Corteva (NYSE:CTVA - Get Free Report)'s stock had its "outperform" rating reiterated by investment analysts at Oppenheimer in a research report issued on Friday,Benzinga reports. They presently have a $70.00 target price on the stock, up from their prior target price of $69.00. Oppenheimer's price target would suggest a potential upside of 20.01% from the stock's current price.

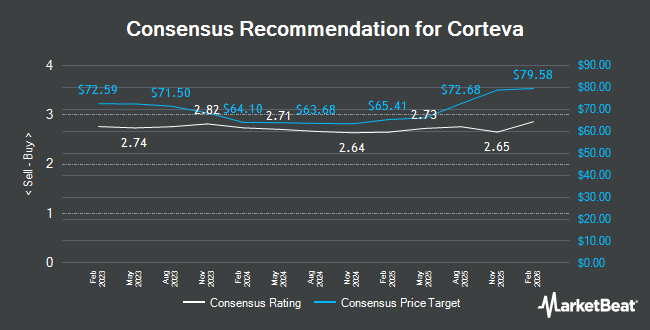

CTVA has been the subject of a number of other reports. Argus lowered shares of Corteva from a "buy" rating to a "hold" rating in a report on Wednesday, August 7th. JPMorgan Chase & Co. lowered their price target on shares of Corteva from $57.00 to $55.00 and set a "neutral" rating for the company in a research note on Friday, August 2nd. Morgan Stanley reaffirmed an "overweight" rating and set a $65.00 price objective on shares of Corteva in a research note on Tuesday, September 24th. KeyCorp decreased their price objective on Corteva from $66.00 to $62.00 and set an "overweight" rating on the stock in a report on Friday, August 2nd. Finally, Citigroup initiated coverage on Corteva in a report on Wednesday, October 23rd. They set a "buy" rating and a $68.00 target price for the company. One equities research analyst has rated the stock with a sell rating, five have given a hold rating and fifteen have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $63.47.

Check Out Our Latest Stock Report on Corteva

Corteva Price Performance

CTVA traded down $0.31 during trading on Friday, reaching $58.33. The stock had a trading volume of 4,673,780 shares, compared to its average volume of 3,270,237. The company has a debt-to-equity ratio of 0.10, a quick ratio of 1.17 and a current ratio of 1.72. The business has a 50-day moving average of $58.19 and a 200-day moving average of $55.59. Corteva has a one year low of $43.22 and a one year high of $63.75. The stock has a market cap of $40.38 billion, a PE ratio of 44.87, a PEG ratio of 1.76 and a beta of 0.77.

Corteva (NYSE:CTVA - Get Free Report) last announced its quarterly earnings data on Wednesday, November 6th. The company reported ($0.49) EPS for the quarter, missing the consensus estimate of ($0.31) by ($0.18). The firm had revenue of $2.33 billion for the quarter, compared to the consensus estimate of $2.69 billion. Corteva had a net margin of 5.31% and a return on equity of 7.30%. As a group, equities research analysts anticipate that Corteva will post 2.66 EPS for the current fiscal year.

Institutional Investors Weigh In On Corteva

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the company. Acadian Asset Management LLC bought a new stake in Corteva in the first quarter worth $25,000. Capital Advisors Ltd. LLC boosted its stake in Corteva by 44.4% in the 3rd quarter. Capital Advisors Ltd. LLC now owns 566 shares of the company's stock worth $33,000 after purchasing an additional 174 shares in the last quarter. Cultivar Capital Inc. purchased a new stake in Corteva during the 2nd quarter valued at about $34,000. Redwood Wealth Management Group LLC bought a new stake in Corteva during the 2nd quarter valued at about $43,000. Finally, Triad Wealth Partners LLC purchased a new position in Corteva in the second quarter worth about $45,000. 81.54% of the stock is owned by hedge funds and other institutional investors.

Corteva Company Profile

(

Get Free Report)

Corteva, Inc operates in the agriculture business. It operates through two segments, Seed and Crop Protection. The Seed segment develops and supplies advanced germplasm and traits that produce optimum yield for farms. It offers trait technologies that enhance resistance to weather, disease, insects, and herbicides used to control weeds, as well as food and nutritional characteristics.

Further Reading

Before you consider Corteva, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corteva wasn't on the list.

While Corteva currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.