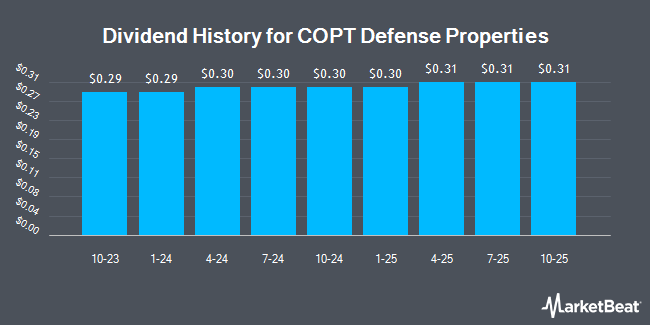

COPT Defense Properties (NYSE:CDP - Get Free Report) declared a quarterly dividend on Friday, November 15th,Wall Street Journal reports. Investors of record on Tuesday, December 31st will be paid a dividend of 0.295 per share on Wednesday, January 15th. This represents a $1.18 dividend on an annualized basis and a yield of 3.95%. The ex-dividend date of this dividend is Tuesday, December 31st.

COPT Defense Properties has a dividend payout ratio of 92.7% indicating that its dividend is currently covered by earnings, but may not be in the future if the company's earnings decline. Equities analysts expect COPT Defense Properties to earn $2.68 per share next year, which means the company should continue to be able to cover its $1.14 annual dividend with an expected future payout ratio of 42.5%.

COPT Defense Properties Price Performance

CDP traded down $0.15 on Friday, reaching $29.90. The company had a trading volume of 1,089,109 shares, compared to its average volume of 854,294. The company has a market capitalization of $3.37 billion, a P/E ratio of 24.63 and a beta of 0.98. The company has a current ratio of 2.38, a quick ratio of 2.38 and a debt-to-equity ratio of 1.56. The company has a fifty day moving average of $31.19 and a 200-day moving average of $27.96. COPT Defense Properties has a one year low of $22.20 and a one year high of $34.22.

COPT Defense Properties (NYSE:CDP - Get Free Report) last issued its quarterly earnings results on Monday, October 28th. The company reported $0.32 EPS for the quarter, missing the consensus estimate of $0.64 by ($0.32). COPT Defense Properties had a return on equity of 8.99% and a net margin of 18.34%. The business had revenue of $189.23 million during the quarter, compared to the consensus estimate of $167.37 million. During the same quarter last year, the firm posted $0.60 earnings per share. COPT Defense Properties's revenue was up 12.3% compared to the same quarter last year. As a group, equities research analysts anticipate that COPT Defense Properties will post 2.57 earnings per share for the current year.

Wall Street Analysts Forecast Growth

CDP has been the topic of several research reports. Truist Financial upped their price target on COPT Defense Properties from $27.00 to $31.00 and gave the company a "hold" rating in a research note on Thursday, August 29th. Wells Fargo & Company cut their target price on COPT Defense Properties from $33.00 to $32.00 and set an "overweight" rating for the company in a research note on Wednesday, September 11th. JPMorgan Chase & Co. boosted their target price on COPT Defense Properties from $26.00 to $31.00 and gave the stock a "neutral" rating in a research note on Wednesday, September 4th. Evercore ISI upped their price objective on shares of COPT Defense Properties from $33.00 to $36.00 and gave the stock an "outperform" rating in a research report on Wednesday, October 30th. Finally, Wedbush increased their target price on COPT Defense Properties from $28.00 to $33.00 and gave the company an "outperform" rating in a research report on Monday, August 5th. Three analysts have rated the stock with a hold rating and four have given a buy rating to the stock. According to data from MarketBeat.com, COPT Defense Properties currently has a consensus rating of "Moderate Buy" and an average target price of $30.86.

Read Our Latest Stock Report on COPT Defense Properties

Insider Buying and Selling

In other COPT Defense Properties news, COO Britt A. Snider acquired 1,000 shares of the firm's stock in a transaction on Tuesday, September 10th. The stock was acquired at an average cost of $29.41 per share, for a total transaction of $29,410.00. Following the purchase, the chief operating officer now owns 2,000 shares in the company, valued at approximately $58,820. The trade was a 100.00 % increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 1.06% of the stock is owned by corporate insiders.

COPT Defense Properties Company Profile

(

Get Free Report)

COPT Defense, an S&P MidCap 400 Company, is a self-managed REIT focused on owning, operating and developing properties in locations proximate to, or sometimes containing, key U.S. Government (USG) defense installations and missions (referred to as its Defense/IT Portfolio). The Company's tenants include the USG and their defense contractors, who are primarily engaged in priority national security activities, and who generally require mission-critical and high security property enhancements.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider COPT Defense Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and COPT Defense Properties wasn't on the list.

While COPT Defense Properties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.