Cornercap Investment Counsel Inc. lowered its position in shares of T-Mobile US, Inc. (NASDAQ:TMUS - Free Report) by 38.3% in the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 8,761 shares of the Wireless communications provider's stock after selling 5,444 shares during the quarter. T-Mobile US accounts for approximately 0.5% of Cornercap Investment Counsel Inc.'s investment portfolio, making the stock its 22nd largest position. Cornercap Investment Counsel Inc.'s holdings in T-Mobile US were worth $1,808,000 at the end of the most recent quarter.

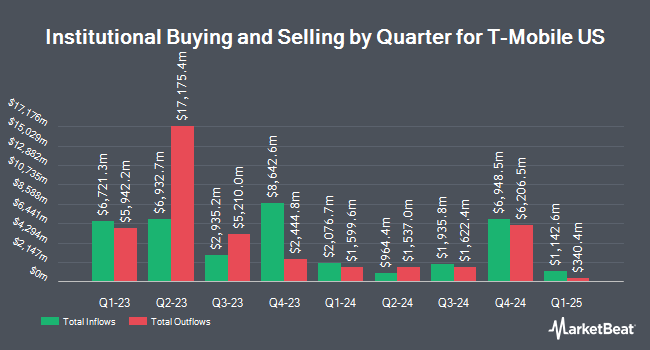

Other hedge funds also recently made changes to their positions in the company. First Business Financial Services Inc. lifted its stake in T-Mobile US by 7.6% during the third quarter. First Business Financial Services Inc. now owns 14,343 shares of the Wireless communications provider's stock valued at $2,960,000 after buying an additional 1,015 shares in the last quarter. CIBC Asset Management Inc increased its stake in shares of T-Mobile US by 1.6% during the 3rd quarter. CIBC Asset Management Inc now owns 324,662 shares of the Wireless communications provider's stock worth $66,997,000 after purchasing an additional 5,154 shares during the last quarter. FUKOKU MUTUAL LIFE INSURANCE Co boosted its holdings in T-Mobile US by 11.1% during the third quarter. FUKOKU MUTUAL LIFE INSURANCE Co now owns 4,304 shares of the Wireless communications provider's stock valued at $888,000 after acquiring an additional 430 shares during the period. Balboa Wealth Partners acquired a new position in shares of T-Mobile US during the third quarter worth approximately $245,000. Finally, Sycomore Asset Management grew its position in T-Mobile US by 90.8% during the third quarter. Sycomore Asset Management now owns 63,037 shares of the Wireless communications provider's stock worth $12,812,000 after buying an additional 29,992 shares in the last quarter. Institutional investors and hedge funds own 42.49% of the company's stock.

Analysts Set New Price Targets

A number of equities research analysts recently commented on TMUS shares. Raymond James lowered T-Mobile US from an "outperform" rating to a "market perform" rating in a research report on Friday, October 25th. Barclays lifted their price target on shares of T-Mobile US from $215.00 to $230.00 and gave the stock an "overweight" rating in a research report on Thursday, October 24th. KeyCorp raised their price objective on shares of T-Mobile US from $230.00 to $252.00 and gave the company an "overweight" rating in a research note on Thursday, October 24th. Daiwa America upgraded shares of T-Mobile US to a "hold" rating in a research report on Friday, October 25th. Finally, Evercore ISI raised their price target on T-Mobile US from $220.00 to $240.00 and gave the stock an "outperform" rating in a research report on Thursday, October 24th. Three analysts have rated the stock with a hold rating, seventeen have assigned a buy rating and two have assigned a strong buy rating to the company. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $241.83.

Get Our Latest Research Report on T-Mobile US

Insider Activity

In other T-Mobile US news, Director Raul Marcelo Claure sold 132,309 shares of the company's stock in a transaction on Wednesday, September 11th. The shares were sold at an average price of $196.74, for a total transaction of $26,030,472.66. Following the transaction, the director now owns 1,551,204 shares in the company, valued at approximately $305,183,874.96. This represents a 7.86 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, insider Michael J. Katz sold 3,000 shares of T-Mobile US stock in a transaction dated Tuesday, October 1st. The shares were sold at an average price of $205.30, for a total transaction of $615,900.00. Following the transaction, the insider now owns 119,687 shares of the company's stock, valued at $24,571,741.10. This represents a 2.45 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 464,924 shares of company stock worth $97,427,925 in the last quarter. 0.67% of the stock is owned by corporate insiders.

T-Mobile US Trading Down 0.9 %

TMUS traded down $2.14 during midday trading on Friday, hitting $235.61. 3,933,732 shares of the company were exchanged, compared to its average volume of 4,440,782. The firm has a market capitalization of $273.42 billion, a P/E ratio of 26.86, a P/E/G ratio of 1.23 and a beta of 0.50. The firm's 50 day moving average price is $215.03 and its 200-day moving average price is $191.94. The company has a quick ratio of 0.99, a current ratio of 1.08 and a debt-to-equity ratio of 1.23. T-Mobile US, Inc. has a 1-year low of $147.07 and a 1-year high of $242.43.

T-Mobile US (NASDAQ:TMUS - Get Free Report) last issued its quarterly earnings results on Wednesday, October 23rd. The Wireless communications provider reported $2.61 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.32 by $0.29. T-Mobile US had a net margin of 12.96% and a return on equity of 16.35%. The firm had revenue of $20.16 billion for the quarter, compared to the consensus estimate of $20.01 billion. During the same quarter in the previous year, the company earned $1.82 EPS. The company's revenue for the quarter was up 4.7% on a year-over-year basis. As a group, equities analysts forecast that T-Mobile US, Inc. will post 9.36 EPS for the current fiscal year.

T-Mobile US Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Thursday, December 12th. Shareholders of record on Wednesday, November 27th will be issued a dividend of $0.88 per share. This represents a $3.52 dividend on an annualized basis and a dividend yield of 1.49%. This is a boost from T-Mobile US's previous quarterly dividend of $0.65. The ex-dividend date is Wednesday, November 27th. T-Mobile US's dividend payout ratio is presently 29.65%.

T-Mobile US Profile

(

Free Report)

T-Mobile US, Inc, together with its subsidiaries, provides mobile communications services in the United States, Puerto Rico, and the United States Virgin Islands. The company offers voice, messaging, and data services to customers in the postpaid, prepaid, and wholesale and other services. It also provides wireless devices, including smartphones, wearables, tablets, home broadband routers, and other mobile communication devices, as well as wireless devices and accessories; financing through equipment installment plans; reinsurance for device insurance policies and extended warranty contracts; leasing through JUMP! On Demand; and High Speed Internet services.

See Also

Before you consider T-Mobile US, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and T-Mobile US wasn't on the list.

While T-Mobile US currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report