Corebridge Financial Inc. cut its holdings in Houlihan Lokey, Inc. (NYSE:HLI - Free Report) by 3.5% in the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 60,682 shares of the financial services provider's stock after selling 2,186 shares during the period. Corebridge Financial Inc. owned approximately 0.09% of Houlihan Lokey worth $10,538,000 at the end of the most recent reporting period.

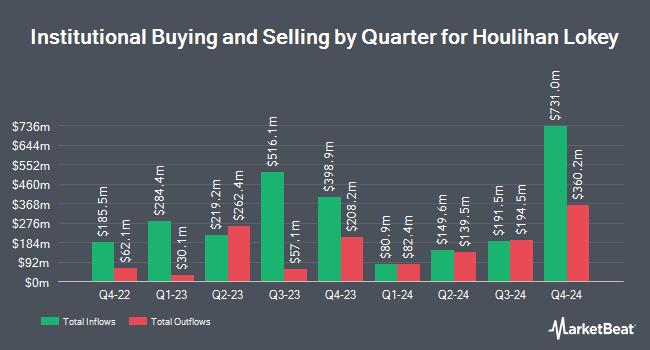

Several other hedge funds have also added to or reduced their stakes in the business. Quest Partners LLC bought a new stake in Houlihan Lokey in the third quarter valued at approximately $92,000. Charles Schwab Investment Management Inc. increased its stake in shares of Houlihan Lokey by 33.0% in the third quarter. Charles Schwab Investment Management Inc. now owns 601,025 shares of the financial services provider's stock worth $94,974,000 after buying an additional 149,114 shares during the period. Dynamic Technology Lab Private Ltd raised its holdings in Houlihan Lokey by 78.6% during the 3rd quarter. Dynamic Technology Lab Private Ltd now owns 6,643 shares of the financial services provider's stock valued at $1,050,000 after buying an additional 2,924 shares during the last quarter. Townsquare Capital LLC boosted its position in Houlihan Lokey by 6.6% during the 3rd quarter. Townsquare Capital LLC now owns 25,654 shares of the financial services provider's stock valued at $4,054,000 after buying an additional 1,598 shares during the period. Finally, Bridgewater Associates LP grew its holdings in Houlihan Lokey by 4.1% in the 3rd quarter. Bridgewater Associates LP now owns 6,749 shares of the financial services provider's stock worth $1,066,000 after acquiring an additional 267 shares during the last quarter. 78.07% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

HLI has been the subject of several recent analyst reports. Wells Fargo & Company raised shares of Houlihan Lokey from an "underweight" rating to an "overweight" rating and lowered their price objective for the company from $180.00 to $179.00 in a research note on Tuesday, March 11th. UBS Group upped their price target on Houlihan Lokey from $229.00 to $230.00 and gave the company a "buy" rating in a research report on Wednesday, January 29th. Keefe, Bruyette & Woods reiterated a "market perform" rating and issued a $192.00 price objective (up previously from $170.00) on shares of Houlihan Lokey in a report on Wednesday, January 29th. Morgan Stanley raised Houlihan Lokey from an "underweight" rating to an "overweight" rating and reduced their target price for the company from $201.00 to $190.00 in a research note on Thursday, March 13th. Finally, JPMorgan Chase & Co. decreased their price target on shares of Houlihan Lokey from $172.00 to $169.00 and set a "neutral" rating for the company in a research note on Wednesday, January 29th. Four research analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to data from MarketBeat, Houlihan Lokey presently has a consensus rating of "Hold" and a consensus target price of $192.00.

Get Our Latest Analysis on Houlihan Lokey

Houlihan Lokey Trading Up 0.1 %

NYSE:HLI traded up $0.11 during trading hours on Monday, reaching $158.21. 53,707 shares of the company traded hands, compared to its average volume of 336,465. Houlihan Lokey, Inc. has a 1 year low of $122.14 and a 1 year high of $192.10. The business's 50-day moving average price is $172.13 and its two-hundred day moving average price is $172.78. The stock has a market capitalization of $11.10 billion, a P/E ratio of 30.19 and a beta of 0.72.

Houlihan Lokey (NYSE:HLI - Get Free Report) last announced its quarterly earnings results on Tuesday, January 28th. The financial services provider reported $1.64 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.51 by $0.13. Houlihan Lokey had a net margin of 16.00% and a return on equity of 20.04%. As a group, equities analysts anticipate that Houlihan Lokey, Inc. will post 5.98 EPS for the current year.

Houlihan Lokey Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Saturday, March 15th. Stockholders of record on Monday, March 3rd were issued a dividend of $0.57 per share. This represents a $2.28 dividend on an annualized basis and a dividend yield of 1.44%. The ex-dividend date was Monday, March 3rd. Houlihan Lokey's payout ratio is 43.51%.

Houlihan Lokey Company Profile

(

Free Report)

Houlihan Lokey, Inc, an investment banking company, provides merger and acquisition (M&A), capital market, financial restructuring, and financial and valuation advisory services worldwide. It operates in three segments: Corporate Finance, Financial Restructuring, and Financial and Valuation Advisory.

Featured Articles

Before you consider Houlihan Lokey, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Houlihan Lokey wasn't on the list.

While Houlihan Lokey currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.