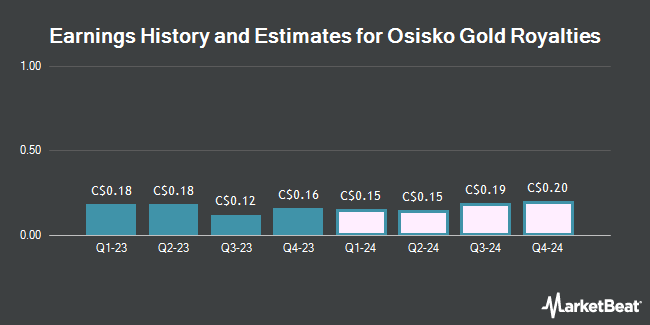

Osisko Gold Royalties Ltd (TSE:OR - Free Report) - Research analysts at Cormark dropped their FY2024 earnings estimates for Osisko Gold Royalties in a report issued on Friday, November 8th. Cormark analyst N. Dion now expects that the company will post earnings per share of $0.69 for the year, down from their prior forecast of $0.71. Cormark also issued estimates for Osisko Gold Royalties' FY2025 earnings at $0.88 EPS.

Other research analysts have also recently issued research reports about the stock. Canaccord Genuity Group boosted their price objective on shares of Osisko Gold Royalties from C$30.00 to C$31.00 in a research report on Tuesday, July 23rd. BMO Capital Markets boosted their price objective on shares of Osisko Gold Royalties from C$27.00 to C$28.00 in a research report on Thursday. TD Securities boosted their price objective on shares of Osisko Gold Royalties from C$27.00 to C$31.00 in a research report on Friday, October 18th. National Bankshares boosted their price objective on shares of Osisko Gold Royalties from C$26.00 to C$28.00 and gave the stock an "outperform" rating in a research report on Wednesday, July 17th. Finally, Scotiabank boosted their price objective on shares of Osisko Gold Royalties from C$25.00 to C$27.00 in a research report on Monday, August 19th. One research analyst has rated the stock with a hold rating and seven have given a buy rating to the company's stock. According to data from MarketBeat.com, Osisko Gold Royalties presently has a consensus rating of "Moderate Buy" and an average price target of C$29.63.

View Our Latest Stock Report on Osisko Gold Royalties

Osisko Gold Royalties Price Performance

Shares of TSE:OR traded down C$2.14 during trading on Monday, reaching C$26.00. The stock had a trading volume of 231,794 shares, compared to its average volume of 292,198. Osisko Gold Royalties has a 52 week low of C$16.32 and a 52 week high of C$29.57. The business's 50-day moving average price is C$25.70 and its 200 day moving average price is C$23.70. The company has a debt-to-equity ratio of 7.00, a current ratio of 4.92 and a quick ratio of 0.98. The stock has a market capitalization of C$4.84 billion, a PE ratio of -56.28, a P/E/G ratio of 1.31 and a beta of 0.90.

Insider Activity at Osisko Gold Royalties

In related news, Director Duncan Cornell Card sold 10,000 shares of the business's stock in a transaction on Tuesday, October 15th. The shares were sold at an average price of C$27.03, for a total value of C$270,331.00. 0.38% of the stock is currently owned by insiders.

Osisko Gold Royalties Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Investors of record on Tuesday, December 31st will be given a $0.065 dividend. The ex-dividend date is Tuesday, December 31st. This represents a $0.26 annualized dividend and a yield of 1.00%. Osisko Gold Royalties's dividend payout ratio is currently -52.00%.

Osisko Gold Royalties Company Profile

(

Get Free Report)

Osisko Gold Royalties Ltd acquires and manages precious metal and other royalties, streams, and other interests in Canada and internationally. It also owns options on offtake; royalty/stream financings; and exclusive rights to participate in future royalty/stream financings on various projects. The company's primary asset is a 3-5% net smelter return royalty on the Canadian Malartic complex located in Canada.

Recommended Stories

Before you consider Osisko Gold Royalties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Osisko Gold Royalties wasn't on the list.

While Osisko Gold Royalties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.