Argus upgraded shares of Cracker Barrel Old Country Store (NASDAQ:CBRL - Free Report) from a hold rating to a buy rating in a research note issued to investors on Monday morning, MarketBeat reports. They currently have $52.00 target price on the restaurant operator's stock.

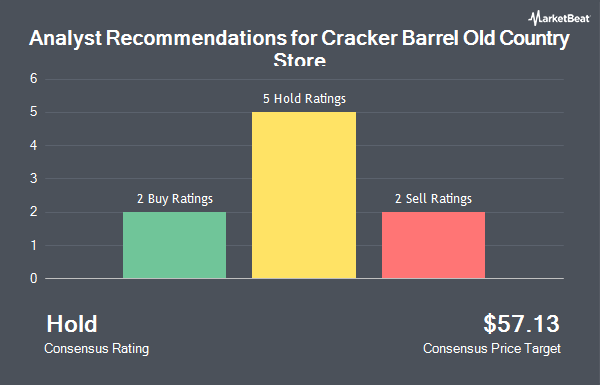

CBRL has been the topic of several other research reports. Bank of America increased their price target on Cracker Barrel Old Country Store from $42.00 to $45.00 and gave the company an "underperform" rating in a report on Friday. Loop Capital dropped their target price on Cracker Barrel Old Country Store from $50.00 to $45.00 and set a "hold" rating for the company in a research report on Friday, September 20th. UBS Group reduced their price target on Cracker Barrel Old Country Store from $55.00 to $42.00 and set a "neutral" rating on the stock in a report on Thursday, September 19th. StockNews.com upgraded Cracker Barrel Old Country Store from a "sell" rating to a "hold" rating in a report on Friday, September 20th. Finally, Truist Financial increased their target price on Cracker Barrel Old Country Store from $44.00 to $48.00 and gave the stock a "hold" rating in a research note on Friday. Two research analysts have rated the stock with a sell rating, seven have assigned a hold rating and one has assigned a buy rating to the company's stock. According to MarketBeat, Cracker Barrel Old Country Store currently has a consensus rating of "Hold" and a consensus price target of $51.25.

View Our Latest Research Report on Cracker Barrel Old Country Store

Cracker Barrel Old Country Store Stock Down 0.8 %

NASDAQ CBRL traded down $0.39 during trading hours on Monday, reaching $48.42. 672,960 shares of the company's stock traded hands, compared to its average volume of 733,420. The firm has a market cap of $1.08 billion, a PE ratio of 26.43, a PEG ratio of 1.40 and a beta of 1.42. The company has a debt-to-equity ratio of 1.08, a current ratio of 0.61 and a quick ratio of 0.21. Cracker Barrel Old Country Store has a 52-week low of $34.88 and a 52-week high of $83.51. The firm has a 50-day simple moving average of $45.15 and a 200 day simple moving average of $44.80.

Cracker Barrel Old Country Store (NASDAQ:CBRL - Get Free Report) last posted its quarterly earnings data on Thursday, September 19th. The restaurant operator reported $0.98 earnings per share for the quarter, missing analysts' consensus estimates of $1.17 by ($0.19). Cracker Barrel Old Country Store had a net margin of 1.15% and a return on equity of 18.58%. The company had revenue of $894.39 million for the quarter, compared to the consensus estimate of $898.94 million. During the same period last year, the business earned $1.79 EPS. The firm's quarterly revenue was up 6.9% on a year-over-year basis. Sell-side analysts anticipate that Cracker Barrel Old Country Store will post 2.97 EPS for the current fiscal year.

Cracker Barrel Old Country Store Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Wednesday, November 13th. Shareholders of record on Friday, October 18th were paid a $0.25 dividend. This represents a $1.00 dividend on an annualized basis and a yield of 2.07%. The ex-dividend date of this dividend was Friday, October 18th. Cracker Barrel Old Country Store's dividend payout ratio (DPR) is presently 55.25%.

Hedge Funds Weigh In On Cracker Barrel Old Country Store

Several hedge funds have recently modified their holdings of CBRL. Public Employees Retirement System of Ohio boosted its stake in Cracker Barrel Old Country Store by 22.4% in the 3rd quarter. Public Employees Retirement System of Ohio now owns 1,349 shares of the restaurant operator's stock worth $61,000 after purchasing an additional 247 shares in the last quarter. ProShare Advisors LLC grew its holdings in Cracker Barrel Old Country Store by 7.4% in the first quarter. ProShare Advisors LLC now owns 4,451 shares of the restaurant operator's stock valued at $324,000 after purchasing an additional 306 shares during the period. Advisors Asset Management Inc. increased its position in shares of Cracker Barrel Old Country Store by 0.3% during the third quarter. Advisors Asset Management Inc. now owns 100,030 shares of the restaurant operator's stock worth $4,536,000 after purchasing an additional 321 shares in the last quarter. Hazlett Burt & Watson Inc. raised its holdings in shares of Cracker Barrel Old Country Store by 200.0% during the 2nd quarter. Hazlett Burt & Watson Inc. now owns 600 shares of the restaurant operator's stock worth $25,000 after acquiring an additional 400 shares during the period. Finally, CWM LLC lifted its holdings in shares of Cracker Barrel Old Country Store by 96.3% in the 2nd quarter. CWM LLC now owns 854 shares of the restaurant operator's stock worth $36,000 after acquiring an additional 419 shares during the last quarter. Institutional investors and hedge funds own 96.01% of the company's stock.

Cracker Barrel Old Country Store Company Profile

(

Get Free Report)

Cracker Barrel Old Country Store, Inc develops and operates the Cracker Barrel Old Country Store concept in the United States. Its Cracker Barrel stores consist of restaurants with a gift shop. The company's restaurants serve breakfast, lunch, and dinner daily, as well as dine-in, pick-up, and delivery services.

Further Reading

Before you consider Cracker Barrel Old Country Store, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cracker Barrel Old Country Store wasn't on the list.

While Cracker Barrel Old Country Store currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.