Algert Global LLC increased its holdings in Coursera, Inc. (NYSE:COUR - Free Report) by 17.7% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 475,496 shares of the company's stock after purchasing an additional 71,382 shares during the period. Algert Global LLC owned approximately 0.30% of Coursera worth $3,775,000 at the end of the most recent reporting period.

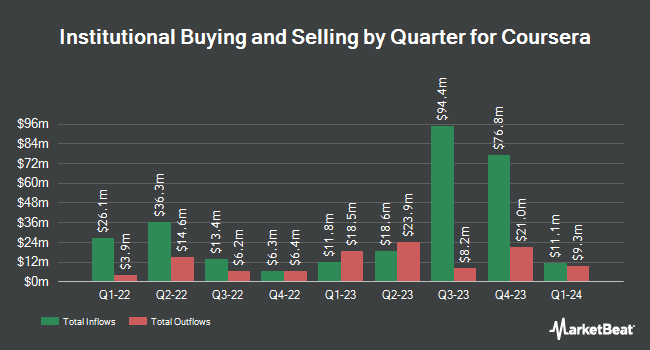

Other large investors have also recently bought and sold shares of the company. CWM LLC boosted its holdings in Coursera by 7,568.6% in the second quarter. CWM LLC now owns 3,911 shares of the company's stock worth $28,000 after purchasing an additional 3,860 shares in the last quarter. nVerses Capital LLC lifted its position in Coursera by 26.1% during the 2nd quarter. nVerses Capital LLC now owns 8,700 shares of the company's stock worth $62,000 after acquiring an additional 1,800 shares during the last quarter. LGT Group Foundation acquired a new position in Coursera during the 2nd quarter worth $73,000. Quarry LP lifted its position in Coursera by 936.6% during the 2nd quarter. Quarry LP now owns 10,356 shares of the company's stock worth $74,000 after acquiring an additional 9,357 shares during the last quarter. Finally, Versor Investments LP acquired a new position in Coursera during the 3rd quarter worth $106,000. 89.55% of the stock is currently owned by institutional investors.

Coursera Trading Down 1.9 %

Shares of COUR traded down $0.15 during trading hours on Tuesday, hitting $7.75. 1,301,495 shares of the stock traded hands, compared to its average volume of 2,289,790. The firm has a market capitalization of $1.23 billion, a PE ratio of -15.49 and a beta of 1.44. The business has a fifty day moving average of $7.47 and a 200-day moving average of $7.63. Coursera, Inc. has a 1-year low of $6.29 and a 1-year high of $21.26.

Insider Activity at Coursera

In other news, Director Andrew Y. Ng sold 6,221 shares of Coursera stock in a transaction on Wednesday, September 18th. The stock was sold at an average price of $8.03, for a total transaction of $49,954.63. Following the completion of the sale, the director now owns 7,297,671 shares of the company's stock, valued at approximately $58,600,298.13. This trade represents a 0.09 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, SVP Alan B. Cardenas sold 6,102 shares of Coursera stock in a transaction on Monday, November 18th. The stock was sold at an average price of $6.83, for a total value of $41,676.66. Following the sale, the senior vice president now directly owns 194,082 shares of the company's stock, valued at $1,325,580.06. This represents a 3.05 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 13,885 shares of company stock worth $102,815 in the last ninety days. Company insiders own 15.90% of the company's stock.

Analysts Set New Price Targets

COUR has been the subject of a number of research analyst reports. Bank of America initiated coverage on shares of Coursera in a research report on Thursday, September 19th. They set a "buy" rating and a $11.00 target price for the company. Royal Bank of Canada cut their target price on shares of Coursera from $18.00 to $10.00 and set an "outperform" rating for the company in a research report on Friday, October 25th. Cantor Fitzgerald cut their price objective on shares of Coursera from $22.00 to $10.00 and set an "overweight" rating for the company in a research report on Friday, October 25th. Needham & Company LLC cut their price objective on shares of Coursera from $15.00 to $11.00 and set a "buy" rating for the company in a research report on Friday, October 25th. Finally, Telsey Advisory Group reaffirmed an "outperform" rating and set a $18.00 price objective on shares of Coursera in a research report on Monday, October 21st. One equities research analyst has rated the stock with a sell rating, two have assigned a hold rating and nine have given a buy rating to the stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $10.66.

Check Out Our Latest Analysis on COUR

About Coursera

(

Free Report)

Coursera, Inc operates an online educational content platform in the United States, Europe, Africa, the Asia Pacific, the Middle East, and internationally. It operates in three segments: Consumer, Enterprise, and Degrees. The company offers guided projects, courses, and specializations, as well as online degrees; and certificates for entry-level professional, non-entry level professional, university, and MasterTrack.

Featured Stories

Before you consider Coursera, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coursera wasn't on the list.

While Coursera currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.