Core Scientific (NASDAQ:CORZ - Get Free Report) had its target price raised by research analysts at Needham & Company LLC from $17.00 to $18.00 in a report issued on Thursday,Benzinga reports. The firm currently has a "buy" rating on the stock. Needham & Company LLC's price objective points to a potential upside of 9.09% from the company's current price.

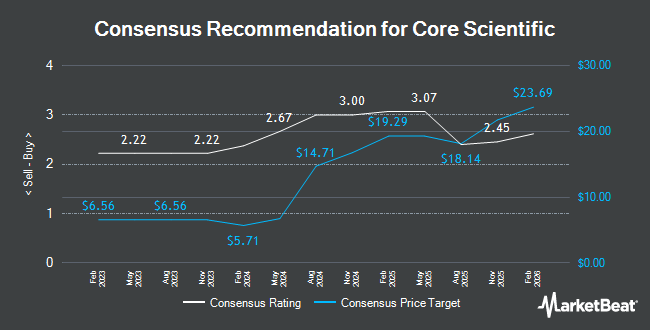

Several other research firms have also recently commented on CORZ. HC Wainwright upped their target price on shares of Core Scientific from $15.00 to $17.00 and gave the company a "buy" rating in a research note on Thursday. Compass Point boosted their price objective on Core Scientific from $18.00 to $20.00 and gave the stock a "buy" rating in a research note on Wednesday, October 23rd. Macquarie began coverage on shares of Core Scientific in a report on Wednesday, September 25th. They issued an "outperform" rating and a $16.00 price target for the company. B. Riley boosted their price objective on Core Scientific from $13.00 to $14.00 and gave the stock a "buy" rating in a report on Friday, October 11th. Finally, Cantor Fitzgerald reissued an "overweight" rating and issued a $20.00 price target on shares of Core Scientific in a research note on Thursday, October 3rd. Twelve investment analysts have rated the stock with a buy rating, According to MarketBeat, the stock presently has a consensus rating of "Buy" and an average target price of $17.21.

Check Out Our Latest Research Report on CORZ

Core Scientific Stock Performance

CORZ traded up $2.17 on Thursday, reaching $16.50. The company had a trading volume of 26,517,316 shares, compared to its average volume of 8,827,691. The company has a fifty day moving average of $12.08 and a 200-day moving average of $9.25. Core Scientific has a one year low of $2.61 and a one year high of $16.70.

Core Scientific (NASDAQ:CORZ - Get Free Report) last issued its earnings results on Wednesday, August 7th. The company reported ($4.51) earnings per share for the quarter, missing the consensus estimate of ($0.04) by ($4.47). The business had revenue of $141.10 million during the quarter, compared to the consensus estimate of $128.58 million. The company's revenue for the quarter was up 11.2% compared to the same quarter last year. On average, sell-side analysts anticipate that Core Scientific will post 0.81 earnings per share for the current fiscal year.

Insider Buying and Selling

In other news, insider Todd M. Duchene sold 11,582 shares of Core Scientific stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $9.41, for a total value of $108,986.62. Following the completion of the transaction, the insider now owns 1,686,474 shares of the company's stock, valued at $15,869,720.34. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. In related news, insider Todd M. Duchene sold 11,582 shares of the stock in a transaction on Friday, August 16th. The stock was sold at an average price of $9.41, for a total value of $108,986.62. Following the sale, the insider now owns 1,686,474 shares in the company, valued at approximately $15,869,720.34. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Jarrod M. Patten acquired 4,000 shares of the company's stock in a transaction dated Wednesday, August 28th. The stock was bought at an average cost of $9.70 per share, for a total transaction of $38,800.00. Following the completion of the transaction, the director now directly owns 279,239 shares of the company's stock, valued at approximately $2,708,618.30. This trade represents a 0.00 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last three months, insiders have bought 12,761 shares of company stock worth $127,080.

Hedge Funds Weigh In On Core Scientific

Institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Barings LLC bought a new stake in shares of Core Scientific during the first quarter worth about $36,515,000. ORG Wealth Partners LLC acquired a new position in Core Scientific in the 3rd quarter valued at approximately $106,266,000. Vanguard Group Inc. bought a new position in shares of Core Scientific during the first quarter valued at $21,973,000. Kensico Capital Management Corp acquired a new position in shares of Core Scientific during the first quarter worth $18,513,000. Finally, Van ECK Associates Corp bought a new stake in shares of Core Scientific in the second quarter worth $12,239,000.

Core Scientific Company Profile

(

Get Free Report)

Core Scientific, Inc provides digital asset mining services in North America. It operates through two segments, Mining and Hosting. The company offers blockchain infrastructure, software solutions, and services; and operates data center mining facilities. It also mines digital assets for its own account; and provides hosting services for other large bitcoin miners, which include deployment, monitoring, trouble shooting, optimization, and maintenance of its customers' digital asset mining equipment.

Further Reading

Before you consider Core Scientific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Core Scientific wasn't on the list.

While Core Scientific currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.