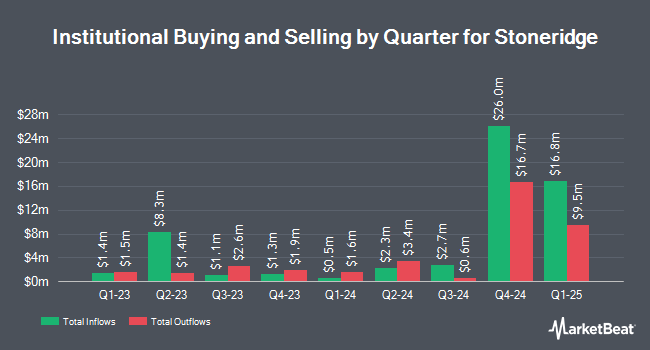

Cooke & Bieler LP lowered its position in shares of Stoneridge, Inc. (NYSE:SRI - Free Report) by 4.8% during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 1,412,994 shares of the auto parts company's stock after selling 70,507 shares during the quarter. Cooke & Bieler LP owned 5.10% of Stoneridge worth $8,859,000 as of its most recent SEC filing.

Other large investors have also added to or reduced their stakes in the company. Royce & Associates LP lifted its holdings in Stoneridge by 12.3% during the third quarter. Royce & Associates LP now owns 1,357,043 shares of the auto parts company's stock valued at $15,185,000 after purchasing an additional 148,461 shares in the last quarter. State Street Corp raised its position in shares of Stoneridge by 1.9% during the third quarter. State Street Corp now owns 628,981 shares of the auto parts company's stock valued at $7,038,000 after buying an additional 11,929 shares during the last quarter. JPMorgan Chase & Co. raised its position in shares of Stoneridge by 296.0% during the third quarter. JPMorgan Chase & Co. now owns 56,696 shares of the auto parts company's stock valued at $634,000 after buying an additional 42,379 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its position in shares of Stoneridge by 27.8% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 33,736 shares of the auto parts company's stock valued at $378,000 after buying an additional 7,332 shares during the last quarter. Finally, Jane Street Group LLC raised its position in shares of Stoneridge by 218.3% during the third quarter. Jane Street Group LLC now owns 69,734 shares of the auto parts company's stock valued at $780,000 after buying an additional 47,829 shares during the last quarter. Hedge funds and other institutional investors own 98.07% of the company's stock.

Analysts Set New Price Targets

Several brokerages recently weighed in on SRI. StockNews.com cut shares of Stoneridge from a "buy" rating to a "hold" rating in a research report on Saturday, March 8th. Barrington Research reaffirmed an "outperform" rating and set a $16.00 price target on shares of Stoneridge in a research note on Tuesday, March 4th.

View Our Latest Research Report on SRI

Stoneridge Trading Up 5.8 %

Shares of SRI traded up $0.28 during midday trading on Friday, hitting $5.02. The stock had a trading volume of 354,977 shares, compared to its average volume of 244,694. Stoneridge, Inc. has a 1 year low of $4.11 and a 1 year high of $18.57. The firm has a market cap of $138.89 million, a PE ratio of -18.57 and a beta of 1.27. The company has a debt-to-equity ratio of 0.72, a current ratio of 2.44 and a quick ratio of 1.40. The stock's 50 day moving average is $5.08 and its 200 day moving average is $7.58.

Stoneridge (NYSE:SRI - Get Free Report) last announced its earnings results on Wednesday, February 26th. The auto parts company reported ($0.18) earnings per share for the quarter, missing the consensus estimate of $0.18 by ($0.36). Stoneridge had a negative net margin of 0.81% and a negative return on equity of 0.42%. The firm had revenue of $218.20 million during the quarter, compared to analysts' expectations of $207.61 million. As a group, analysts forecast that Stoneridge, Inc. will post -0.42 EPS for the current fiscal year.

Stoneridge Profile

(

Free Report)

Stoneridge, Inc, together with its subsidiaries, designs and manufactures engineered electrical and electronic systems, components, and modules for the automotive, commercial, off-highway, motorcycle, and agricultural vehicle markets in North America, South America, Europe, and internationally. The company operates through three segments: Control Devices, Electronics, and Stoneridge Brazil.

Further Reading

Before you consider Stoneridge, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stoneridge wasn't on the list.

While Stoneridge currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.