Nomura Asset Management Co. Ltd. decreased its holdings in shares of Coterra Energy Inc. (NYSE:CTRA - Free Report) by 8.2% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 1,121,270 shares of the company's stock after selling 100,133 shares during the quarter. Nomura Asset Management Co. Ltd. owned about 0.15% of Coterra Energy worth $28,637,000 at the end of the most recent quarter.

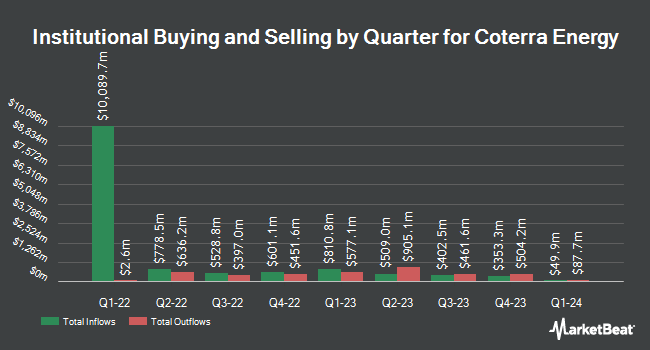

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. City State Bank purchased a new stake in shares of Coterra Energy in the 4th quarter valued at approximately $26,000. AdvisorNet Financial Inc increased its holdings in Coterra Energy by 192.2% in the 4th quarter. AdvisorNet Financial Inc now owns 1,131 shares of the company's stock valued at $29,000 after purchasing an additional 744 shares during the last quarter. MCF Advisors LLC raised its position in Coterra Energy by 230.5% in the fourth quarter. MCF Advisors LLC now owns 1,246 shares of the company's stock valued at $32,000 after purchasing an additional 869 shares during the period. R Squared Ltd acquired a new position in Coterra Energy during the fourth quarter worth $32,000. Finally, Plato Investment Management Ltd purchased a new position in shares of Coterra Energy during the fourth quarter worth $43,000. Hedge funds and other institutional investors own 87.92% of the company's stock.

Insiders Place Their Bets

In related news, SVP Michael D. Deshazer sold 35,377 shares of the company's stock in a transaction on Monday, March 10th. The shares were sold at an average price of $26.62, for a total value of $941,735.74. Following the completion of the sale, the senior vice president now owns 126,770 shares in the company, valued at $3,374,617.40. This represents a 21.82 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, SVP Kevin William Smith sold 25,733 shares of the stock in a transaction on Wednesday, March 19th. The stock was sold at an average price of $29.09, for a total transaction of $748,572.97. Following the sale, the senior vice president now owns 106,114 shares of the company's stock, valued at approximately $3,086,856.26. This represents a 19.52 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 1.70% of the company's stock.

Coterra Energy Stock Down 5.8 %

Shares of NYSE:CTRA traded down $1.67 during trading on Thursday, hitting $27.32. 2,011,095 shares of the company were exchanged, compared to its average volume of 6,083,058. The firm's 50 day moving average price is $27.90 and its 200-day moving average price is $26.17. Coterra Energy Inc. has a 12-month low of $22.30 and a 12-month high of $29.95. The company has a debt-to-equity ratio of 0.16, a current ratio of 1.61 and a quick ratio of 1.56. The stock has a market capitalization of $20.88 billion, a P/E ratio of 16.46, a PEG ratio of 0.59 and a beta of 0.26.

Coterra Energy Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Thursday, March 27th. Shareholders of record on Thursday, March 13th were paid a $0.22 dividend. This represents a $0.88 annualized dividend and a yield of 3.22%. The ex-dividend date of this dividend was Thursday, March 13th. This is an increase from Coterra Energy's previous quarterly dividend of $0.21. Coterra Energy's dividend payout ratio is currently 58.28%.

Analyst Ratings Changes

Several research firms recently issued reports on CTRA. Piper Sandler increased their target price on Coterra Energy from $34.00 to $37.00 and gave the stock an "overweight" rating in a research note on Thursday, March 6th. Jefferies Financial Group increased their price target on shares of Coterra Energy from $26.00 to $28.00 and gave the stock a "hold" rating in a research report on Tuesday, February 4th. UBS Group lifted their price objective on shares of Coterra Energy from $35.00 to $37.00 and gave the company a "buy" rating in a report on Thursday, February 13th. Barclays upped their target price on shares of Coterra Energy from $37.00 to $38.00 and gave the stock an "overweight" rating in a research note on Tuesday, March 18th. Finally, Williams Trading set a $37.00 price target on shares of Coterra Energy in a research note on Wednesday, March 5th. Three research analysts have rated the stock with a hold rating, seventeen have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $34.35.

Read Our Latest Stock Report on CTRA

Coterra Energy Profile

(

Free Report)

Coterra Energy Inc, an independent oil and gas company, engages in the development, exploration, and production of oil, natural gas, and natural gas liquids in the United States. The company's properties include the Marcellus Shale with approximately 186,000 net acres in the dry gas window of the play located in Susquehanna County, Pennsylvania; Permian Basin properties with approximately 296,000 net acres located in west Texas and southeast New Mexico; and Anadarko Basin properties with approximately 182,000 net acres located in Oklahoma.

Featured Stories

Before you consider Coterra Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coterra Energy wasn't on the list.

While Coterra Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.