Corient Private Wealth LLC increased its position in shares of Clearwater Paper Co. (NYSE:CLW - Free Report) by 115.9% in the fourth quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 50,655 shares of the basic materials company's stock after purchasing an additional 27,189 shares during the quarter. Corient Private Wealth LLC owned approximately 0.31% of Clearwater Paper worth $1,508,000 at the end of the most recent quarter.

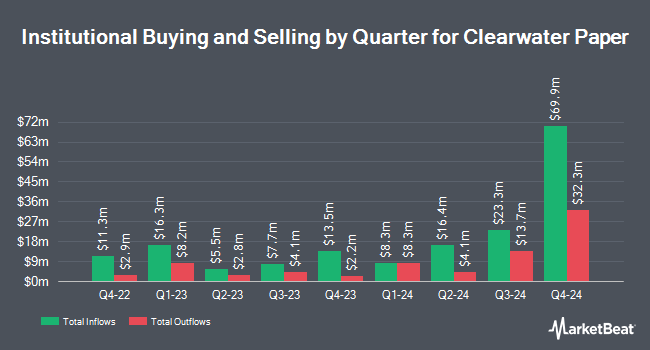

Several other institutional investors have also recently added to or reduced their stakes in CLW. Victory Capital Management Inc. raised its position in Clearwater Paper by 63.9% in the 3rd quarter. Victory Capital Management Inc. now owns 50,240 shares of the basic materials company's stock valued at $1,434,000 after purchasing an additional 19,580 shares during the last quarter. Connor Clark & Lunn Investment Management Ltd. increased its stake in shares of Clearwater Paper by 16.2% in the third quarter. Connor Clark & Lunn Investment Management Ltd. now owns 35,762 shares of the basic materials company's stock valued at $1,021,000 after buying an additional 4,994 shares in the last quarter. Intech Investment Management LLC bought a new position in shares of Clearwater Paper in the third quarter valued at about $1,043,000. D.A. Davidson & CO. lifted its position in Clearwater Paper by 23.4% during the 3rd quarter. D.A. Davidson & CO. now owns 7,900 shares of the basic materials company's stock worth $225,000 after buying an additional 1,500 shares in the last quarter. Finally, PEAK6 Investments LLC grew its holdings in Clearwater Paper by 15.5% during the 3rd quarter. PEAK6 Investments LLC now owns 9,127 shares of the basic materials company's stock worth $260,000 after acquiring an additional 1,227 shares during the last quarter. 89.98% of the stock is owned by institutional investors.

Insider Activity

In other news, SVP Kari G. Moyes sold 1,132 shares of the company's stock in a transaction dated Monday, March 17th. The stock was sold at an average price of $23.98, for a total value of $27,145.36. Following the completion of the sale, the senior vice president now directly owns 81,439 shares of the company's stock, valued at $1,952,907.22. This represents a 1.37 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. 2.30% of the stock is currently owned by company insiders.

Clearwater Paper Trading Down 2.1 %

CLW stock traded down $0.56 during midday trading on Friday, reaching $25.36. The stock had a trading volume of 233,023 shares, compared to its average volume of 293,038. The company has a quick ratio of 0.90, a current ratio of 1.70 and a debt-to-equity ratio of 0.33. Clearwater Paper Co. has a twelve month low of $22.58 and a twelve month high of $57.13. The firm has a market cap of $410.12 million, a price-to-earnings ratio of 2.16 and a beta of 0.37. The business has a fifty day simple moving average of $27.67 and a two-hundred day simple moving average of $27.77.

Clearwater Paper (NYSE:CLW - Get Free Report) last posted its quarterly earnings results on Thursday, February 13th. The basic materials company reported ($1.17) earnings per share for the quarter, missing analysts' consensus estimates of ($0.33) by ($0.84). Clearwater Paper had a negative return on equity of 1.87% and a net margin of 10.54%.

Analyst Ratings Changes

A number of brokerages have recently issued reports on CLW. Royal Bank of Canada reiterated an "outperform" rating and set a $37.00 target price on shares of Clearwater Paper in a research report on Tuesday, February 18th. StockNews.com raised Clearwater Paper from a "sell" rating to a "hold" rating in a report on Monday, February 17th.

Read Our Latest Research Report on Clearwater Paper

Clearwater Paper Profile

(

Free Report)

Clearwater Paper Corporation manufactures and supplies bleached paperboards, and consumer and parent roll tissues in the United States and internationally. It operates through Pulp and Paperboard, and Consumer Products segments. The Pulp and Paperboard segment manufactures and markets bleached paperboard; Solid Bleached Sulfate paperboard that is used to produce folding cartons, liquid packaging, cups and plates, blister and carded packaging, and top sheet and commercial printing items; and hardwood and softwood pulp, as well as offers services that include custom sheeting, slitting, and cutting.

Featured Articles

Before you consider Clearwater Paper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clearwater Paper wasn't on the list.

While Clearwater Paper currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.