Torex Gold Resources (TSE:TXG - Free Report) had its price objective boosted by Cormark from C$46.00 to C$55.00 in a report published on Monday morning,BayStreet.CA reports. Cormark also issued estimates for Torex Gold Resources' Q1 2025 earnings at $0.41 EPS, Q4 2025 earnings at $1.15 EPS and FY2025 earnings at $3.66 EPS.

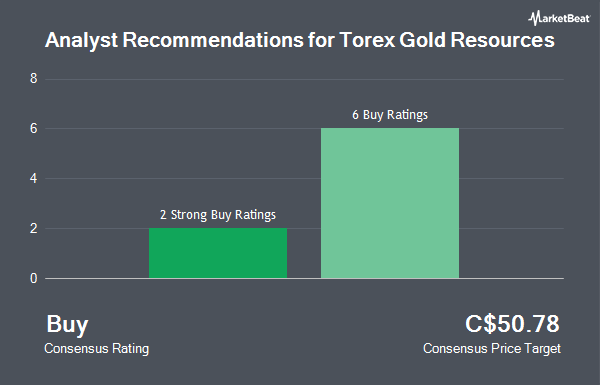

A number of other research analysts have also recently issued reports on TXG. Royal Bank of Canada raised their price target on shares of Torex Gold Resources from C$44.00 to C$45.00 in a report on Friday, April 4th. BMO Capital Markets raised their target price on shares of Torex Gold Resources from C$36.00 to C$38.00 in a research note on Thursday, February 20th. Raymond James raised their target price on Torex Gold Resources from C$34.00 to C$47.00 in a research note on Friday, April 4th. Finally, CIBC lifted their price objective on shares of Torex Gold Resources from C$36.00 to C$42.00 in a report on Friday, February 21st. Five research analysts have rated the stock with a buy rating and two have assigned a strong buy rating to the stock. Based on data from MarketBeat, the company presently has an average rating of "Buy" and a consensus target price of C$45.19.

Read Our Latest Research Report on TXG

Torex Gold Resources Price Performance

Shares of TSE:TXG traded down C$1.00 on Monday, reaching C$47.24. The company's stock had a trading volume of 508,335 shares, compared to its average volume of 326,368. The company has a 50-day simple moving average of C$36.21 and a 200 day simple moving average of C$31.49. The company has a market cap of C$2.86 billion, a P/E ratio of 25.40, a PEG ratio of 0.02 and a beta of 1.34. The company has a debt-to-equity ratio of 8.09, a quick ratio of 2.12 and a current ratio of 1.00. Torex Gold Resources has a 52-week low of C$18.79 and a 52-week high of C$48.59.

Insider Buying and Selling at Torex Gold Resources

In other Torex Gold Resources news, Senior Officer Faysal Abhem Rodriguez Valenzuela sold 5,623 shares of Torex Gold Resources stock in a transaction that occurred on Tuesday, January 21st. The stock was sold at an average price of C$28.97, for a total value of C$162,898.31. Also, Director Caroline Donally purchased 1,000 shares of the company's stock in a transaction dated Monday, January 20th. The shares were bought at an average price of C$27.91 per share, for a total transaction of C$27,908.00. 0.35% of the stock is currently owned by insiders.

Torex Gold Resources Company Profile

(

Get Free Report)

Torex Gold Resources Inc operates as an intermediate gold producer in Mexico. It primarily holds a 100% interest in the Morelos Gold property, including Morelos Complex, which includes the El Limón Guajes Mine Complex; the Media Luna Project, a processing plant; and related infrastructure that covers an area of 29,000 hectares located southwest of Mexico City.

Read More

Before you consider Torex Gold Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Torex Gold Resources wasn't on the list.

While Torex Gold Resources currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.