Franklin Resources Inc. boosted its stake in shares of Coterra Energy Inc. (NYSE:CTRA - Free Report) by 40.0% in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 1,194,064 shares of the company's stock after purchasing an additional 341,180 shares during the quarter. Franklin Resources Inc. owned about 0.16% of Coterra Energy worth $29,147,000 at the end of the most recent quarter.

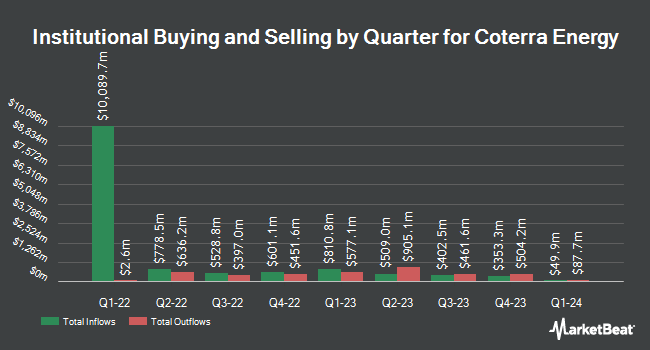

Other institutional investors and hedge funds have also modified their holdings of the company. Wellington Management Group LLP boosted its stake in Coterra Energy by 28.4% during the 3rd quarter. Wellington Management Group LLP now owns 71,210,013 shares of the company's stock valued at $1,705,480,000 after purchasing an additional 15,736,247 shares during the period. Holocene Advisors LP boosted its position in shares of Coterra Energy by 187.2% in the third quarter. Holocene Advisors LP now owns 4,533,269 shares of the company's stock valued at $108,572,000 after acquiring an additional 2,954,675 shares during the period. Bank of Montreal Can boosted its position in shares of Coterra Energy by 160.1% in the second quarter. Bank of Montreal Can now owns 2,898,876 shares of the company's stock valued at $80,154,000 after acquiring an additional 1,784,192 shares during the period. Weiss Asset Management LP acquired a new stake in shares of Coterra Energy in the third quarter worth $28,380,000. Finally, Marshall Wace LLP increased its position in Coterra Energy by 5,325.5% during the second quarter. Marshall Wace LLP now owns 1,148,569 shares of the company's stock worth $30,632,000 after acquiring an additional 1,127,399 shares during the period. 87.92% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of equities research analysts recently weighed in on the company. Citigroup lifted their target price on Coterra Energy from $28.00 to $32.00 and gave the stock a "buy" rating in a research report on Tuesday, November 26th. Susquehanna lifted their price objective on Coterra Energy from $30.00 to $33.00 and gave the stock a "positive" rating in a report on Thursday, November 14th. JPMorgan Chase & Co. lowered their price objective on Coterra Energy from $31.00 to $26.00 and set an "overweight" rating on the stock in a research report on Thursday, September 12th. Morgan Stanley raised their target price on Coterra Energy from $27.00 to $29.00 and gave the stock an "equal weight" rating in a research report on Thursday, November 14th. Finally, Barclays lifted their price target on shares of Coterra Energy from $31.00 to $33.00 and gave the stock an "overweight" rating in a research note on Thursday, November 14th. Two research analysts have rated the stock with a hold rating, sixteen have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $32.53.

Check Out Our Latest Report on CTRA

Insider Transactions at Coterra Energy

In related news, SVP Kevin William Smith sold 29,643 shares of the business's stock in a transaction on Tuesday, December 3rd. The shares were sold at an average price of $26.16, for a total transaction of $775,460.88. Following the transaction, the senior vice president now directly owns 77,075 shares in the company, valued at approximately $2,016,282. The trade was a 27.78 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, SVP Adam M. Vela sold 16,435 shares of the company's stock in a transaction on Wednesday, November 20th. The stock was sold at an average price of $26.76, for a total transaction of $439,800.60. Following the sale, the senior vice president now directly owns 72,409 shares in the company, valued at $1,937,664.84. This trade represents a 18.50 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 1.70% of the company's stock.

Coterra Energy Trading Down 0.3 %

Shares of CTRA stock traded down $0.07 on Thursday, hitting $23.67. The stock had a trading volume of 6,436,062 shares, compared to its average volume of 6,209,113. The company has a current ratio of 1.61, a quick ratio of 1.56 and a debt-to-equity ratio of 0.16. Coterra Energy Inc. has a twelve month low of $22.30 and a twelve month high of $28.90. The company has a fifty day moving average price of $24.99 and a two-hundred day moving average price of $25.15. The firm has a market cap of $17.44 billion, a P/E ratio of 14.26, a PEG ratio of 1.64 and a beta of 0.27.

Coterra Energy (NYSE:CTRA - Get Free Report) last announced its earnings results on Thursday, October 31st. The company reported $0.32 EPS for the quarter, missing the consensus estimate of $0.35 by ($0.03). The company had revenue of $1.36 billion for the quarter, compared to analyst estimates of $1.28 billion. Coterra Energy had a return on equity of 9.38% and a net margin of 21.91%. The business's quarterly revenue was up .2% on a year-over-year basis. During the same quarter last year, the business posted $0.47 earnings per share. As a group, analysts forecast that Coterra Energy Inc. will post 1.53 earnings per share for the current fiscal year.

Coterra Energy Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Wednesday, November 27th. Shareholders of record on Thursday, November 14th were paid a $0.21 dividend. This represents a $0.84 annualized dividend and a yield of 3.55%. The ex-dividend date was Thursday, November 14th. Coterra Energy's payout ratio is 50.60%.

Coterra Energy Company Profile

(

Free Report)

Coterra Energy Inc, an independent oil and gas company, engages in the development, exploration, and production of oil, natural gas, and natural gas liquids in the United States. The company's properties include the Marcellus Shale with approximately 186,000 net acres in the dry gas window of the play located in Susquehanna County, Pennsylvania; Permian Basin properties with approximately 296,000 net acres located in west Texas and southeast New Mexico; and Anadarko Basin properties with approximately 182,000 net acres located in Oklahoma.

Featured Articles

Before you consider Coterra Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coterra Energy wasn't on the list.

While Coterra Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report