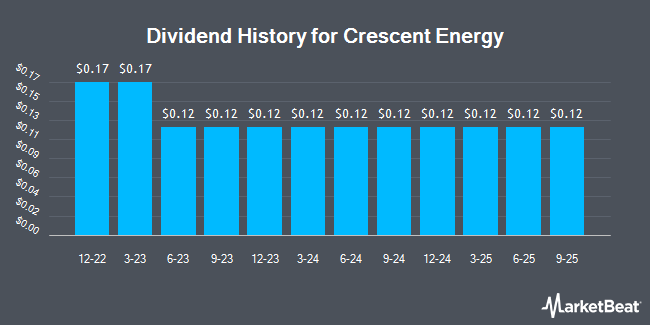

Crescent Energy (NYSE:CRGY - Get Free Report) declared a quarterly dividend on Monday, November 4th, Zacks reports. Investors of record on Monday, November 18th will be given a dividend of 0.12 per share on Monday, December 2nd. This represents a $0.48 annualized dividend and a yield of 3.59%. The ex-dividend date of this dividend is Monday, November 18th.

Crescent Energy has a payout ratio of 33.3% meaning its dividend is sufficiently covered by earnings. Equities analysts expect Crescent Energy to earn $1.52 per share next year, which means the company should continue to be able to cover its $0.48 annual dividend with an expected future payout ratio of 31.6%.

Crescent Energy Stock Performance

CRGY stock traded up $0.41 during midday trading on Wednesday, reaching $13.36. 3,294,583 shares of the company's stock traded hands, compared to its average volume of 2,100,891. The firm has a market capitalization of $2.37 billion, a PE ratio of 21.54 and a beta of 2.19. The company has a 50-day moving average price of $11.89 and a two-hundred day moving average price of $11.79. Crescent Energy has a 52 week low of $9.88 and a 52 week high of $13.85. The company has a debt-to-equity ratio of 1.13, a quick ratio of 1.87 and a current ratio of 1.87.

Crescent Energy (NYSE:CRGY - Get Free Report) last issued its quarterly earnings data on Monday, November 4th. The company reported $0.39 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.28 by $0.11. Crescent Energy had a return on equity of 14.01% and a net margin of 2.17%. The business had revenue of $744.87 million for the quarter, compared to analysts' expectations of $793.88 million. During the same quarter in the prior year, the firm posted $0.35 EPS. As a group, equities analysts anticipate that Crescent Energy will post 1.11 EPS for the current year.

Insider Transactions at Crescent Energy

In related news, Director Michael Duginski acquired 9,344 shares of the firm's stock in a transaction on Thursday, August 8th. The stock was acquired at an average cost of $10.62 per share, for a total transaction of $99,233.28. Following the acquisition, the director now owns 201,081 shares of the company's stock, valued at $2,135,480.22. This trade represents a 0.00 % increase in their ownership of the stock. The purchase was disclosed in a legal filing with the SEC, which is available at this link. In the last three months, insiders have acquired 12,294 shares of company stock worth $131,297. 13.20% of the stock is currently owned by insiders.

Analyst Ratings Changes

CRGY has been the subject of a number of research analyst reports. Wells Fargo & Company dropped their price target on Crescent Energy from $20.00 to $19.00 and set an "overweight" rating for the company in a research report on Monday, October 21st. Stephens increased their price target on shares of Crescent Energy from $15.00 to $16.00 and gave the stock an "overweight" rating in a report on Monday, October 28th. Wolfe Research initiated coverage on shares of Crescent Energy in a research report on Thursday, July 18th. They issued an "outperform" rating and a $16.00 target price for the company. Pickering Energy Partners initiated coverage on Crescent Energy in a research report on Monday, October 28th. They set an "outperform" rating on the stock. Finally, JPMorgan Chase & Co. started coverage on Crescent Energy in a research report on Wednesday, September 18th. They set a "neutral" rating and a $12.00 price objective on the stock. Two investment analysts have rated the stock with a hold rating, seven have issued a buy rating and two have given a strong buy rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Buy" and a consensus price target of $15.80.

View Our Latest Analysis on CRGY

Crescent Energy Company Profile

(

Get Free Report)

Crescent Energy Company acquires, develops, and produces crude oil, natural gas, and natural gas liquids (NGLs) reserves. Its portfolio of assets comprises mid-cycle unconventional and conventional assets in the Eagle Ford and Uinta Basins. It also owns and operates various midstream assets, which provide services to customers.

Read More

Before you consider Crescent Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crescent Energy wasn't on the list.

While Crescent Energy currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.