Adell Harriman & Carpenter Inc. raised its position in shares of Costco Wholesale Co. (NASDAQ:COST - Free Report) by 2.5% during the 4th quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 37,860 shares of the retailer's stock after purchasing an additional 934 shares during the quarter. Costco Wholesale accounts for 2.4% of Adell Harriman & Carpenter Inc.'s portfolio, making the stock its 11th largest position. Adell Harriman & Carpenter Inc.'s holdings in Costco Wholesale were worth $34,691,000 at the end of the most recent reporting period.

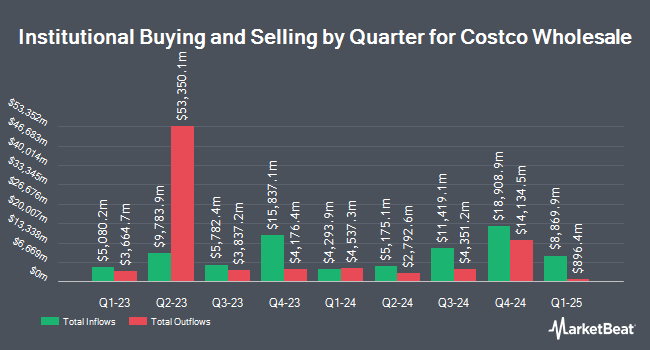

Several other institutional investors have also recently modified their holdings of the company. Geode Capital Management LLC lifted its holdings in Costco Wholesale by 1.7% in the third quarter. Geode Capital Management LLC now owns 9,487,057 shares of the retailer's stock valued at $8,380,648,000 after acquiring an additional 162,191 shares during the period. FMR LLC lifted its stake in shares of Costco Wholesale by 3.6% in the 3rd quarter. FMR LLC now owns 9,308,615 shares of the retailer's stock valued at $8,252,274,000 after purchasing an additional 324,973 shares during the period. International Assets Investment Management LLC grew its position in Costco Wholesale by 113,947.9% during the third quarter. International Assets Investment Management LLC now owns 7,370,916 shares of the retailer's stock valued at $6,534,464,000 after buying an additional 7,364,453 shares during the period. Jennison Associates LLC increased its holdings in Costco Wholesale by 3.8% in the third quarter. Jennison Associates LLC now owns 3,399,127 shares of the retailer's stock valued at $3,013,394,000 after buying an additional 125,444 shares in the last quarter. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its position in shares of Costco Wholesale by 2.3% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 3,075,065 shares of the retailer's stock worth $2,726,107,000 after acquiring an additional 70,561 shares during the period. 68.48% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of equities analysts recently weighed in on COST shares. Jefferies Financial Group upped their price target on Costco Wholesale from $1,050.00 to $1,145.00 and gave the stock a "buy" rating in a report on Thursday, December 5th. TD Cowen raised their target price on Costco Wholesale from $975.00 to $1,090.00 and gave the company a "buy" rating in a research report on Friday, December 13th. Truist Financial boosted their price target on Costco Wholesale from $909.00 to $935.00 and gave the stock a "hold" rating in a research report on Friday, December 13th. DA Davidson lifted their target price on shares of Costco Wholesale from $900.00 to $1,000.00 and gave the stock a "neutral" rating in a research note on Thursday, February 6th. Finally, Robert W. Baird upped their target price on shares of Costco Wholesale from $975.00 to $1,075.00 and gave the stock an "outperform" rating in a report on Thursday, December 5th. Nine analysts have rated the stock with a hold rating and nineteen have given a buy rating to the stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average price target of $1,021.93.

View Our Latest Research Report on Costco Wholesale

Costco Wholesale Price Performance

Costco Wholesale stock traded up $6.51 during midday trading on Wednesday, reaching $1,062.54. The company's stock had a trading volume of 1,346,846 shares, compared to its average volume of 1,906,059. The firm has a market capitalization of $471.66 billion, a PE ratio of 62.39, a P/E/G ratio of 6.37 and a beta of 0.84. Costco Wholesale Co. has a fifty-two week low of $697.27 and a fifty-two week high of $1,078.23. The stock's 50 day simple moving average is $972.43 and its 200 day simple moving average is $927.29. The company has a debt-to-equity ratio of 0.23, a quick ratio of 0.43 and a current ratio of 0.98.

Costco Wholesale Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, February 21st. Shareholders of record on Friday, February 7th will be issued a $1.16 dividend. The ex-dividend date of this dividend is Friday, February 7th. This represents a $4.64 dividend on an annualized basis and a yield of 0.44%. Costco Wholesale's dividend payout ratio (DPR) is presently 27.25%.

Costco Wholesale Profile

(

Free Report)

Costco Wholesale Corporation, together with its subsidiaries, engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden. The company offers branded and private-label products in a range of merchandise categories.

Read More

Before you consider Costco Wholesale, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Costco Wholesale wasn't on the list.

While Costco Wholesale currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.