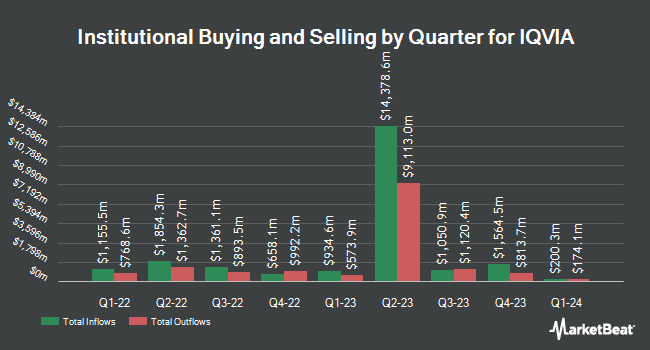

Corsair Capital Management L.P. reduced its position in shares of IQVIA Holdings Inc. (NYSE:IQV - Free Report) by 31.3% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 21,920 shares of the medical research company's stock after selling 9,975 shares during the period. IQVIA makes up 1.2% of Corsair Capital Management L.P.'s portfolio, making the stock its 20th biggest holding. Corsair Capital Management L.P.'s holdings in IQVIA were worth $5,194,000 at the end of the most recent quarter.

Other hedge funds have also recently made changes to their positions in the company. FMR LLC raised its stake in IQVIA by 38.7% in the third quarter. FMR LLC now owns 2,887,342 shares of the medical research company's stock worth $684,213,000 after buying an additional 804,963 shares in the last quarter. B. Metzler seel. Sohn & Co. Holding AG purchased a new position in shares of IQVIA during the 3rd quarter worth $147,683,000. 1832 Asset Management L.P. boosted its stake in shares of IQVIA by 472.3% during the 2nd quarter. 1832 Asset Management L.P. now owns 456,335 shares of the medical research company's stock worth $96,487,000 after acquiring an additional 376,595 shares during the last quarter. Renaissance Technologies LLC bought a new stake in shares of IQVIA during the 2nd quarter valued at $70,610,000. Finally, Impax Asset Management Group plc raised its position in shares of IQVIA by 19.3% during the 2nd quarter. Impax Asset Management Group plc now owns 1,635,201 shares of the medical research company's stock valued at $344,998,000 after purchasing an additional 264,555 shares during the period. 89.62% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

A number of research firms have recently weighed in on IQV. Royal Bank of Canada restated an "outperform" rating and issued a $270.00 target price on shares of IQVIA in a report on Friday, November 1st. StockNews.com raised shares of IQVIA from a "hold" rating to a "buy" rating in a research report on Wednesday, November 20th. The Goldman Sachs Group lowered their price objective on shares of IQVIA from $280.00 to $250.00 and set a "buy" rating for the company in a research report on Friday, November 1st. JPMorgan Chase & Co. reduced their price target on shares of IQVIA from $279.00 to $240.00 and set an "overweight" rating for the company in a report on Tuesday, November 5th. Finally, Truist Financial reduced their price objective on shares of IQVIA from $286.00 to $265.00 and set a "buy" rating for the company in a research note on Monday, November 4th. Four analysts have rated the stock with a hold rating, fifteen have issued a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat.com, IQVIA has a consensus rating of "Moderate Buy" and an average target price of $256.50.

View Our Latest Stock Report on IQV

IQVIA Price Performance

Shares of NYSE IQV traded up $0.21 during trading on Wednesday, hitting $201.44. 822,728 shares of the company were exchanged, compared to its average volume of 1,177,509. The company has a market cap of $36.56 billion, a price-to-earnings ratio of 26.41, a PEG ratio of 2.10 and a beta of 1.51. IQVIA Holdings Inc. has a 1 year low of $187.62 and a 1 year high of $261.73. The firm's fifty day moving average price is $221.18 and its 200 day moving average price is $226.75. The company has a debt-to-equity ratio of 1.76, a current ratio of 0.81 and a quick ratio of 0.81.

IQVIA Company Profile

(

Free Report)

IQVIA Holdings Inc engages in the provision of advanced analytics, technology solutions, and clinical research services to the life sciences industry in the Americas, Europe, Africa, and the Asia-Pacific. It operates through three segments: Technology & Analytics Solutions, Research & Development Solutions, and Contract Sales & Medical Solutions.

Featured Articles

Before you consider IQVIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IQVIA wasn't on the list.

While IQVIA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.