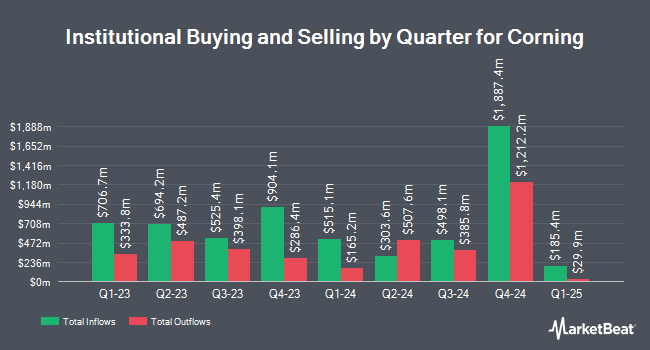

Robeco Institutional Asset Management B.V. boosted its holdings in Corning Incorporated (NYSE:GLW - Free Report) by 372.1% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 413,327 shares of the electronics maker's stock after purchasing an additional 325,776 shares during the quarter. Robeco Institutional Asset Management B.V.'s holdings in Corning were worth $18,662,000 at the end of the most recent quarter.

Other institutional investors have also recently added to or reduced their stakes in the company. Price T Rowe Associates Inc. MD increased its position in Corning by 35.1% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 17,200,828 shares of the electronics maker's stock valued at $566,941,000 after acquiring an additional 4,464,893 shares during the period. Natixis boosted its holdings in Corning by 2,405.2% during the first quarter. Natixis now owns 1,807,801 shares of the electronics maker's stock worth $59,585,000 after buying an additional 1,735,638 shares in the last quarter. Pathway Financial Advisers LLC grew its holdings in shares of Corning by 4,306.9% in the 3rd quarter. Pathway Financial Advisers LLC now owns 1,050,463 shares of the electronics maker's stock worth $47,428,000 after acquiring an additional 1,026,626 shares during the last quarter. Healthcare of Ontario Pension Plan Trust Fund increased its stake in Corning by 10,626.4% in the 1st quarter. Healthcare of Ontario Pension Plan Trust Fund now owns 1,013,000 shares of the electronics maker's stock worth $33,388,000 after purchasing an additional 1,003,556 shares in the last quarter. Finally, Shellback Capital LP purchased a new position in shares of Corning in the second quarter worth approximately $34,483,000. Institutional investors own 69.80% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts have recently commented on GLW shares. Barclays raised their target price on Corning from $40.00 to $53.00 and gave the stock an "equal weight" rating in a research report on Tuesday, October 29th. UBS Group lifted their target price on Corning from $46.00 to $51.00 and gave the company a "neutral" rating in a research note on Wednesday, October 30th. Citigroup increased their price target on shares of Corning from $45.00 to $51.00 and gave the stock a "buy" rating in a research report on Friday, July 12th. JPMorgan Chase & Co. boosted their price target on shares of Corning from $55.00 to $60.00 and gave the company an "overweight" rating in a report on Wednesday, October 30th. Finally, Susquehanna increased their price objective on Corning from $46.00 to $55.00 and gave the stock a "positive" rating in a report on Friday, September 20th. Five investment analysts have rated the stock with a hold rating and ten have given a buy rating to the company. Based on data from MarketBeat.com, Corning currently has a consensus rating of "Moderate Buy" and a consensus price target of $50.08.

Get Our Latest Report on Corning

Corning Stock Performance

Corning stock remained flat at $48.24 on Thursday. 1,849,997 shares of the company's stock were exchanged, compared to its average volume of 5,718,027. The company has a debt-to-equity ratio of 0.62, a quick ratio of 1.05 and a current ratio of 1.66. Corning Incorporated has a 52-week low of $26.94 and a 52-week high of $51.03. The company's fifty day moving average is $44.83 and its two-hundred day moving average is $40.75. The firm has a market cap of $41.30 billion, a PE ratio of 283.76, a PEG ratio of 1.51 and a beta of 1.03.

Corning (NYSE:GLW - Get Free Report) last announced its earnings results on Tuesday, October 29th. The electronics maker reported $0.54 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.53 by $0.01. Corning had a net margin of 1.24% and a return on equity of 13.45%. The business had revenue of $3.39 billion for the quarter, compared to analyst estimates of $3.72 billion. During the same quarter in the previous year, the firm posted $0.45 earnings per share. Corning's revenue was up 6.9% compared to the same quarter last year. Equities analysts anticipate that Corning Incorporated will post 1.95 EPS for the current fiscal year.

Corning Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, December 13th. Investors of record on Friday, November 15th will be paid a $0.28 dividend. The ex-dividend date is Friday, November 15th. This represents a $1.12 dividend on an annualized basis and a yield of 2.32%. Corning's payout ratio is currently 658.82%.

Corning Company Profile

(

Free Report)

Corning Incorporated engages in the display technologies, optical communications, environmental technologies, specialty materials, and life sciences businesses in the United States and internationally. The company's Display Technologies segment offers glass substrates for flat panel displays, including liquid crystal displays and organic light-emitting diodes that are used in televisions, notebook computers, desktop monitors, tablets, and handheld devices.

Read More

Before you consider Corning, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corning wasn't on the list.

While Corning currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.