Cove Street Capital LLC trimmed its position in shares of Advance Auto Parts, Inc. (NYSE:AAP - Free Report) by 20.9% during the fourth quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 77,818 shares of the company's stock after selling 20,588 shares during the period. Advance Auto Parts makes up about 4.3% of Cove Street Capital LLC's holdings, making the stock its 6th largest holding. Cove Street Capital LLC owned about 0.13% of Advance Auto Parts worth $3,675,000 at the end of the most recent reporting period.

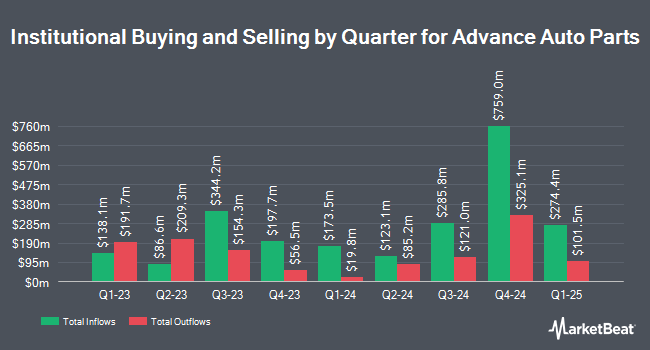

Several other institutional investors and hedge funds have also recently modified their holdings of the company. Pzena Investment Management LLC grew its stake in shares of Advance Auto Parts by 12.5% in the fourth quarter. Pzena Investment Management LLC now owns 3,270,897 shares of the company's stock worth $154,681,000 after acquiring an additional 362,239 shares in the last quarter. Royce & Associates LP grew its stake in Advance Auto Parts by 30.4% during the 4th quarter. Royce & Associates LP now owns 1,403,004 shares of the company's stock worth $66,348,000 after purchasing an additional 327,417 shares in the last quarter. Thrivent Financial for Lutherans increased its holdings in Advance Auto Parts by 2,662.0% during the 4th quarter. Thrivent Financial for Lutherans now owns 1,293,205 shares of the company's stock worth $61,156,000 after purchasing an additional 1,246,384 shares during the period. Allianz Asset Management GmbH raised its position in Advance Auto Parts by 244.7% in the 4th quarter. Allianz Asset Management GmbH now owns 740,234 shares of the company's stock valued at $35,006,000 after purchasing an additional 525,504 shares in the last quarter. Finally, Segall Bryant & Hamill LLC purchased a new position in shares of Advance Auto Parts in the 4th quarter valued at about $34,586,000. Hedge funds and other institutional investors own 88.75% of the company's stock.

Wall Street Analyst Weigh In

A number of analysts recently weighed in on the stock. Citigroup cut their target price on shares of Advance Auto Parts from $47.00 to $40.00 and set a "neutral" rating on the stock in a research note on Thursday, February 27th. Wells Fargo & Company boosted their target price on shares of Advance Auto Parts from $40.00 to $45.00 and gave the stock an "equal weight" rating in a research note on Monday, January 6th. Wedbush reissued an "outperform" rating and issued a $55.00 target price on shares of Advance Auto Parts in a report on Monday, March 3rd. Evercore ISI decreased their price target on Advance Auto Parts from $37.00 to $35.00 and set an "in-line" rating for the company in a report on Tuesday, March 11th. Finally, BMO Capital Markets dropped their price objective on Advance Auto Parts from $45.00 to $40.00 and set a "market perform" rating on the stock in a report on Thursday, February 27th. One analyst has rated the stock with a sell rating, sixteen have given a hold rating and one has assigned a buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $45.13.

View Our Latest Report on AAP

Insider Activity

In other news, CEO Shane M. Okelly acquired 1,500 shares of the stock in a transaction that occurred on Tuesday, March 11th. The shares were purchased at an average cost of $36.79 per share, for a total transaction of $55,185.00. Following the transaction, the chief executive officer now directly owns 183,121 shares in the company, valued at approximately $6,737,021.59. This represents a 0.83 % increase in their position. The acquisition was disclosed in a legal filing with the SEC, which is accessible through this link. Also, Director Eugene I. Lee, Jr. bought 14,640 shares of Advance Auto Parts stock in a transaction dated Thursday, March 6th. The stock was purchased at an average price of $34.15 per share, with a total value of $499,956.00. Following the purchase, the director now directly owns 34,070 shares in the company, valued at approximately $1,163,490.50. This trade represents a 75.35 % increase in their position. The disclosure for this purchase can be found here. Corporate insiders own 0.35% of the company's stock.

Advance Auto Parts Stock Performance

Shares of NYSE:AAP traded down $1.58 on Thursday, reaching $37.74. The company's stock had a trading volume of 1,863,997 shares, compared to its average volume of 2,162,721. The company has a debt-to-equity ratio of 0.69, a current ratio of 1.34 and a quick ratio of 0.62. Advance Auto Parts, Inc. has a 52-week low of $33.08 and a 52-week high of $85.30. The stock's 50-day moving average is $42.05 and its two-hundred day moving average is $41.85. The stock has a market capitalization of $2.26 billion, a P/E ratio of 51.70, a PEG ratio of 1.98 and a beta of 1.27.

Advance Auto Parts Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Friday, April 25th. Shareholders of record on Friday, April 11th will be paid a $0.25 dividend. The ex-dividend date is Friday, April 11th. This represents a $1.00 annualized dividend and a dividend yield of 2.65%. Advance Auto Parts's dividend payout ratio (DPR) is currently -17.86%.

Advance Auto Parts Profile

(

Free Report)

Advance Auto Parts, Inc provides automotive replacement parts, accessories, batteries, and maintenance items for domestic and imported cars, vans, sport utility vehicles, and light and heavy duty trucks. The company offers battery accessories; belts and hoses; brakes and brake pads; chassis and climate control parts; clutches and drive shafts; engines and engine parts; exhaust systems and parts; hub assemblies; ignition components and wires; radiators and cooling parts; starters and alternators; and steering and alignment parts.

Recommended Stories

Before you consider Advance Auto Parts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advance Auto Parts wasn't on the list.

While Advance Auto Parts currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report