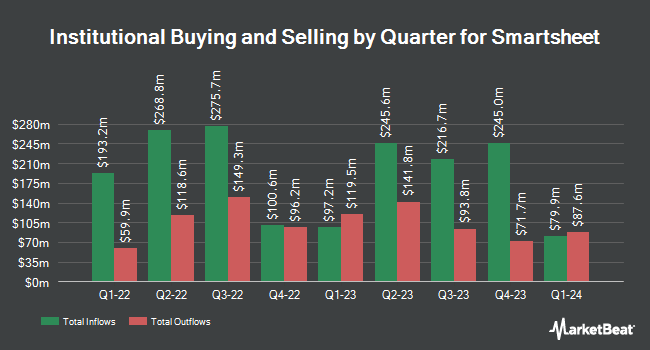

Cornercap Investment Counsel Inc. lessened its stake in shares of Smartsheet Inc (NYSE:SMAR - Free Report) by 50.5% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 13,513 shares of the company's stock after selling 13,808 shares during the period. Cornercap Investment Counsel Inc.'s holdings in Smartsheet were worth $748,000 at the end of the most recent reporting period.

Other hedge funds have also recently added to or reduced their stakes in the company. CIBC Asset Management Inc bought a new position in shares of Smartsheet in the 3rd quarter valued at $222,000. ING Groep NV lifted its holdings in Smartsheet by 224.4% during the 3rd quarter. ING Groep NV now owns 348,100 shares of the company's stock worth $19,271,000 after buying an additional 240,800 shares during the period. Tokio Marine Asset Management Co. Ltd. acquired a new position in Smartsheet during the 3rd quarter worth about $7,828,000. KBC Group NV lifted its holdings in Smartsheet by 16.7% during the 3rd quarter. KBC Group NV now owns 3,712 shares of the company's stock worth $205,000 after buying an additional 530 shares during the period. Finally, Versor Investments LP acquired a new position in shares of Smartsheet in the 3rd quarter valued at about $5,953,000. Institutional investors own 90.01% of the company's stock.

Analyst Ratings Changes

A number of brokerages have recently issued reports on SMAR. William Blair reissued a "market perform" rating on shares of Smartsheet in a research note on Wednesday, September 25th. Truist Financial reissued a "hold" rating and set a $56.50 price objective (down from $60.00) on shares of Smartsheet in a report on Wednesday, September 25th. DA Davidson restated a "neutral" rating and issued a $56.50 target price (up previously from $55.00) on shares of Smartsheet in a research note on Tuesday, September 24th. Jefferies Financial Group restated a "hold" rating and issued a $56.50 target price (down previously from $60.00) on shares of Smartsheet in a research note on Tuesday, September 24th. Finally, Citigroup reiterated a "neutral" rating and issued a $56.50 price objective (down previously from $63.00) on shares of Smartsheet in a research note on Friday, September 27th. One investment analyst has rated the stock with a sell rating, seventeen have issued a hold rating and two have given a buy rating to the company's stock. According to data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average target price of $55.82.

Get Our Latest Report on SMAR

Insider Buying and Selling at Smartsheet

In other Smartsheet news, CEO Mark Patrick Mader sold 20,000 shares of Smartsheet stock in a transaction that occurred on Thursday, September 19th. The shares were sold at an average price of $51.78, for a total value of $1,035,600.00. Following the completion of the sale, the chief executive officer now owns 588,762 shares of the company's stock, valued at approximately $30,486,096.36. The trade was a 3.29 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Jolene Lau Marshall sold 3,571 shares of Smartsheet stock in a transaction on Friday, September 13th. The stock was sold at an average price of $50.59, for a total transaction of $180,656.89. Following the transaction, the insider now owns 13,529 shares in the company, valued at $684,432.11. This represents a 20.88 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 38,989 shares of company stock valued at $2,068,874. Corporate insiders own 4.52% of the company's stock.

Smartsheet Trading Down 0.0 %

Shares of NYSE:SMAR traded down $0.01 on Friday, reaching $55.85. 2,293,564 shares of the company traded hands, compared to its average volume of 2,206,754. The business's 50-day simple moving average is $54.92 and its 200 day simple moving average is $47.84. Smartsheet Inc has a 52 week low of $35.52 and a 52 week high of $56.55. The stock has a market capitalization of $7.76 billion, a P/E ratio of -180.16 and a beta of 0.74.

Smartsheet (NYSE:SMAR - Get Free Report) last issued its quarterly earnings data on Thursday, September 5th. The company reported $0.44 EPS for the quarter, topping the consensus estimate of $0.29 by $0.15. Smartsheet had a negative net margin of 4.07% and a negative return on equity of 4.29%. The business had revenue of $276.41 million during the quarter, compared to analyst estimates of $274.23 million. During the same period last year, the business posted ($0.23) earnings per share. Smartsheet's quarterly revenue was up 17.3% compared to the same quarter last year. Sell-side analysts expect that Smartsheet Inc will post -0.05 EPS for the current fiscal year.

Smartsheet announced that its Board of Directors has approved a stock repurchase program on Thursday, September 5th that authorizes the company to repurchase $150.00 million in outstanding shares. This repurchase authorization authorizes the company to reacquire up to 2.1% of its stock through open market purchases. Stock repurchase programs are often an indication that the company's leadership believes its shares are undervalued.

About Smartsheet

(

Free Report)

Smartsheet, Inc engages in managing and automating collaborative work. Its platform provides solutions that eliminate the obstacles to capturing information, including a familiar and intuitive spreadsheet interface as well as easily customizable forms. The company was founded by W. Eric Browne, Maria Colacurcio, John D.

Read More

Before you consider Smartsheet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Smartsheet wasn't on the list.

While Smartsheet currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.