Cornercap Investment Counsel Inc. cut its position in Addus HomeCare Co. (NASDAQ:ADUS - Free Report) by 51.7% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 5,537 shares of the company's stock after selling 5,923 shares during the quarter. Cornercap Investment Counsel Inc.'s holdings in Addus HomeCare were worth $737,000 as of its most recent filing with the Securities and Exchange Commission.

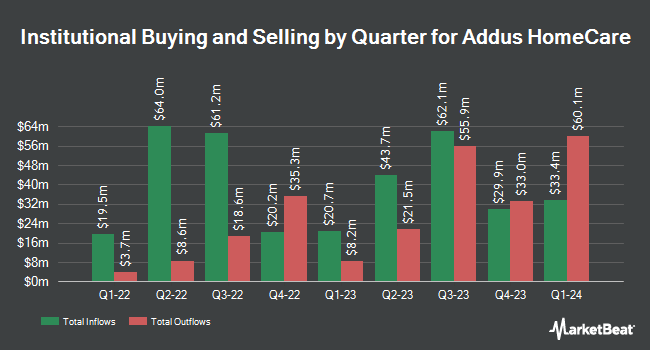

Other institutional investors and hedge funds have also made changes to their positions in the company. UMB Bank n.a. grew its stake in shares of Addus HomeCare by 64.2% during the second quarter. UMB Bank n.a. now owns 225 shares of the company's stock valued at $26,000 after acquiring an additional 88 shares in the last quarter. Quest Partners LLC acquired a new stake in Addus HomeCare in the second quarter valued at $31,000. EntryPoint Capital LLC acquired a new position in Addus HomeCare during the 1st quarter worth $44,000. Innealta Capital LLC acquired a new position in Addus HomeCare during the 2nd quarter worth $44,000. Finally, Farther Finance Advisors LLC increased its position in shares of Addus HomeCare by 9,150.0% in the 3rd quarter. Farther Finance Advisors LLC now owns 370 shares of the company's stock worth $49,000 after purchasing an additional 366 shares during the last quarter. 95.35% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of equities analysts recently commented on ADUS shares. Stephens lifted their price target on Addus HomeCare from $143.00 to $145.00 and gave the stock an "overweight" rating in a research note on Wednesday, November 6th. Royal Bank of Canada restated an "outperform" rating and issued a $136.00 price target on shares of Addus HomeCare in a research report on Thursday. Macquarie reaffirmed an "outperform" rating and issued a $139.00 price target on shares of Addus HomeCare in a report on Monday, November 4th. Oppenheimer lifted their target price on Addus HomeCare from $140.00 to $145.00 and gave the company an "outperform" rating in a research note on Monday, September 23rd. Finally, KeyCorp assumed coverage on Addus HomeCare in a report on Friday, October 11th. They issued an "overweight" rating and a $150.00 price target on the stock. One research analyst has rated the stock with a sell rating, eight have assigned a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $131.63.

Read Our Latest Stock Analysis on ADUS

Addus HomeCare Stock Down 1.9 %

Shares of ADUS traded down $2.29 during mid-day trading on Friday, reaching $119.78. The company's stock had a trading volume of 129,357 shares, compared to its average volume of 131,641. The company has a market cap of $2.17 billion, a price-to-earnings ratio of 27.41, a price-to-earnings-growth ratio of 2.15 and a beta of 1.04. The business has a fifty day moving average of $128.99 and a 200 day moving average of $122.42. Addus HomeCare Co. has a 1 year low of $85.43 and a 1 year high of $136.12.

Addus HomeCare (NASDAQ:ADUS - Get Free Report) last announced its quarterly earnings data on Monday, November 4th. The company reported $1.30 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.28 by $0.02. The firm had revenue of $289.80 million during the quarter, compared to the consensus estimate of $289.42 million. Addus HomeCare had a return on equity of 9.62% and a net margin of 6.50%. The business's revenue for the quarter was up 7.1% on a year-over-year basis. During the same period in the prior year, the business earned $1.03 EPS. On average, analysts predict that Addus HomeCare Co. will post 4.58 earnings per share for the current year.

Insider Activity at Addus HomeCare

In related news, EVP Michael D. Wattenbarger sold 21,917 shares of the business's stock in a transaction that occurred on Monday, August 26th. The stock was sold at an average price of $133.29, for a total value of $2,921,316.93. Following the completion of the sale, the executive vice president now owns 7,215 shares of the company's stock, valued at approximately $961,687.35. The trade was a 75.23 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, Director Esteban Lopez sold 500 shares of the stock in a transaction that occurred on Wednesday, September 4th. The stock was sold at an average price of $130.03, for a total value of $65,015.00. Following the completion of the transaction, the director now owns 3,866 shares in the company, valued at $502,695.98. This represents a 11.45 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 22,917 shares of company stock valued at $3,050,082. Corporate insiders own 4.60% of the company's stock.

Addus HomeCare Profile

(

Free Report)

Addus HomeCare Corporation, together with its subsidiaries, provides personal care services to elderly, chronically ill, disabled persons, and individuals who are at risk of hospitalization or institutionalization in the United States. The company operates through three segments: Personal Care, Hospice, and Home Health.

Further Reading

Before you consider Addus HomeCare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Addus HomeCare wasn't on the list.

While Addus HomeCare currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.