Falcon Wealth Planning lifted its position in Costco Wholesale Co. (NASDAQ:COST - Free Report) by 220.5% in the fourth quarter, according to its most recent Form 13F filing with the SEC. The firm owned 6,413 shares of the retailer's stock after purchasing an additional 4,412 shares during the period. Costco Wholesale accounts for about 0.7% of Falcon Wealth Planning's investment portfolio, making the stock its 23rd biggest position. Falcon Wealth Planning's holdings in Costco Wholesale were worth $5,876,000 at the end of the most recent reporting period.

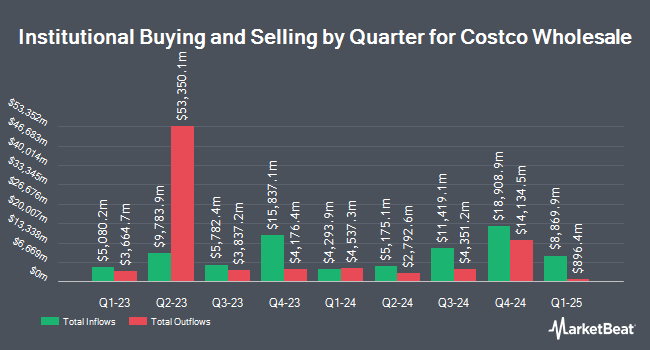

Several other hedge funds and other institutional investors also recently bought and sold shares of the company. RPg Family Wealth Advisory LLC purchased a new stake in shares of Costco Wholesale in the 3rd quarter worth approximately $29,000. Endeavor Private Wealth Inc. bought a new position in Costco Wholesale in the fourth quarter worth approximately $33,000. FSC Wealth Advisors LLC purchased a new stake in Costco Wholesale during the fourth quarter worth $41,000. Retirement Wealth Solutions LLC purchased a new position in shares of Costco Wholesale in the 4th quarter valued at $55,000. Finally, Mowery & Schoenfeld Wealth Management LLC bought a new position in shares of Costco Wholesale in the 3rd quarter worth $58,000. Institutional investors own 68.48% of the company's stock.

Costco Wholesale Stock Performance

Shares of COST traded up $14.99 during mid-day trading on Thursday, reaching $979.01. The company had a trading volume of 1,785,690 shares, compared to its average volume of 1,923,543. The stock has a market capitalization of $434.58 billion, a P/E ratio of 57.49, a PEG ratio of 5.63 and a beta of 0.84. Costco Wholesale Co. has a 52-week low of $691.50 and a 52-week high of $1,008.25. The stock has a 50 day moving average of $953.78 and a two-hundred day moving average of $906.03. The company has a quick ratio of 0.43, a current ratio of 0.98 and a debt-to-equity ratio of 0.23.

Costco Wholesale Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, February 21st. Shareholders of record on Friday, February 7th will be given a $1.16 dividend. The ex-dividend date of this dividend is Friday, February 7th. This represents a $4.64 annualized dividend and a yield of 0.47%. Costco Wholesale's dividend payout ratio is presently 27.25%.

Analyst Ratings Changes

A number of brokerages have commented on COST. Telsey Advisory Group reiterated an "outperform" rating and issued a $1,100.00 target price on shares of Costco Wholesale in a report on Thursday, January 9th. Sanford C. Bernstein started coverage on shares of Costco Wholesale in a research note on Tuesday, October 22nd. They set an "outperform" rating and a $1,016.00 price objective for the company. Morgan Stanley raised their target price on shares of Costco Wholesale from $950.00 to $1,150.00 and gave the company an "overweight" rating in a research note on Friday, December 13th. Roth Mkm upped their price target on Costco Wholesale from $755.00 to $907.00 and gave the stock a "neutral" rating in a research report on Friday, December 13th. Finally, Barclays raised their price objective on Costco Wholesale from $850.00 to $940.00 and gave the stock an "equal weight" rating in a research report on Friday, December 13th. Nine equities research analysts have rated the stock with a hold rating and nineteen have assigned a buy rating to the company's stock. According to data from MarketBeat.com, Costco Wholesale currently has a consensus rating of "Moderate Buy" and a consensus target price of $1,013.59.

Read Our Latest Stock Analysis on COST

Costco Wholesale Company Profile

(

Free Report)

Costco Wholesale Corporation, together with its subsidiaries, engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden. The company offers branded and private-label products in a range of merchandise categories.

Read More

Before you consider Costco Wholesale, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Costco Wholesale wasn't on the list.

While Costco Wholesale currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.