M&T Bank Corp reduced its position in Costco Wholesale Co. (NASDAQ:COST - Free Report) by 1.2% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 226,633 shares of the retailer's stock after selling 2,852 shares during the quarter. M&T Bank Corp owned about 0.05% of Costco Wholesale worth $200,915,000 at the end of the most recent reporting period.

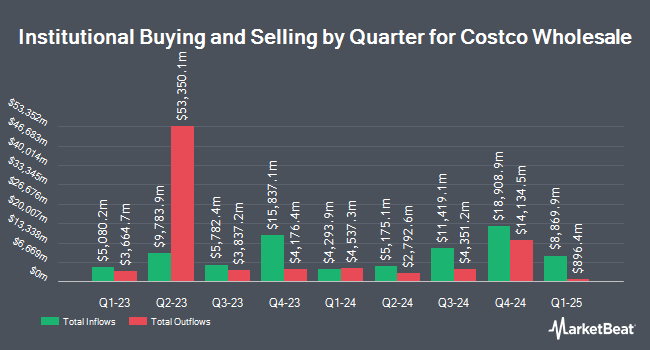

Other hedge funds have also modified their holdings of the company. Charles Schwab Investment Management Inc. lifted its stake in shares of Costco Wholesale by 1.2% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 2,808,255 shares of the retailer's stock worth $2,489,574,000 after acquiring an additional 32,074 shares during the period. C2P Capital Advisory Group LLC d.b.a. Prosperity Capital Advisors increased its holdings in Costco Wholesale by 62.8% in the third quarter. C2P Capital Advisory Group LLC d.b.a. Prosperity Capital Advisors now owns 2,417 shares of the retailer's stock valued at $2,143,000 after buying an additional 932 shares in the last quarter. Hudson Value Partners LLC lifted its position in shares of Costco Wholesale by 7.6% during the 3rd quarter. Hudson Value Partners LLC now owns 8,046 shares of the retailer's stock valued at $7,133,000 after acquiring an additional 568 shares during the period. Nwam LLC purchased a new stake in shares of Costco Wholesale during the 3rd quarter worth approximately $20,056,000. Finally, Cantor Fitzgerald Investment Advisors L.P. grew its holdings in shares of Costco Wholesale by 66.9% in the 3rd quarter. Cantor Fitzgerald Investment Advisors L.P. now owns 3,088 shares of the retailer's stock worth $2,738,000 after acquiring an additional 1,238 shares during the period. 68.48% of the stock is currently owned by hedge funds and other institutional investors.

Insider Buying and Selling at Costco Wholesale

In other Costco Wholesale news, EVP Claudine Adamo sold 3,200 shares of the firm's stock in a transaction on Monday, September 30th. The shares were sold at an average price of $888.99, for a total transaction of $2,844,768.00. Following the completion of the transaction, the executive vice president now directly owns 8,630 shares of the company's stock, valued at $7,671,983.70. This trade represents a 27.05 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, EVP Richard A. Galanti sold 1,416 shares of the company's stock in a transaction dated Thursday, October 24th. The shares were sold at an average price of $894.68, for a total transaction of $1,266,866.88. Following the completion of the sale, the executive vice president now owns 27,400 shares in the company, valued at approximately $24,514,232. This trade represents a 4.91 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 11,016 shares of company stock valued at $9,826,115 over the last 90 days. 0.18% of the stock is owned by corporate insiders.

Wall Street Analysts Forecast Growth

Several analysts have weighed in on the company. UBS Group upped their target price on Costco Wholesale from $840.00 to $1,040.00 and gave the company a "buy" rating in a report on Thursday, December 12th. Truist Financial lifted their target price on shares of Costco Wholesale from $909.00 to $935.00 and gave the stock a "hold" rating in a research report on Friday, December 13th. Robert W. Baird increased their price target on shares of Costco Wholesale from $975.00 to $1,075.00 and gave the company an "outperform" rating in a research report on Thursday, December 5th. Tigress Financial restated a "buy" rating and set a $1,065.00 price objective on shares of Costco Wholesale in a research report on Thursday, October 17th. Finally, DA Davidson increased their target price on Costco Wholesale from $880.00 to $900.00 and gave the company a "neutral" rating in a report on Friday, December 13th. Nine investment analysts have rated the stock with a hold rating and nineteen have assigned a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $1,011.74.

View Our Latest Stock Report on Costco Wholesale

Costco Wholesale Trading Down 0.1 %

COST traded down $0.73 during trading on Friday, hitting $954.07. 5,316,703 shares of the company's stock were exchanged, compared to its average volume of 1,952,027. The stock has a 50 day moving average price of $934.70 and a 200 day moving average price of $890.17. Costco Wholesale Co. has a 1 year low of $640.51 and a 1 year high of $1,008.25. The company has a current ratio of 0.97, a quick ratio of 0.44 and a debt-to-equity ratio of 0.25. The firm has a market cap of $422.72 billion, a P/E ratio of 56.02, a price-to-earnings-growth ratio of 6.02 and a beta of 0.82.

Costco Wholesale (NASDAQ:COST - Get Free Report) last announced its quarterly earnings results on Thursday, September 26th. The retailer reported $5.15 earnings per share for the quarter, topping analysts' consensus estimates of $5.05 by $0.10. The firm had revenue of $79.70 billion during the quarter, compared to analysts' expectations of $79.91 billion. Costco Wholesale had a net margin of 2.93% and a return on equity of 33.19%. The firm's revenue was up 1.0% on a year-over-year basis. During the same period in the prior year, the company earned $4.86 EPS. As a group, analysts expect that Costco Wholesale Co. will post 17.83 EPS for the current fiscal year.

Costco Wholesale Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, November 15th. Shareholders of record on Friday, November 1st were issued a $1.16 dividend. This represents a $4.64 dividend on an annualized basis and a yield of 0.49%. The ex-dividend date was Friday, November 1st. Costco Wholesale's dividend payout ratio is presently 27.25%.

Costco Wholesale Company Profile

(

Free Report)

Costco Wholesale Corporation, together with its subsidiaries, engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden. The company offers branded and private-label products in a range of merchandise categories.

Further Reading

Before you consider Costco Wholesale, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Costco Wholesale wasn't on the list.

While Costco Wholesale currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report