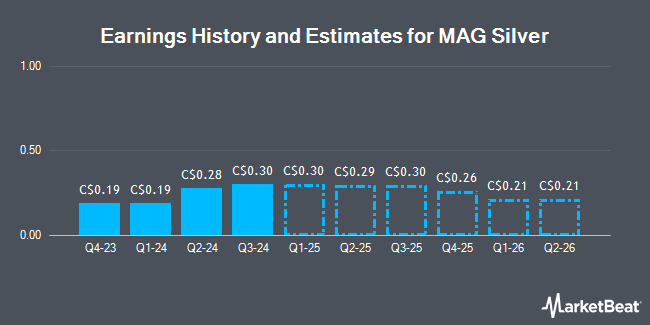

MAG Silver Corp. (TSE:MAG - Free Report) NYSEAMERICAN: MAG - Equities research analysts at Cormark lowered their FY2025 earnings per share (EPS) estimates for MAG Silver in a research note issued to investors on Tuesday, March 25th. Cormark analyst N. Dion now expects that the company will post earnings of $0.96 per share for the year, down from their previous forecast of $1.11. The consensus estimate for MAG Silver's current full-year earnings is $1.22 per share.

Several other research firms have also recently weighed in on MAG. CIBC boosted their price target on shares of MAG Silver from C$25.00 to C$26.00 in a report on Monday, December 2nd. Raymond James boosted their target price on MAG Silver from C$26.00 to C$27.00 in a research note on Tuesday, March 25th. Finally, TD Securities raised MAG Silver to a "strong-buy" rating in a research report on Monday, March 10th. Three equities research analysts have rated the stock with a hold rating, three have issued a buy rating and one has issued a strong buy rating to the company. According to MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of C$25.58.

Check Out Our Latest Stock Report on MAG Silver

MAG Silver Stock Down 1.6 %

Shares of TSE MAG traded down C$0.37 during trading on Thursday, hitting C$22.07. The stock had a trading volume of 109,552 shares, compared to its average volume of 201,728. The firm has a fifty day moving average of C$22.62 and a two-hundred day moving average of C$21.61. The company has a market capitalization of C$1.60 billion, a PE ratio of 21.44, a PEG ratio of 0.84 and a beta of 1.14. The company has a debt-to-equity ratio of 0.01, a current ratio of 32.55 and a quick ratio of 25.31. MAG Silver has a 12 month low of C$14.43 and a 12 month high of C$25.36.

MAG Silver Company Profile

(

Get Free Report)

MAG Silver Corp is a Canadian mining company. It is focused on becoming a top-tier primary silver mining company by exploring and advancing high-grade, district-scale, silver-dominant projects in the Americas. Its principal focus and asset are the Juanicipio Project (44%), being developed in a JV partnership with Fresnillo Plc (56%).

Featured Articles

Before you consider MAG Silver, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MAG Silver wasn't on the list.

While MAG Silver currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.