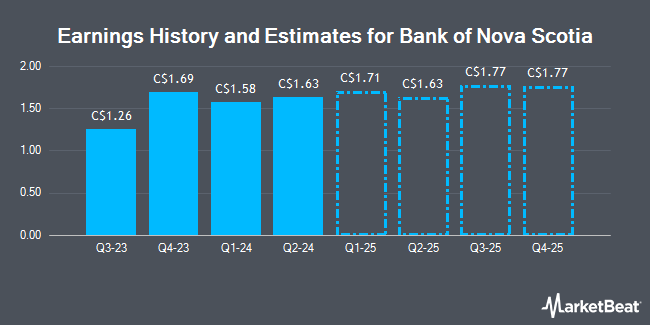

The Bank of Nova Scotia (TSE:BNS - Free Report) NYSE: BNS - Equities researchers at Cormark dropped their FY2025 earnings per share estimates for shares of Bank of Nova Scotia in a research report issued to clients and investors on Wednesday, December 4th. Cormark analyst L. Persaud now anticipates that the bank will post earnings of $6.96 per share for the year, down from their prior estimate of $7.06. Cormark has a "Market Perform" rating and a $65.00 price objective on the stock. The consensus estimate for Bank of Nova Scotia's current full-year earnings is $7.13 per share.

Other analysts have also issued research reports about the stock. National Bankshares upped their target price on shares of Bank of Nova Scotia from C$66.00 to C$78.00 in a research note on Wednesday, November 20th. CIBC upped their price objective on shares of Bank of Nova Scotia from C$82.00 to C$84.00 in a research report on Tuesday, November 26th. Royal Bank of Canada lifted their target price on shares of Bank of Nova Scotia from C$65.00 to C$74.00 in a research report on Wednesday. Cibc World Mkts raised Bank of Nova Scotia from a "hold" rating to a "strong-buy" rating in a report on Friday, September 20th. Finally, UBS Group raised Bank of Nova Scotia from a "hold" rating to a "strong-buy" rating in a research report on Monday, November 18th. Seven investment analysts have rated the stock with a hold rating, four have given a buy rating and two have issued a strong buy rating to the company. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of C$76.73.

Get Our Latest Stock Report on BNS

Bank of Nova Scotia Trading Up 0.8 %

Bank of Nova Scotia stock traded up C$0.65 during trading on Friday, hitting C$78.94. 5,090,884 shares of the company were exchanged, compared to its average volume of 4,279,625. The business's 50 day moving average is C$74.65 and its 200 day moving average is C$68.39. Bank of Nova Scotia has a 52 week low of C$59.62 and a 52 week high of C$80.14. The company has a market capitalization of C$97.89 billion, a P/E ratio of 13.82, a PEG ratio of 1.33 and a beta of 0.97.

Bank of Nova Scotia Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 29th. Investors of record on Tuesday, January 7th will be issued a $1.06 dividend. This represents a $4.24 annualized dividend and a yield of 5.37%. Bank of Nova Scotia's dividend payout ratio (DPR) is currently 74.26%.

About Bank of Nova Scotia

(

Get Free Report)

The Bank of Nova Scotia provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally. It operates through Canadian Banking, International Banking, Global Wealth Management, and Global Banking and Markets segments.

See Also

Before you consider Bank of Nova Scotia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank of Nova Scotia wasn't on the list.

While Bank of Nova Scotia currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.