Acuta Capital Partners LLC decreased its position in shares of Corbus Pharmaceuticals Holdings, Inc. (NASDAQ:CRBP - Free Report) by 71.3% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 18,500 shares of the biopharmaceutical company's stock after selling 46,000 shares during the quarter. Acuta Capital Partners LLC owned 0.15% of Corbus Pharmaceuticals worth $382,000 as of its most recent SEC filing.

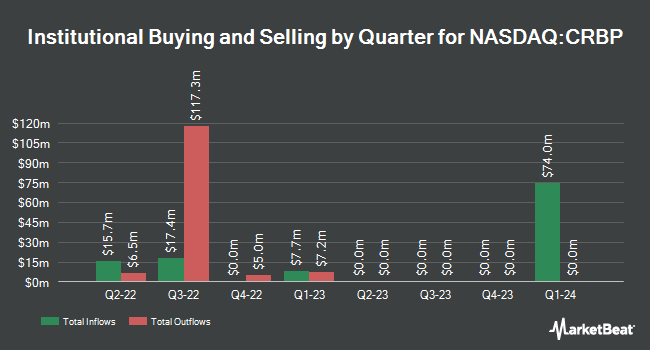

Other large investors have also recently bought and sold shares of the company. MetLife Investment Management LLC purchased a new stake in shares of Corbus Pharmaceuticals in the 3rd quarter valued at $123,000. FMR LLC boosted its holdings in Corbus Pharmaceuticals by 33.0% in the third quarter. FMR LLC now owns 10,028 shares of the biopharmaceutical company's stock valued at $207,000 after purchasing an additional 2,486 shares during the last quarter. The Manufacturers Life Insurance Company raised its stake in shares of Corbus Pharmaceuticals by 7.6% during the 3rd quarter. The Manufacturers Life Insurance Company now owns 22,731 shares of the biopharmaceutical company's stock valued at $469,000 after buying an additional 1,600 shares during the last quarter. Charles Schwab Investment Management Inc. lifted its holdings in shares of Corbus Pharmaceuticals by 224.7% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 93,643 shares of the biopharmaceutical company's stock valued at $1,932,000 after buying an additional 64,800 shares during the period. Finally, HealthInvest Partners AB boosted its stake in shares of Corbus Pharmaceuticals by 77.9% in the third quarter. HealthInvest Partners AB now owns 69,573 shares of the biopharmaceutical company's stock worth $1,435,000 after buying an additional 30,473 shares during the last quarter. Hedge funds and other institutional investors own 64.64% of the company's stock.

Insider Buying and Selling

In other Corbus Pharmaceuticals news, major shareholder Cormorant Asset Management, Lp acquired 350,000 shares of the business's stock in a transaction on Friday, September 20th. The stock was bought at an average price of $20.01 per share, for a total transaction of $7,003,500.00. Following the acquisition, the insider now owns 2,375,000 shares in the company, valued at approximately $47,523,750. The trade was a 17.28 % increase in their ownership of the stock. The purchase was disclosed in a filing with the SEC, which is available through the SEC website. 4.00% of the stock is owned by company insiders.

Corbus Pharmaceuticals Price Performance

CRBP stock traded down $0.34 during trading on Thursday, hitting $17.64. The stock had a trading volume of 155,488 shares, compared to its average volume of 558,834. The company's 50-day moving average price is $18.91 and its two-hundred day moving average price is $39.99. Corbus Pharmaceuticals Holdings, Inc. has a twelve month low of $4.06 and a twelve month high of $61.90. The stock has a market capitalization of $214.86 million, a P/E ratio of -3.76 and a beta of 2.56.

Analysts Set New Price Targets

Several research analysts recently weighed in on the company. Lifesci Capital upgraded Corbus Pharmaceuticals to a "strong-buy" rating in a research report on Wednesday, August 21st. Oppenheimer boosted their target price on shares of Corbus Pharmaceuticals from $80.00 to $88.00 and gave the company an "outperform" rating in a research note on Wednesday, August 7th. StockNews.com lowered shares of Corbus Pharmaceuticals from a "hold" rating to a "sell" rating in a research report on Saturday, August 10th. Mizuho reissued an "outperform" rating and set a $74.00 target price on shares of Corbus Pharmaceuticals in a research note on Friday, September 20th. Finally, Wedbush restated an "outperform" rating and issued a $51.00 price target on shares of Corbus Pharmaceuticals in a research note on Monday, November 4th. One analyst has rated the stock with a sell rating, seven have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $65.86.

View Our Latest Stock Report on Corbus Pharmaceuticals

Corbus Pharmaceuticals Profile

(

Free Report)

Corbus Pharmaceuticals Holdings, Inc, a biopharmaceutical company, develops products to defeat serious illness. It develops CRB-701, an antibody drug conjugate (ADC) that targets the expression of Nectin-4 on cancer cells to release a cytotoxic payload of monomethyl auristatin E (MMAE), which is in Phase I clinical trial; CRB-601, an anti-integrin monoclonal antibody that blocks the activation of TGFß expressed on cancer cells for the treatment of solid tumors; CRB-913, a peripherally restricted cannabinoid type-1 (CB1) receptor inverse agonist for the treatment of obesity.

Further Reading

Before you consider Corbus Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corbus Pharmaceuticals wasn't on the list.

While Corbus Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.