StockNews.com upgraded shares of Cooper Companies (NASDAQ:COO - Free Report) from a hold rating to a buy rating in a research report released on Thursday morning.

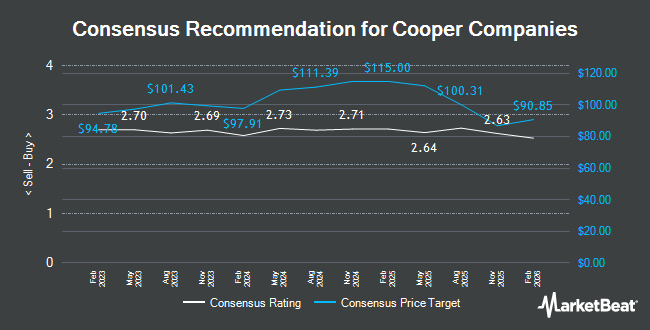

Other analysts have also recently issued research reports about the company. Stifel Nicolaus reaffirmed a "buy" rating and issued a $115.00 price target (up previously from $110.00) on shares of Cooper Companies in a research report on Thursday, August 29th. Needham & Company LLC reaffirmed a "hold" rating on shares of Cooper Companies in a research report on Thursday, August 29th. Morgan Stanley lifted their price target on shares of Cooper Companies from $95.00 to $104.00 and gave the company an "equal weight" rating in a research report on Tuesday, September 10th. Robert W. Baird upped their price objective on shares of Cooper Companies from $118.00 to $125.00 and gave the stock an "outperform" rating in a report on Thursday, August 29th. Finally, Piper Sandler lifted their target price on shares of Cooper Companies from $115.00 to $120.00 and gave the stock an "overweight" rating in a report on Thursday, August 29th. Three analysts have rated the stock with a hold rating and ten have assigned a buy rating to the company's stock. According to data from MarketBeat, Cooper Companies has a consensus rating of "Moderate Buy" and a consensus price target of $117.00.

Check Out Our Latest Stock Analysis on COO

Cooper Companies Stock Down 2.0 %

Cooper Companies stock traded down $2.02 during trading hours on Thursday, hitting $99.86. The company had a trading volume of 1,260,617 shares, compared to its average volume of 1,125,182. The firm's fifty day moving average is $107.10 and its 200-day moving average is $97.85. The firm has a market capitalization of $19.89 billion, a P/E ratio of 56.76, a price-to-earnings-growth ratio of 2.20 and a beta of 0.99. Cooper Companies has a fifty-two week low of $82.21 and a fifty-two week high of $112.38. The company has a debt-to-equity ratio of 0.33, a current ratio of 1.99 and a quick ratio of 1.18.

Cooper Companies (NASDAQ:COO - Get Free Report) last released its quarterly earnings data on Wednesday, August 28th. The medical device company reported $0.96 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.91 by $0.05. Cooper Companies had a return on equity of 9.08% and a net margin of 9.45%. The firm had revenue of $1 billion during the quarter, compared to analysts' expectations of $997.30 million. During the same quarter last year, the firm earned $0.84 earnings per share. The business's revenue for the quarter was up 7.8% on a year-over-year basis. On average, research analysts forecast that Cooper Companies will post 3.65 earnings per share for the current year.

Insider Activity

In related news, CFO Brian G. Andrews sold 24,788 shares of the stock in a transaction dated Thursday, September 5th. The shares were sold at an average price of $105.90, for a total value of $2,625,049.20. Following the completion of the transaction, the chief financial officer now owns 6,614 shares of the company's stock, valued at $700,422.60. This represents a 78.94 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. In other news, CAO Agostino Ricupati sold 1,601 shares of the business's stock in a transaction on Tuesday, September 10th. The shares were sold at an average price of $108.03, for a total value of $172,956.03. Following the sale, the chief accounting officer now owns 4,818 shares in the company, valued at approximately $520,488.54. The trade was a 24.94 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CFO Brian G. Andrews sold 24,788 shares of the stock in a transaction dated Thursday, September 5th. The stock was sold at an average price of $105.90, for a total transaction of $2,625,049.20. Following the sale, the chief financial officer now owns 6,614 shares of the company's stock, valued at $700,422.60. This trade represents a 78.94 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 256,373 shares of company stock worth $27,637,427. Corporate insiders own 2.00% of the company's stock.

Hedge Funds Weigh In On Cooper Companies

A number of institutional investors and hedge funds have recently added to or reduced their stakes in COO. Verition Fund Management LLC raised its position in Cooper Companies by 153.1% in the 3rd quarter. Verition Fund Management LLC now owns 42,053 shares of the medical device company's stock valued at $4,640,000 after purchasing an additional 25,440 shares during the last quarter. Captrust Financial Advisors increased its stake in shares of Cooper Companies by 9.7% in the third quarter. Captrust Financial Advisors now owns 3,816 shares of the medical device company's stock valued at $421,000 after buying an additional 338 shares in the last quarter. Public Sector Pension Investment Board raised its holdings in shares of Cooper Companies by 14.5% in the third quarter. Public Sector Pension Investment Board now owns 8,690 shares of the medical device company's stock valued at $959,000 after buying an additional 1,100 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its position in Cooper Companies by 11.9% during the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 1,818,610 shares of the medical device company's stock worth $200,665,000 after buying an additional 194,118 shares in the last quarter. Finally, Zurcher Kantonalbank Zurich Cantonalbank grew its holdings in Cooper Companies by 28.5% during the 3rd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 45,261 shares of the medical device company's stock worth $4,994,000 after acquiring an additional 10,045 shares during the last quarter. 24.39% of the stock is currently owned by institutional investors and hedge funds.

About Cooper Companies

(

Get Free Report)

The Cooper Companies, Inc, together with its subsidiaries, develops, manufactures, and markets contact lens wearers. The company operates in two segments, CooperVision and CooperSurgical. The CooperVision segment provides spherical lense, including lenses that correct near and farsightedness; and toric and multifocal lenses comprising lenses correcting vision challenges, such as astigmatism, presbyopia, and myopia in the Americas, Europe, Middle East, Africa, and Asia Pacific.

Featured Articles

Before you consider Cooper Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cooper Companies wasn't on the list.

While Cooper Companies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.