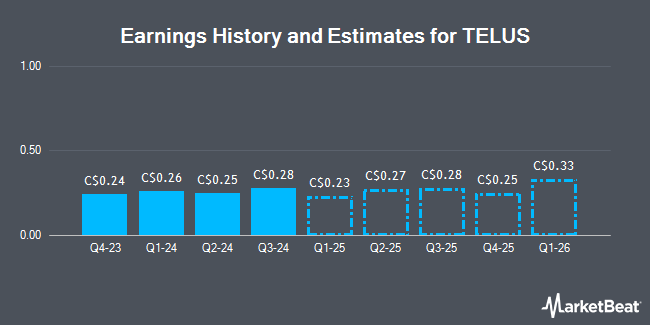

TELUS Co. (TSE:T - Free Report) NYSE: TU - Investment analysts at Cormark increased their FY2024 earnings per share estimates for TELUS in a research report issued to clients and investors on Monday, November 11th. Cormark analyst D. Mcfadgen now forecasts that the company will earn $0.99 per share for the year, up from their prior forecast of $0.94. The consensus estimate for TELUS's current full-year earnings is $1.23 per share. Cormark also issued estimates for TELUS's FY2025 earnings at $0.91 EPS.

T has been the topic of a number of other research reports. Scotiabank upgraded shares of TELUS from a "sector perform" rating to an "outperform" rating in a research report on Monday, October 28th. TD Securities cut their price target on shares of TELUS from C$26.00 to C$25.00 and set a "buy" rating on the stock in a report on Wednesday, August 7th. BMO Capital Markets raised their price objective on shares of TELUS from C$24.00 to C$25.00 in a research note on Thursday, September 5th. Royal Bank of Canada cut their target price on TELUS from C$26.00 to C$25.00 and set an "outperform" rating on the stock in a research note on Tuesday, August 6th. Finally, Canaccord Genuity Group downgraded TELUS from a "buy" rating to a "hold" rating and reduced their price target for the stock from C$23.00 to C$21.50 in a report on Tuesday, August 6th. One research analyst has rated the stock with a sell rating, two have assigned a hold rating and seven have assigned a buy rating to the company. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of C$24.46.

Get Our Latest Stock Report on TELUS

TELUS Trading Down 0.3 %

Shares of TSE T traded down C$0.07 during trading hours on Wednesday, hitting C$21.81. 3,033,366 shares of the company traded hands, compared to its average volume of 3,328,957. The stock has a market capitalization of C$32.28 billion, a price-to-earnings ratio of 41.28, a price-to-earnings-growth ratio of 1.65 and a beta of 0.72. The company's 50 day moving average price is C$22.32 and its 200 day moving average price is C$22.06. TELUS has a 12 month low of C$20.04 and a 12 month high of C$25.94. The company has a current ratio of 0.66, a quick ratio of 0.52 and a debt-to-equity ratio of 171.58.

TELUS Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, January 2nd. Shareholders of record on Wednesday, December 11th will be issued a $0.402 dividend. This represents a $1.61 annualized dividend and a dividend yield of 7.37%. This is a boost from TELUS's previous quarterly dividend of $0.39. The ex-dividend date is Wednesday, December 11th. TELUS's dividend payout ratio is currently 294.34%.

TELUS Company Profile

(

Get Free Report)

TELUS Corporation, together with its subsidiaries, provides a range of telecommunications and information technology products and services in Canada. It operates through Technology Solutions and Digitally-Led Customer Experiences segments. The Technology Solutions segment offers a range of telecommunications products and services; network services; healthcare services; mobile technologies equipment; data services, such as internet protocol; television; hosting, managed information technology, and cloud-based services; software, data management, and data analytics-driven smart food-chain and consumer goods technologies; home and business security; healthcare software and technology solutions; and voice and other telecommunications services, as well as mobile and fixed voice and data telecommunications services and products.

Read More

Before you consider TELUS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TELUS wasn't on the list.

While TELUS currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.