Joho Capital LLC decreased its holdings in Constellation Brands, Inc. (NYSE:STZ - Free Report) by 19.0% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 9,815 shares of the company's stock after selling 2,300 shares during the period. Constellation Brands comprises 0.4% of Joho Capital LLC's portfolio, making the stock its 10th largest holding. Joho Capital LLC's holdings in Constellation Brands were worth $2,529,000 as of its most recent SEC filing.

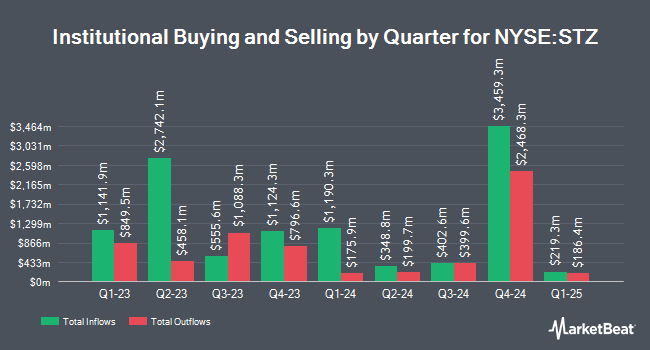

A number of other hedge funds have also made changes to their positions in STZ. New Millennium Group LLC acquired a new stake in Constellation Brands during the second quarter valued at $25,000. Thurston Springer Miller Herd & Titak Inc. bought a new stake in shares of Constellation Brands in the 2nd quarter valued at approximately $29,000. Horizon Bancorp Inc. IN acquired a new position in Constellation Brands in the second quarter worth approximately $32,000. Opal Wealth Advisors LLC bought a new position in Constellation Brands during the second quarter valued at approximately $36,000. Finally, Ashton Thomas Private Wealth LLC acquired a new stake in Constellation Brands in the second quarter valued at approximately $36,000. 77.34% of the stock is owned by hedge funds and other institutional investors.

Constellation Brands Stock Performance

NYSE STZ traded up $4.98 during midday trading on Friday, hitting $240.95. The company had a trading volume of 833,709 shares, compared to its average volume of 1,206,769. The firm has a fifty day simple moving average of $241.72 and a two-hundred day simple moving average of $246.75. The stock has a market cap of $43.75 billion, a price-to-earnings ratio of 77.98, a P/E/G ratio of 1.67 and a beta of 1.75. The company has a quick ratio of 0.53, a current ratio of 1.25 and a debt-to-equity ratio of 1.31. Constellation Brands, Inc. has a fifty-two week low of $224.76 and a fifty-two week high of $274.87.

Constellation Brands (NYSE:STZ - Get Free Report) last posted its quarterly earnings results on Thursday, October 3rd. The company reported $4.32 EPS for the quarter, beating the consensus estimate of $4.08 by $0.24. Constellation Brands had a return on equity of 25.34% and a net margin of 5.29%. The firm had revenue of $2.92 billion during the quarter, compared to analysts' expectations of $2.95 billion. During the same quarter in the prior year, the firm posted $3.70 EPS. The company's revenue for the quarter was up 2.9% on a year-over-year basis. Equities analysts forecast that Constellation Brands, Inc. will post 13.57 earnings per share for the current fiscal year.

Constellation Brands Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Thursday, November 21st. Investors of record on Tuesday, November 5th were given a $1.01 dividend. This represents a $4.04 annualized dividend and a yield of 1.68%. The ex-dividend date was Tuesday, November 5th. Constellation Brands's dividend payout ratio (DPR) is presently 130.74%.

Analyst Upgrades and Downgrades

Several brokerages have recently commented on STZ. Bank of America restated a "neutral" rating and set a $255.00 price target (down previously from $300.00) on shares of Constellation Brands in a research note on Monday, October 7th. BNP Paribas started coverage on shares of Constellation Brands in a research report on Monday, November 25th. They set a "neutral" rating and a $261.00 target price on the stock. TD Cowen cut Constellation Brands from a "buy" rating to a "hold" rating and reduced their price target for the stock from $300.00 to $270.00 in a research report on Tuesday, October 8th. Roth Mkm reissued a "buy" rating and set a $298.00 price objective on shares of Constellation Brands in a report on Friday, October 4th. Finally, Royal Bank of Canada reissued an "outperform" rating and issued a $308.00 price objective on shares of Constellation Brands in a research note on Tuesday, November 19th. Five investment analysts have rated the stock with a hold rating and fourteen have assigned a buy rating to the company. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $289.16.

Read Our Latest Research Report on Constellation Brands

Insiders Place Their Bets

In other news, CEO William A. Newlands sold 25,000 shares of the business's stock in a transaction on Thursday, November 14th. The shares were sold at an average price of $243.58, for a total value of $6,089,500.00. Following the sale, the chief executive officer now owns 7,274 shares in the company, valued at approximately $1,771,800.92. The trade was a 77.46 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, EVP Samuel J. Glaetzer sold 1,510 shares of the stock in a transaction dated Monday, October 14th. The stock was sold at an average price of $245.57, for a total transaction of $370,810.70. Following the sale, the executive vice president now owns 4,970 shares of the company's stock, valued at $1,220,482.90. This trade represents a 23.30 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 189,956 shares of company stock worth $46,058,091 over the last quarter. Company insiders own 12.19% of the company's stock.

About Constellation Brands

(

Free Report)

Constellation Brands, Inc, together with its subsidiaries, produces, imports, markets, and sells beer, wine, and spirits in the United States, Canada, Mexico, New Zealand, and Italy. The company provides beer primarily under the Corona Extra, Corona Familiar, Corona Hard Seltzer, Corona Light, Corona Non-Alcoholic, Corona Premier, Corona Refresca, Modelo Especial, Modelo Chelada, Modelo Negra, Modelo Oro, Victoria, Vicky Chamoy, and Pacifico brands.

Featured Articles

Before you consider Constellation Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Constellation Brands wasn't on the list.

While Constellation Brands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report