Core Scientific (NASDAQ:CORZ - Get Free Report) was upgraded by analysts at Roth Capital to a "strong-buy" rating in a note issued to investors on Thursday,Zacks.com reports.

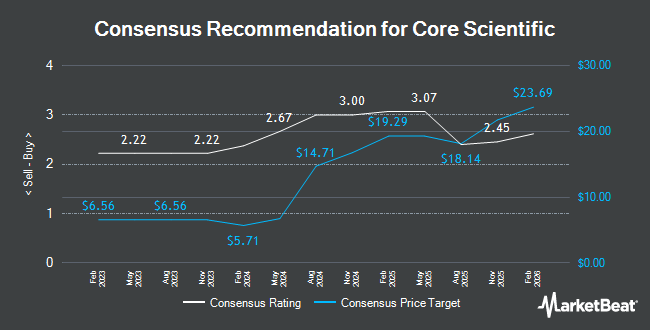

Other research analysts also recently issued reports about the stock. Needham & Company LLC raised their price target on shares of Core Scientific from $17.00 to $18.00 and gave the stock a "buy" rating in a research report on Thursday, November 7th. Macquarie lifted their price objective on shares of Core Scientific from $16.00 to $19.00 and gave the company an "outperform" rating in a research report on Thursday. HC Wainwright lifted their price objective on shares of Core Scientific from $15.00 to $17.00 and gave the company a "buy" rating in a research report on Thursday, November 7th. Jefferies Financial Group initiated coverage on shares of Core Scientific in a research report on Monday, October 28th. They issued a "buy" rating and a $19.00 price objective on the stock. Finally, Cantor Fitzgerald reiterated an "overweight" rating and issued a $20.00 price objective on shares of Core Scientific in a research report on Thursday, October 3rd. Thirteen equities research analysts have rated the stock with a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the company presently has a consensus rating of "Buy" and an average target price of $18.38.

Get Our Latest Stock Report on CORZ

Core Scientific Price Performance

CORZ traded up $0.39 during trading hours on Thursday, reaching $15.83. 7,901,672 shares of the stock traded hands, compared to its average volume of 8,891,639. The firm's fifty day simple moving average is $12.99 and its two-hundred day simple moving average is $9.84. The company has a market cap of $4.42 billion and a price-to-earnings ratio of -2.93. Core Scientific has a fifty-two week low of $2.61 and a fifty-two week high of $18.03.

Insider Transactions at Core Scientific

In other Core Scientific news, Director Jarrod M. Patten bought 4,000 shares of Core Scientific stock in a transaction on Wednesday, August 28th. The stock was purchased at an average cost of $9.70 per share, for a total transaction of $38,800.00. Following the completion of the purchase, the director now directly owns 279,239 shares of the company's stock, valued at $2,708,618.30. The trade was a 1.45 % increase in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Insiders have bought a total of 12,761 shares of company stock valued at $127,080 over the last ninety days. Corporate insiders own 32.00% of the company's stock.

Institutional Trading of Core Scientific

A number of institutional investors have recently added to or reduced their stakes in CORZ. ORG Wealth Partners LLC acquired a new stake in shares of Core Scientific in the third quarter worth $106,266,000. Vanguard Group Inc. acquired a new stake in shares of Core Scientific in the first quarter worth $21,973,000. Parsifal Capital Management LP lifted its stake in shares of Core Scientific by 3.9% in the third quarter. Parsifal Capital Management LP now owns 5,412,825 shares of the company's stock worth $64,196,000 after buying an additional 204,314 shares during the last quarter. Geode Capital Management LLC lifted its stake in shares of Core Scientific by 26.7% in the third quarter. Geode Capital Management LLC now owns 5,276,573 shares of the company's stock worth $62,594,000 after buying an additional 1,113,285 shares during the last quarter. Finally, State Street Corp increased its position in Core Scientific by 17.0% during the third quarter. State Street Corp now owns 4,006,922 shares of the company's stock worth $47,522,000 after acquiring an additional 583,493 shares during the period.

Core Scientific Company Profile

(

Get Free Report)

Core Scientific, Inc provides digital asset mining services in North America. It operates through two segments, Mining and Hosting. The company offers blockchain infrastructure, software solutions, and services; and operates data center mining facilities. It also mines digital assets for its own account; and provides hosting services for other large bitcoin miners, which include deployment, monitoring, trouble shooting, optimization, and maintenance of its customers' digital asset mining equipment.

Further Reading

Before you consider Core Scientific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Core Scientific wasn't on the list.

While Core Scientific currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.