Cooke & Bieler LP acquired a new stake in shares of Ryman Hospitality Properties, Inc. (NYSE:RHP - Free Report) during the fourth quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund acquired 716,994 shares of the real estate investment trust's stock, valued at approximately $74,811,000. Cooke & Bieler LP owned 1.20% of Ryman Hospitality Properties at the end of the most recent quarter.

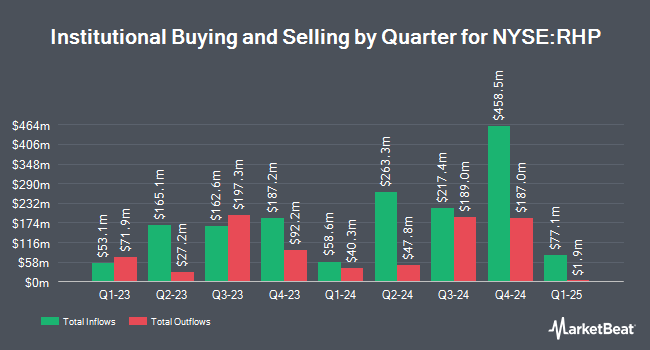

Other institutional investors and hedge funds have also modified their holdings of the company. Principal Financial Group Inc. boosted its stake in Ryman Hospitality Properties by 41.9% in the 3rd quarter. Principal Financial Group Inc. now owns 3,153,360 shares of the real estate investment trust's stock valued at $338,168,000 after buying an additional 931,283 shares in the last quarter. Hamlin Capital Management LLC acquired a new position in shares of Ryman Hospitality Properties during the fourth quarter valued at $65,142,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its stake in shares of Ryman Hospitality Properties by 483.2% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 609,761 shares of the real estate investment trust's stock valued at $65,391,000 after acquiring an additional 505,207 shares during the period. Victory Capital Management Inc. lifted its stake in shares of Ryman Hospitality Properties by 3,800.4% during the third quarter. Victory Capital Management Inc. now owns 292,410 shares of the real estate investment trust's stock valued at $31,358,000 after acquiring an additional 284,913 shares during the period. Finally, Raymond James Financial Inc. acquired a new position in shares of Ryman Hospitality Properties during the fourth quarter valued at $23,995,000. 94.48% of the stock is currently owned by institutional investors.

Insider Activity at Ryman Hospitality Properties

In other news, Chairman Colin V. Reed acquired 8,231 shares of the business's stock in a transaction that occurred on Wednesday, February 26th. The shares were bought at an average price of $97.54 per share, with a total value of $802,851.74. Following the acquisition, the chairman now directly owns 832,260 shares in the company, valued at $81,178,640.40. The trade was a 1.00 % increase in their position. The acquisition was disclosed in a filing with the SEC, which is available through this hyperlink. Also, Director Alvin L. Bowles, Jr. sold 473 shares of the firm's stock in a transaction on Wednesday, February 26th. The shares were sold at an average price of $97.03, for a total value of $45,895.19. Following the sale, the director now directly owns 2,675 shares in the company, valued at approximately $259,555.25. This trade represents a 15.03 % decrease in their position. The disclosure for this sale can be found here. 3.00% of the stock is currently owned by company insiders.

Ryman Hospitality Properties Price Performance

Shares of NYSE RHP opened at $100.62 on Tuesday. The firm has a market cap of $6.03 billion, a P/E ratio of 22.92, a price-to-earnings-growth ratio of 2.71 and a beta of 1.65. The company has a current ratio of 1.73, a quick ratio of 1.73 and a debt-to-equity ratio of 6.07. Ryman Hospitality Properties, Inc. has a 1-year low of $93.76 and a 1-year high of $121.77. The business's 50 day moving average is $102.22 and its 200-day moving average is $106.80.

Ryman Hospitality Properties (NYSE:RHP - Get Free Report) last posted its quarterly earnings data on Thursday, February 20th. The real estate investment trust reported $2.15 EPS for the quarter, topping analysts' consensus estimates of $1.21 by $0.94. Ryman Hospitality Properties had a return on equity of 49.23% and a net margin of 11.61%. The firm had revenue of $647.63 million for the quarter, compared to analyst estimates of $656.01 million. Equities research analysts predict that Ryman Hospitality Properties, Inc. will post 8.81 earnings per share for the current year.

Ryman Hospitality Properties Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, April 15th. Investors of record on Monday, March 31st will be issued a dividend of $1.15 per share. This represents a $4.60 annualized dividend and a dividend yield of 4.57%. The ex-dividend date is Monday, March 31st. Ryman Hospitality Properties's dividend payout ratio (DPR) is 104.78%.

Analyst Upgrades and Downgrades

A number of research firms recently commented on RHP. BMO Capital Markets began coverage on Ryman Hospitality Properties in a report on Monday, December 9th. They issued an "outperform" rating and a $133.00 price objective for the company. StockNews.com upgraded Ryman Hospitality Properties from a "sell" rating to a "hold" rating in a report on Saturday, March 1st. Wells Fargo & Company lowered their price target on Ryman Hospitality Properties from $130.00 to $122.00 and set an "overweight" rating for the company in a report on Tuesday, February 18th. Truist Financial restated a "buy" rating and issued a $133.00 price target (down from $136.00) on shares of Ryman Hospitality Properties in a report on Tuesday, February 25th. Finally, JPMorgan Chase & Co. restated an "underweight" rating and issued a $100.00 price target on shares of Ryman Hospitality Properties in a report on Friday, December 13th. One equities research analyst has rated the stock with a sell rating, one has assigned a hold rating and five have given a buy rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $125.67.

Check Out Our Latest Analysis on RHP

Ryman Hospitality Properties Profile

(

Free Report)

Ryman Hospitality Properties, Inc NYSE: RHP is a leading lodging and hospitality real estate investment trust that specializes in upscale convention center resorts and entertainment experiences. The Company's holdings include Gaylord Opryland Resort & Convention Center; Gaylord Palms Resort & Convention Center; Gaylord Texan Resort & Convention Center; Gaylord National Resort & Convention Center; and Gaylord Rockies Resort & Convention Center, five of the top seven largest non-gaming convention center hotels in the United States based on total indoor meeting space.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ryman Hospitality Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ryman Hospitality Properties wasn't on the list.

While Ryman Hospitality Properties currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.