Cornercap Investment Counsel Inc. lessened its position in shares of Ameris Bancorp (NASDAQ:ABCB - Free Report) by 57.3% during the third quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 11,807 shares of the bank's stock after selling 15,815 shares during the quarter. Cornercap Investment Counsel Inc.'s holdings in Ameris Bancorp were worth $737,000 as of its most recent SEC filing.

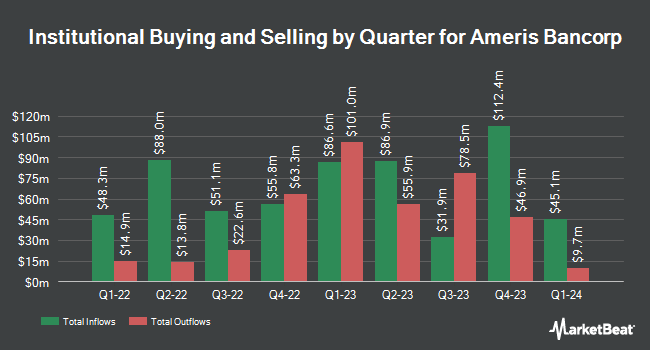

Several other institutional investors also recently added to or reduced their stakes in the company. Oppenheimer Asset Management Inc. purchased a new position in shares of Ameris Bancorp during the third quarter worth approximately $232,000. Victory Capital Management Inc. grew its position in Ameris Bancorp by 1.4% during the 3rd quarter. Victory Capital Management Inc. now owns 863,294 shares of the bank's stock worth $53,861,000 after purchasing an additional 12,054 shares during the last quarter. Entropy Technologies LP increased its stake in Ameris Bancorp by 29.0% in the third quarter. Entropy Technologies LP now owns 8,007 shares of the bank's stock valued at $500,000 after purchasing an additional 1,801 shares during the period. Versor Investments LP purchased a new stake in shares of Ameris Bancorp in the third quarter valued at about $349,000. Finally, Portside Wealth Group LLC acquired a new stake in shares of Ameris Bancorp during the third quarter worth about $231,000. Institutional investors and hedge funds own 91.64% of the company's stock.

Insider Activity at Ameris Bancorp

In other news, Director Robert Dale Ezzell sold 8,000 shares of the company's stock in a transaction on Wednesday, November 6th. The stock was sold at an average price of $69.91, for a total transaction of $559,280.00. Following the completion of the sale, the director now directly owns 27,444 shares in the company, valued at $1,918,610.04. This represents a 22.57 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at this link. Insiders own 5.50% of the company's stock.

Ameris Bancorp Price Performance

Ameris Bancorp stock traded up $0.01 during mid-day trading on Friday, reaching $69.63. The company had a trading volume of 400,422 shares, compared to its average volume of 365,429. The stock's 50-day simple moving average is $63.41 and its 200-day simple moving average is $56.79. Ameris Bancorp has a 1 year low of $40.71 and a 1 year high of $72.68. The company has a debt-to-equity ratio of 0.13, a current ratio of 1.03 and a quick ratio of 1.01. The company has a market capitalization of $4.81 billion, a P/E ratio of 14.51 and a beta of 1.01.

Ameris Bancorp (NASDAQ:ABCB - Get Free Report) last issued its quarterly earnings data on Thursday, October 24th. The bank reported $1.38 EPS for the quarter, beating analysts' consensus estimates of $1.25 by $0.13. Ameris Bancorp had a net margin of 20.08% and a return on equity of 9.18%. The firm had revenue of $424.86 million for the quarter, compared to analysts' expectations of $290.60 million. During the same period in the prior year, the company earned $1.16 EPS. On average, equities analysts predict that Ameris Bancorp will post 4.83 EPS for the current year.

Ameris Bancorp Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Monday, October 7th. Stockholders of record on Monday, September 30th were given a $0.15 dividend. This represents a $0.60 dividend on an annualized basis and a dividend yield of 0.86%. The ex-dividend date of this dividend was Monday, September 30th. Ameris Bancorp's dividend payout ratio is currently 12.50%.

Analysts Set New Price Targets

Several analysts have commented on the company. DA Davidson upped their price objective on Ameris Bancorp from $61.00 to $76.00 and gave the company a "buy" rating in a research note on Monday, July 29th. Raymond James raised Ameris Bancorp from a "market perform" rating to an "outperform" rating and set a $67.00 price target for the company in a report on Monday, October 28th. Stephens boosted their price objective on shares of Ameris Bancorp from $64.00 to $67.00 and gave the company an "equal weight" rating in a research note on Monday, October 28th. StockNews.com upgraded shares of Ameris Bancorp from a "sell" rating to a "hold" rating in a research report on Thursday, October 31st. Finally, Truist Financial dropped their price target on shares of Ameris Bancorp from $73.00 to $68.00 and set a "buy" rating on the stock in a research note on Monday, October 28th. Two investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the company's stock. According to data from MarketBeat, Ameris Bancorp presently has a consensus rating of "Moderate Buy" and an average target price of $66.67.

Get Our Latest Stock Analysis on Ameris Bancorp

About Ameris Bancorp

(

Free Report)

Ameris Bancorp operates as the bank holding company for Ameris Bank that provides range of banking services to retail and commercial customers. It operates through five segments: Banking Division, Retail Mortgage Division, Warehouse Lending Division, SBA Division, and Premium Finance Division. The company offers commercial and retail checking, regular interest-bearing savings, money market, individual retirement, and certificates of deposit accounts.

See Also

Before you consider Ameris Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ameris Bancorp wasn't on the list.

While Ameris Bancorp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.