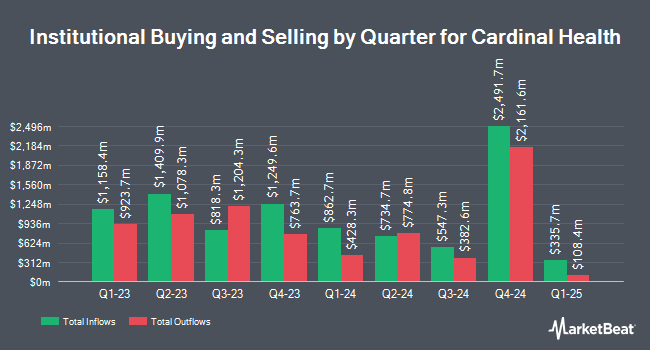

Cozad Asset Management Inc. reduced its position in Cardinal Health, Inc. (NYSE:CAH - Free Report) by 18.8% during the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 26,878 shares of the company's stock after selling 6,238 shares during the period. Cozad Asset Management Inc.'s holdings in Cardinal Health were worth $2,971,000 at the end of the most recent quarter.

A number of other institutional investors have also modified their holdings of the company. Pacer Advisors Inc. boosted its stake in Cardinal Health by 9.9% in the 2nd quarter. Pacer Advisors Inc. now owns 4,099,082 shares of the company's stock worth $403,022,000 after purchasing an additional 370,181 shares in the last quarter. Acadian Asset Management LLC boosted its stake in Cardinal Health by 19.1% in the 1st quarter. Acadian Asset Management LLC now owns 3,723,159 shares of the company's stock worth $416,585,000 after purchasing an additional 598,002 shares in the last quarter. Price T Rowe Associates Inc. MD lifted its stake in Cardinal Health by 0.5% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 2,730,854 shares of the company's stock valued at $305,584,000 after acquiring an additional 14,030 shares during the period. ProShare Advisors LLC lifted its stake in Cardinal Health by 5.1% during the 2nd quarter. ProShare Advisors LLC now owns 1,759,299 shares of the company's stock valued at $172,974,000 after acquiring an additional 85,247 shares during the period. Finally, Renaissance Technologies LLC lifted its stake in Cardinal Health by 7.1% during the 2nd quarter. Renaissance Technologies LLC now owns 1,683,447 shares of the company's stock valued at $165,517,000 after acquiring an additional 111,137 shares during the period. 87.17% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

Several brokerages have commented on CAH. StockNews.com cut shares of Cardinal Health from a "strong-buy" rating to a "buy" rating in a research note on Sunday. Wells Fargo & Company lifted their price objective on shares of Cardinal Health from $95.00 to $101.00 and gave the company an "underweight" rating in a research note on Thursday, August 15th. Barclays lifted their price objective on shares of Cardinal Health from $117.00 to $133.00 and gave the company an "overweight" rating in a research note on Monday. Deutsche Bank Aktiengesellschaft lifted their price objective on shares of Cardinal Health from $119.00 to $124.00 and gave the company a "hold" rating in a research note on Monday. Finally, Argus lifted their price objective on shares of Cardinal Health from $115.00 to $125.00 and gave the company a "buy" rating in a research note on Wednesday, September 11th. One equities research analyst has rated the stock with a sell rating, five have assigned a hold rating and eight have issued a buy rating to the company. Based on data from MarketBeat.com, Cardinal Health currently has an average rating of "Moderate Buy" and a consensus target price of $123.00.

Check Out Our Latest Research Report on Cardinal Health

Cardinal Health Trading Up 2.2 %

CAH traded up $2.60 during midday trading on Thursday, hitting $118.18. 1,393,369 shares of the company traded hands, compared to its average volume of 2,079,305. The company has a market capitalization of $28.59 billion, a price-to-earnings ratio of 22.49, a PEG ratio of 1.57 and a beta of 0.60. The business has a 50 day simple moving average of $111.95 and a two-hundred day simple moving average of $104.31. Cardinal Health, Inc. has a 52-week low of $93.17 and a 52-week high of $119.58.

Cardinal Health (NYSE:CAH - Get Free Report) last posted its quarterly earnings data on Friday, November 1st. The company reported $1.88 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.62 by $0.26. Cardinal Health had a negative return on equity of 56.56% and a net margin of 0.56%. The company had revenue of $52.28 billion for the quarter, compared to analysts' expectations of $50.90 billion. During the same period in the previous year, the firm posted $1.73 EPS. Cardinal Health's revenue was down 4.3% compared to the same quarter last year. Equities research analysts anticipate that Cardinal Health, Inc. will post 7.69 earnings per share for the current year.

Cardinal Health Cuts Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Investors of record on Thursday, January 2nd will be paid a $0.5056 dividend. This represents a $2.02 annualized dividend and a yield of 1.71%. The ex-dividend date is Thursday, January 2nd. Cardinal Health's dividend payout ratio is currently 39.30%.

Insider Buying and Selling at Cardinal Health

In related news, CEO Jason M. Hollar sold 26,716 shares of the business's stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $108.87, for a total transaction of $2,908,570.92. Following the transaction, the chief executive officer now directly owns 244,091 shares in the company, valued at approximately $26,574,187.17. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. In other Cardinal Health news, insider Jessica L. Mayer sold 17,896 shares of the stock in a transaction dated Thursday, August 15th. The shares were sold at an average price of $106.48, for a total value of $1,905,566.08. Following the completion of the sale, the insider now owns 94,529 shares in the company, valued at approximately $10,065,447.92. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO Jason M. Hollar sold 26,716 shares of the stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $108.87, for a total transaction of $2,908,570.92. Following the completion of the sale, the chief executive officer now owns 244,091 shares of the company's stock, valued at approximately $26,574,187.17. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 113,963 shares of company stock worth $12,379,980. Corporate insiders own 0.09% of the company's stock.

About Cardinal Health

(

Free Report)

Cardinal Health, Inc operates as a healthcare services and products company in the United States, Canada, Europe, Asia, and internationally. It provides customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, physician offices, and patients in the home.

See Also

Before you consider Cardinal Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cardinal Health wasn't on the list.

While Cardinal Health currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report