Creative Planning bought a new stake in Freshworks Inc. (NASDAQ:FRSH - Free Report) during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor bought 42,006 shares of the company's stock, valued at approximately $482,000.

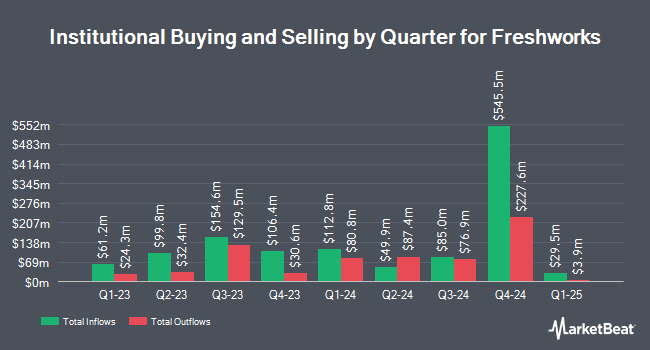

Other hedge funds have also recently made changes to their positions in the company. Sapient Capital LLC grew its position in Freshworks by 42.9% during the 3rd quarter. Sapient Capital LLC now owns 14,326 shares of the company's stock worth $164,000 after purchasing an additional 4,303 shares during the period. Exchange Traded Concepts LLC grew its position in Freshworks by 7.7% during the 3rd quarter. Exchange Traded Concepts LLC now owns 213,654 shares of the company's stock worth $2,453,000 after purchasing an additional 15,186 shares during the period. Handelsbanken Fonder AB grew its position in Freshworks by 34.8% during the 3rd quarter. Handelsbanken Fonder AB now owns 43,400 shares of the company's stock worth $498,000 after purchasing an additional 11,200 shares during the period. SG Americas Securities LLC acquired a new stake in Freshworks during the 3rd quarter worth about $260,000. Finally, Quarry LP grew its position in Freshworks by 157.6% during the 2nd quarter. Quarry LP now owns 4,323 shares of the company's stock worth $55,000 after purchasing an additional 2,645 shares during the period. 75.58% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several brokerages have weighed in on FRSH. Piper Sandler increased their price target on Freshworks from $13.00 to $18.00 and gave the stock an "overweight" rating in a research report on Thursday. Barclays cut their price target on Freshworks from $15.00 to $14.00 and set an "equal weight" rating on the stock in a research report on Wednesday, July 31st. Canaccord Genuity Group increased their price target on Freshworks from $17.00 to $19.00 and gave the stock a "buy" rating in a research report on Thursday. Robert W. Baird lowered their target price on shares of Freshworks from $16.00 to $15.00 and set a "neutral" rating on the stock in a research note on Thursday. Finally, Needham & Company LLC reissued a "buy" rating and set a $20.00 target price on shares of Freshworks in a research note on Thursday. Seven analysts have rated the stock with a hold rating and eight have issued a buy rating to the stock. Based on data from MarketBeat.com, Freshworks has an average rating of "Moderate Buy" and a consensus price target of $18.69.

Get Our Latest Research Report on Freshworks

Freshworks Price Performance

Freshworks stock traded up $3.73 during midday trading on Thursday, reaching $16.82. The company had a trading volume of 16,528,799 shares, compared to its average volume of 2,746,653. The company has a market capitalization of $5.08 billion, a P/E ratio of -47.54 and a beta of 0.72. Freshworks Inc. has a 12-month low of $10.81 and a 12-month high of $24.98. The firm's fifty day simple moving average is $11.45 and its 200-day simple moving average is $12.60.

Freshworks (NASDAQ:FRSH - Get Free Report) last issued its quarterly earnings results on Wednesday, November 6th. The company reported ($0.09) earnings per share for the quarter, beating analysts' consensus estimates of ($0.10) by $0.01. The firm had revenue of $186.58 million for the quarter, compared to analyst estimates of $181.50 million. Freshworks had a negative net margin of 15.72% and a negative return on equity of 9.08%. On average, analysts expect that Freshworks Inc. will post -0.38 EPS for the current fiscal year.

Insider Buying and Selling at Freshworks

In other Freshworks news, Director Zachary Nelson sold 8,442 shares of the stock in a transaction dated Wednesday, October 2nd. The shares were sold at an average price of $11.04, for a total value of $93,199.68. Following the completion of the sale, the director now owns 23,497 shares in the company, valued at approximately $259,406.88. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. In other Freshworks news, Director Jennifer H. Taylor sold 4,690 shares of the stock in a transaction dated Monday, August 12th. The shares were sold at an average price of $11.23, for a total value of $52,668.70. Following the completion of the sale, the director now owns 35,853 shares in the company, valued at approximately $402,629.19. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Zachary Nelson sold 8,442 shares of the stock in a transaction dated Wednesday, October 2nd. The shares were sold at an average price of $11.04, for a total transaction of $93,199.68. Following the completion of the sale, the director now owns 23,497 shares of the company's stock, valued at approximately $259,406.88. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 46,456 shares of company stock worth $530,102. Insiders own 19.15% of the company's stock.

About Freshworks

(

Free Report)

Freshworks Inc, a software development company, provides software-as-a-service products worldwide. It offers Freshworks Customer Service Suite, which provides automated, personalized self-service on various channels, including web, chat, mobile messaging, email, and social; Freshdesk, a ticketing-centric customer service solution; Freshsuccess, a customer success solution; and Freshchat that provides agents with a modern conversational experience to proactively engage customers across digital messaging channels.

Featured Stories

Before you consider Freshworks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Freshworks wasn't on the list.

While Freshworks currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.