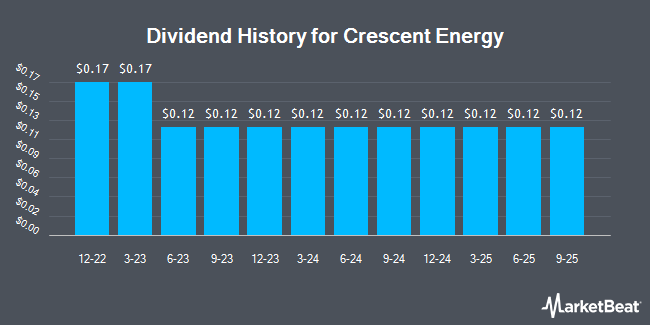

Crescent Energy (NYSE:CRGY - Get Free Report) announced a quarterly dividend on Wednesday, February 26th, Wall Street Journal reports. Shareholders of record on Wednesday, March 12th will be paid a dividend of 0.12 per share on Wednesday, March 26th. This represents a $0.48 dividend on an annualized basis and a dividend yield of 4.14%. The ex-dividend date is Wednesday, March 12th.

Crescent Energy has a dividend payout ratio of 23.6% indicating that its dividend is sufficiently covered by earnings. Analysts expect Crescent Energy to earn $2.21 per share next year, which means the company should continue to be able to cover its $0.48 annual dividend with an expected future payout ratio of 21.7%.

Crescent Energy Trading Down 8.2 %

Shares of CRGY traded down $1.03 during midday trading on Monday, reaching $11.59. The company had a trading volume of 5,321,032 shares, compared to its average volume of 2,583,878. Crescent Energy has a 1-year low of $9.88 and a 1-year high of $16.94. The stock has a market cap of $2.65 billion, a PE ratio of 18.69 and a beta of 2.16. The firm has a 50 day simple moving average of $15.02 and a 200-day simple moving average of $13.52. The company has a quick ratio of 0.93, a current ratio of 0.93 and a debt-to-equity ratio of 1.12.

Analyst Upgrades and Downgrades

A number of analysts have issued reports on CRGY shares. Truist Financial raised their target price on Crescent Energy from $18.00 to $21.00 and gave the stock a "buy" rating in a research note on Monday, January 13th. Stephens reaffirmed an "overweight" rating and issued a $17.00 target price on shares of Crescent Energy in a research note on Monday. Siebert Williams Shank assumed coverage on Crescent Energy in a research note on Monday, February 3rd. They issued a "buy" rating for the company. Mizuho raised their price objective on Crescent Energy from $16.00 to $17.00 and gave the stock a "neutral" rating in a research report on Tuesday, January 14th. Finally, Raymond James raised their price objective on Crescent Energy from $22.00 to $23.00 and gave the stock a "strong-buy" rating in a research report on Thursday, January 23rd. Two analysts have rated the stock with a hold rating, eight have assigned a buy rating and two have given a strong buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Buy" and an average target price of $17.60.

Check Out Our Latest Stock Report on Crescent Energy

About Crescent Energy

(

Get Free Report)

Crescent Energy Company acquires, develops, and produces crude oil, natural gas, and natural gas liquids (NGLs) reserves. Its portfolio of assets comprises mid-cycle unconventional and conventional assets in the Eagle Ford and Uinta Basins. It also owns and operates various midstream assets, which provide services to customers.

Read More

Before you consider Crescent Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crescent Energy wasn't on the list.

While Crescent Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.