Counterpoint Mutual Funds LLC trimmed its stake in Perimeter Solutions, SA (NYSE:PRM - Free Report) by 42.8% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 58,135 shares of the company's stock after selling 43,549 shares during the period. Counterpoint Mutual Funds LLC's holdings in Perimeter Solutions were worth $743,000 at the end of the most recent quarter.

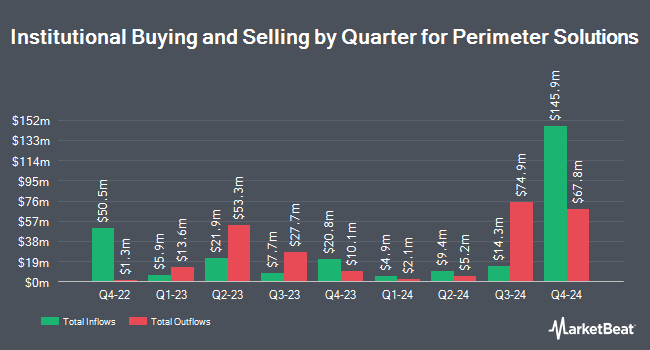

Several other hedge funds and other institutional investors have also recently bought and sold shares of PRM. Pennant Select LLC grew its holdings in shares of Perimeter Solutions by 41.6% during the third quarter. Pennant Select LLC now owns 814,000 shares of the company's stock worth $10,948,000 after purchasing an additional 239,000 shares during the last quarter. Entropy Technologies LP purchased a new position in Perimeter Solutions during the 4th quarter worth approximately $305,000. Barclays PLC increased its position in Perimeter Solutions by 305.3% during the third quarter. Barclays PLC now owns 206,967 shares of the company's stock worth $2,784,000 after buying an additional 155,899 shares during the period. Bleakley Financial Group LLC increased its position in Perimeter Solutions by 6.7% during the fourth quarter. Bleakley Financial Group LLC now owns 28,380 shares of the company's stock worth $363,000 after buying an additional 1,778 shares during the period. Finally, FMR LLC lifted its stake in Perimeter Solutions by 2,993.1% in the third quarter. FMR LLC now owns 307,426 shares of the company's stock valued at $4,135,000 after buying an additional 297,487 shares during the last quarter. 89.93% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling

In related news, Director Vivek Raj sold 250,000 shares of Perimeter Solutions stock in a transaction on Friday, March 14th. The shares were sold at an average price of $9.17, for a total value of $2,292,500.00. Following the transaction, the director now directly owns 471,226 shares in the company, valued at $4,321,142.42. This trade represents a 34.66 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Corporate insiders own 8.70% of the company's stock.

Perimeter Solutions Stock Performance

Shares of PRM traded down $0.25 during mid-day trading on Friday, reaching $9.06. 3,526,755 shares of the company's stock were exchanged, compared to its average volume of 843,415. The business's fifty day simple moving average is $11.39 and its 200-day simple moving average is $12.30. The stock has a market capitalization of $1.36 billion, a PE ratio of -64.67 and a beta of 1.93. Perimeter Solutions, SA has a 52-week low of $6.13 and a 52-week high of $14.44. The company has a debt-to-equity ratio of 0.67, a current ratio of 3.91 and a quick ratio of 2.95.

Perimeter Solutions (NYSE:PRM - Get Free Report) last issued its quarterly earnings data on Thursday, February 20th. The company reported $0.11 earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.10) by $0.21. The company had revenue of $86.23 million for the quarter, compared to the consensus estimate of $77.01 million. Perimeter Solutions had a negative net margin of 1.05% and a negative return on equity of 7.62%. On average, equities research analysts expect that Perimeter Solutions, SA will post 0.71 earnings per share for the current year.

About Perimeter Solutions

(

Free Report)

Perimeter Solutions, SA manufactures and supplies firefighting products and lubricant additives in the United States, Germany, and internationally. It operates in two segments, Fire Safety and Specialty Products. The Fire Safety segment provides fire retardants and firefighting foams, as well as specialized equipment and services for federal, state, provincial, local/municipal, and commercial customers.

Read More

Before you consider Perimeter Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Perimeter Solutions wasn't on the list.

While Perimeter Solutions currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.