Swiss National Bank decreased its stake in shares of Corpay, Inc. (NYSE:CPAY - Free Report) by 1.9% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 198,200 shares of the company's stock after selling 3,900 shares during the period. Swiss National Bank owned about 0.29% of Corpay worth $61,989,000 at the end of the most recent reporting period.

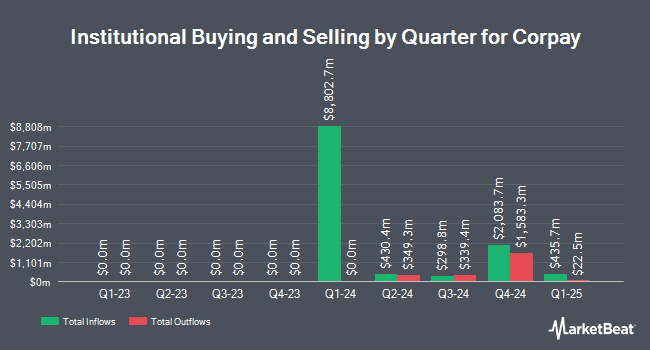

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Albion Financial Group UT bought a new position in Corpay in the third quarter worth approximately $27,000. LGT Financial Advisors LLC purchased a new stake in shares of Corpay in the second quarter worth $33,000. Huntington National Bank increased its stake in shares of Corpay by 43.0% in the third quarter. Huntington National Bank now owns 133 shares of the company's stock worth $42,000 after purchasing an additional 40 shares in the last quarter. Innealta Capital LLC purchased a new stake in shares of Corpay in the second quarter worth $36,000. Finally, Blue Trust Inc. increased its stake in shares of Corpay by 246.2% in the second quarter. Blue Trust Inc. now owns 135 shares of the company's stock worth $36,000 after purchasing an additional 96 shares in the last quarter. Institutional investors own 98.84% of the company's stock.

Wall Street Analyst Weigh In

CPAY has been the subject of a number of analyst reports. Raymond James cut their target price on shares of Corpay from $330.00 to $311.00 and set an "outperform" rating for the company in a research note on Thursday, August 8th. Keefe, Bruyette & Woods raised their target price on shares of Corpay from $380.00 to $400.00 and gave the company an "outperform" rating in a research note on Friday, November 8th. Wolfe Research raised shares of Corpay from an "underperform" rating to a "peer perform" rating in a research note on Tuesday, September 3rd. William Blair raised shares of Corpay to a "strong-buy" rating in a research note on Thursday, August 8th. Finally, Morgan Stanley increased their price objective on shares of Corpay from $325.00 to $350.00 and gave the company an "equal weight" rating in a research report on Monday, November 11th. Four analysts have rated the stock with a hold rating, ten have issued a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the company has an average rating of "Moderate Buy" and a consensus target price of $363.93.

Check Out Our Latest Report on CPAY

Insider Activity at Corpay

In other Corpay news, Director Joseph W. Farrelly sold 2,975 shares of the firm's stock in a transaction dated Wednesday, November 13th. The shares were sold at an average price of $375.18, for a total transaction of $1,116,160.50. Following the sale, the director now directly owns 10,530 shares of the company's stock, valued at $3,950,645.40. This trade represents a 22.03 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. 6.10% of the stock is owned by corporate insiders.

Corpay Price Performance

Shares of NYSE:CPAY traded up $1.05 on Wednesday, reaching $369.24. 277,089 shares of the company were exchanged, compared to its average volume of 474,479. The company has a current ratio of 1.05, a quick ratio of 1.05 and a debt-to-equity ratio of 1.69. Corpay, Inc. has a 1-year low of $230.68 and a 1-year high of $375.98. The firm has a market cap of $25.74 billion, a price-to-earnings ratio of 26.26, a price-to-earnings-growth ratio of 1.42 and a beta of 1.21. The company has a 50-day moving average of $334.29 and a 200-day moving average of $299.71.

Corpay Profile

(

Free Report)

Corpay, Inc operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally. The company offers vehicle payment solutions, which include fuel, tolls, parking, fleet maintenance, and long-haul transportation services, as well as prepaid food and transportation vouchers and cards.

Featured Articles

Before you consider Corpay, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corpay wasn't on the list.

While Corpay currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.