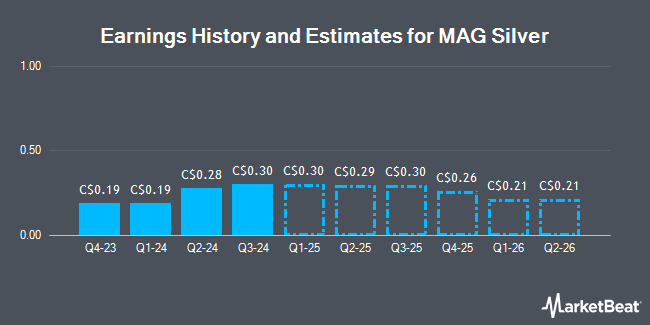

MAG Silver Corp. (TSE:MAG - Free Report) NYSEAMERICAN: MAG - Equities research analysts at Cormark raised their FY2026 earnings per share (EPS) estimates for MAG Silver in a research note issued to investors on Thursday, April 24th. Cormark analyst N. Dion now expects that the company will post earnings of $0.95 per share for the year, up from their previous forecast of $0.89. The consensus estimate for MAG Silver's current full-year earnings is $1.22 per share.

MAG has been the subject of several other research reports. Raymond James lifted their target price on shares of MAG Silver from C$26.00 to C$27.00 in a research note on Tuesday, March 25th. TD Securities upgraded shares of MAG Silver to a "strong-buy" rating in a research note on Monday, March 10th. Three equities research analysts have rated the stock with a hold rating, two have given a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of C$26.09.

Check Out Our Latest Research Report on MAG Silver

MAG Silver Stock Performance

MAG stock traded up C$0.17 during midday trading on Friday, hitting C$21.64. The company's stock had a trading volume of 90,673 shares, compared to its average volume of 214,023. The stock's 50-day moving average price is C$21.78 and its 200 day moving average price is C$21.84. The company has a quick ratio of 25.31, a current ratio of 32.55 and a debt-to-equity ratio of 0.01. MAG Silver has a 1 year low of C$15.64 and a 1 year high of C$25.36. The stock has a market cap of C$1.57 billion, a price-to-earnings ratio of 21.02, a PEG ratio of 0.84 and a beta of 1.14.

MAG Silver Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, April 21st. Shareholders of record on Monday, April 21st were paid a $0.02 dividend. The ex-dividend date of this dividend was Friday, April 4th. This represents a $0.08 dividend on an annualized basis and a yield of 0.37%.

MAG Silver Company Profile

(

Get Free Report)

MAG Silver Corp is a Canadian mining company. It is focused on becoming a top-tier primary silver mining company by exploring and advancing high-grade, district-scale, silver-dominant projects in the Americas. Its principal focus and asset are the Juanicipio Project (44%), being developed in a JV partnership with Fresnillo Plc (56%).

Featured Articles

Before you consider MAG Silver, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MAG Silver wasn't on the list.

While MAG Silver currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.