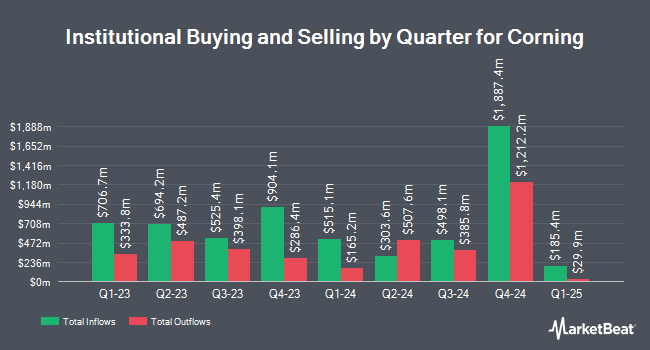

Van ECK Associates Corp reduced its stake in shares of Corning Incorporated (NYSE:GLW - Free Report) by 74.8% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 25,772 shares of the electronics maker's stock after selling 76,540 shares during the quarter. Van ECK Associates Corp's holdings in Corning were worth $1,208,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other institutional investors and hedge funds have also recently modified their holdings of the stock. Envestnet Portfolio Solutions Inc. increased its stake in Corning by 25.2% in the 1st quarter. Envestnet Portfolio Solutions Inc. now owns 22,826 shares of the electronics maker's stock worth $752,000 after acquiring an additional 4,588 shares during the last quarter. Empowered Funds LLC raised its stake in Corning by 35.4% during the first quarter. Empowered Funds LLC now owns 19,431 shares of the electronics maker's stock valued at $640,000 after purchasing an additional 5,081 shares in the last quarter. QRG Capital Management Inc. lifted its position in Corning by 7.3% during the first quarter. QRG Capital Management Inc. now owns 44,161 shares of the electronics maker's stock valued at $1,456,000 after purchasing an additional 2,991 shares during the last quarter. ProShare Advisors LLC grew its stake in shares of Corning by 3.0% in the 1st quarter. ProShare Advisors LLC now owns 384,442 shares of the electronics maker's stock worth $12,671,000 after buying an additional 11,298 shares in the last quarter. Finally, Bleakley Financial Group LLC increased its holdings in shares of Corning by 4.9% in the 1st quarter. Bleakley Financial Group LLC now owns 9,984 shares of the electronics maker's stock worth $329,000 after buying an additional 464 shares during the last quarter. Institutional investors own 69.80% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts recently commented on GLW shares. Deutsche Bank Aktiengesellschaft increased their price target on shares of Corning from $49.00 to $54.00 and gave the company a "buy" rating in a report on Wednesday, October 30th. UBS Group raised their price objective on Corning from $46.00 to $51.00 and gave the company a "neutral" rating in a research note on Wednesday, October 30th. Barclays boosted their target price on Corning from $40.00 to $53.00 and gave the company an "equal weight" rating in a research report on Tuesday, October 29th. Morgan Stanley restated an "equal weight" rating and issued a $39.00 price target on shares of Corning in a research report on Friday, July 26th. Finally, Susquehanna boosted their price objective on shares of Corning from $46.00 to $55.00 and gave the company a "positive" rating in a research report on Friday, September 20th. Five analysts have rated the stock with a hold rating and ten have given a buy rating to the company. According to data from MarketBeat, Corning currently has an average rating of "Moderate Buy" and a consensus target price of $50.08.

View Our Latest Report on Corning

Corning Trading Down 1.7 %

GLW traded down $0.81 on Tuesday, reaching $48.11. 795,016 shares of the company traded hands, compared to its average volume of 5,683,529. The company has a quick ratio of 1.05, a current ratio of 1.66 and a debt-to-equity ratio of 0.62. The company has a market cap of $41.19 billion, a P/E ratio of 287.76, a price-to-earnings-growth ratio of 1.56 and a beta of 1.03. The firm has a fifty day simple moving average of $45.24 and a two-hundred day simple moving average of $41.17. Corning Incorporated has a one year low of $27.41 and a one year high of $51.03.

Corning (NYSE:GLW - Get Free Report) last announced its quarterly earnings results on Tuesday, October 29th. The electronics maker reported $0.54 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.53 by $0.01. The firm had revenue of $3.39 billion during the quarter, compared to analyst estimates of $3.72 billion. Corning had a return on equity of 13.45% and a net margin of 1.24%. Corning's quarterly revenue was up 6.9% on a year-over-year basis. During the same quarter in the previous year, the business earned $0.45 earnings per share. As a group, equities research analysts expect that Corning Incorporated will post 1.95 earnings per share for the current year.

Corning Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, December 13th. Stockholders of record on Friday, November 15th will be paid a dividend of $0.28 per share. The ex-dividend date is Friday, November 15th. This represents a $1.12 annualized dividend and a dividend yield of 2.33%. Corning's dividend payout ratio is currently 658.82%.

Corning Company Profile

(

Free Report)

Corning Incorporated engages in the display technologies, optical communications, environmental technologies, specialty materials, and life sciences businesses in the United States and internationally. The company's Display Technologies segment offers glass substrates for flat panel displays, including liquid crystal displays and organic light-emitting diodes that are used in televisions, notebook computers, desktop monitors, tablets, and handheld devices.

Featured Articles

Before you consider Corning, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corning wasn't on the list.

While Corning currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.