturing.

Further Reading

Before you consider Consolidated Water, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Consolidated Water wasn't on the list.

While Consolidated Water currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.