Corsair Gaming (NASDAQ:CRSR - Free Report) had its price objective trimmed by The Goldman Sachs Group from $9.00 to $7.00 in a report released on Thursday,Benzinga reports. The brokerage currently has a neutral rating on the stock.

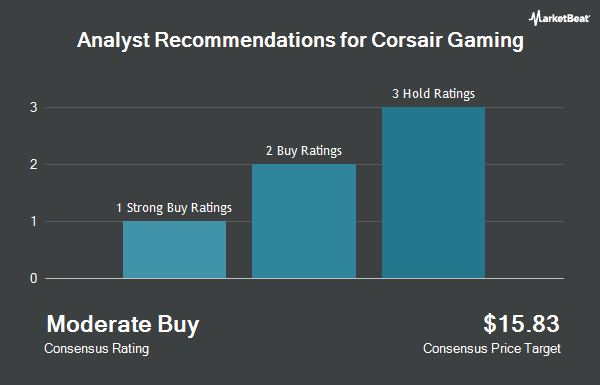

Several other analysts also recently commented on CRSR. Stifel Nicolaus lowered their price objective on Corsair Gaming from $16.00 to $11.00 and set a "buy" rating for the company in a research note on Monday, July 22nd. Barclays reduced their price objective on Corsair Gaming from $14.00 to $9.00 and set an "overweight" rating for the company in a report on Thursday. Robert W. Baird lowered their price target on shares of Corsair Gaming from $10.00 to $8.00 and set a "neutral" rating on the stock in a research report on Wednesday, September 25th. Finally, Wedbush reissued an "outperform" rating and set a $11.00 price objective on shares of Corsair Gaming in a report on Tuesday. Three research analysts have rated the stock with a hold rating and three have issued a buy rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $9.17.

Read Our Latest Stock Analysis on Corsair Gaming

Corsair Gaming Price Performance

NASDAQ:CRSR traded down $0.27 on Thursday, hitting $6.85. The company had a trading volume of 1,259,055 shares, compared to its average volume of 447,793. The firm has a 50 day moving average of $6.60 and a two-hundred day moving average of $8.67. The stock has a market capitalization of $713.43 million, a price-to-earnings ratio of -18.59 and a beta of 1.59. The company has a current ratio of 1.80, a quick ratio of 0.97 and a debt-to-equity ratio of 0.26. Corsair Gaming has a 52 week low of $5.59 and a 52 week high of $15.07.

Corsair Gaming (NASDAQ:CRSR - Get Free Report) last released its quarterly earnings results on Wednesday, November 6th. The company reported ($0.36) EPS for the quarter. Corsair Gaming had a negative net margin of 2.83% and a positive return on equity of 2.17%. The company had revenue of $304.20 million during the quarter, compared to the consensus estimate of $305.03 million. On average, research analysts anticipate that Corsair Gaming will post 0.07 earnings per share for the current year.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently made changes to their positions in the company. Vanguard Group Inc. increased its stake in shares of Corsair Gaming by 1.2% during the first quarter. Vanguard Group Inc. now owns 5,485,063 shares of the company's stock valued at $67,686,000 after buying an additional 64,373 shares during the period. Massachusetts Financial Services Co. MA boosted its stake in shares of Corsair Gaming by 7.5% during the 2nd quarter. Massachusetts Financial Services Co. MA now owns 2,180,426 shares of the company's stock valued at $24,072,000 after purchasing an additional 153,036 shares in the last quarter. Bank of New York Mellon Corp increased its position in shares of Corsair Gaming by 3.5% during the second quarter. Bank of New York Mellon Corp now owns 1,252,737 shares of the company's stock valued at $13,830,000 after buying an additional 41,832 shares during the period. Renaissance Technologies LLC boosted its position in shares of Corsair Gaming by 12.2% during the second quarter. Renaissance Technologies LLC now owns 418,033 shares of the company's stock valued at $4,615,000 after purchasing an additional 45,400 shares in the last quarter. Finally, Rhumbline Advisers grew its holdings in Corsair Gaming by 11.6% in the second quarter. Rhumbline Advisers now owns 134,322 shares of the company's stock worth $1,483,000 after purchasing an additional 13,940 shares during the period. Institutional investors own 25.66% of the company's stock.

Corsair Gaming Company Profile

(

Get Free Report)

Corsair Gaming, Inc, together with its subsidiaries, designs, develops, markets, and sells gaming and streaming peripherals, components and systems in the Americas, Europe, the Middle East, and the Asia Pacific. It offers gamer and creator peripherals, including gaming keyboards, mice, headsets, controllers, and streaming products, such as capture cards, stream decks, microphones and audio interfaces, facecam streaming cameras, studio accessories, gaming furniture, and other related products.

Read More

Before you consider Corsair Gaming, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corsair Gaming wasn't on the list.

While Corsair Gaming currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.